Share price: CA$0.24

Market cap: CA$20.7 Million; USD$15.3M

Shares outstanding: 86.21 Million

Date: 23 Jan 2024

From the depths of Canadian microcap Discord servers, emerges the next stock we'll be dissecting. With a current market cap of around $15 million, it's important to emphasize the inherent risk of this type of investment. This is not financial advice; we own shares in the company mentioned, and we strongly encourage you to conduct your own research before making any investment decisions. The purpose of this article is to provide you with a glimpse into our stock selection process, not to persuade you to make a specific investment. With that said, we introduce to you Nova Leap Health, a Canadian serial acquirer in the home care industry.

Nova Leap Health is a company that specializes in home and home healthcare services, such as dementia care, personal and respite care, daily living and companionship, and more. The company was founded in 2015 and is headquartered in Halifax, Nova Scotia. It has a presence in 10 states across the United States and Canada. Nova Leap Health is listed on the TSX Venture Exchange under the symbol NLH and reports its financial results in US dollars. So far, the company has completed nineteen acquisitions and has opened one organic location.

It has a low level of debt, which it is constantly paying off and does not have any capital expenditures, as it is a pure service-based industry that utilizes the infrastructure of its clients. The industry is a cash flow-based business, where a reasonable amount of debt would be three times the earnings before interest, taxes, depreciation, and amortization (EBITDA). This gives Nova Leap Health room for new debt to finance its acquisitions. The company has historically maintained a gross margin of around 33% and it has pricing power that has allowed the company to raise its prices without losing customers.

NLH operates primarily in the non-medical home care sector, providing services to senior citizens in their own homes. Its primary focus is dementia care, serving around 75% of clients with this condition. As a private pay company, Nova Leap's services are typically funded by the clients themselves or their adult children, and the general belief is that they will keep the interest in the services no matter what happens on a larger macro scale, which makes providing care a recession proof sector.

The company has grown its business primarily through acquisitions and plans to continue this strategy in the coming years. It has identified hundreds of potential acquisition targets, focusing on businesses with a track record of around 10 years of profitability. Up until the end of 2021, Nova Leap was averaging an acquisition per quarter. Many of these acquisition opportunities arise from succession planning, as business owners who have started their companies 10 or 15 years ago are looking for an exit strategy. The company is well-positioned to continue making acquisitions in 2024, as it has no debt and is prepared to pay anywhere from three to five times EBITDA for target businesses.

The goal is to profit from the “multiple arbitrage” that is significantly higher for publicly traded companies, which is one of the main drivers for a potential upside of the stock price. The CEO of Nova Leap Health has compared his company's stock performance to that of other companies with similar early stories, such as Boyd Auto Group, Parklawn Corporation, and Med Assist. He noted that these companies typically experienced slow growth in their first ten years, but then saw a significant increase in their stock price in years eight through ten. He believes that Nova Leap Health is following a similar trajectory as it is approaching year ten of its founding.

The company has a significant level of insider ownership, with 40% of its shares held by insiders, including CEO Chris Dobbin who owns 10% of the company's stock. The management team is actively buying shares in the open market, and they were doing it even at CA$0.7. While some investors such as us - appreciate managers demonstrating their confidence in the company by purchasing its stock, others raise concerns about such high levels of insider ownership. This is particularly relevant in the case of Nova Leap Health, given that its stock is not very liquid. As a result, it is possible that much of the upward price movement in the stock may be due to insider purchases, rather than other catalyzing factors.

In this scenario, the undeniable factor is the long-term prospects of the industry. We believe that NLH is uniquely poised to capitalize on this situation. As the CEO has articulated, they operate a boring business where not much excitement occurs. However, unlike many stocks of this size, they have managed to generate actual profits and have significantly increased their revenue since inception - they reached $28 million of revenues for 2022. Even those who may have valid criticisms (which we will address later) would concur that at its current price level of CA$0.2 per share, it is a remarkably inexpensive stock. The greater concern is whether it will be able to recapture the attention of a broader investor audience, as it did towards the end of 2020 when it nearly reached CA$1 in mid-2021.

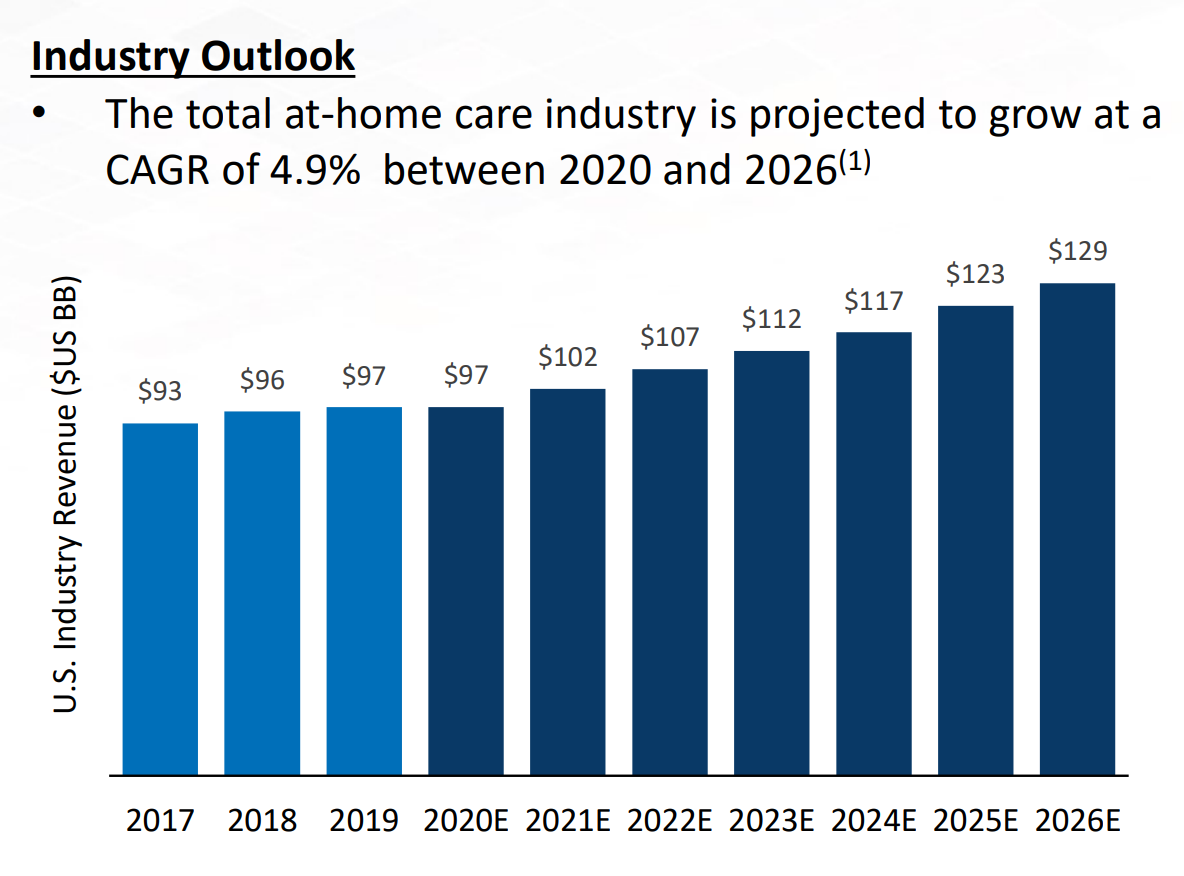

Every 13 seconds, another American turns 65 years old. As this trend continues, the demand for home health services will grow

The biggest challenge for the company in the next 10 years will be finding enough staff to keep up with demand. While the company has made progress in this area in the latest reporting quarter, the broader home health care industry is facing a shortage of workers. This could put a strain on Nova Leap's ability to grow at a rate that is sustainable and profitable.

Health and personal care aides are one of the fastest growing jobs. It is estimated that an average of 711,700 jobs will open up every year in the US from 2021 to 2031. This is mainly caused by the unprecedented growth of the US's senior population, where about 10,000 baby boomers (Americans born between 1946 and 1964) will turn 65 every day. It is estimated that 7 in 10 baby boomers will need long-term care during their lifetime. As a result, the number of home health and personal care jobs is expected to jump by over 25 percent in the next 10 years, from 3.6 million in 2021 to 4.6 million in 2031.

Having discussed the promising aspects of Nova Leap Health's stock potential, it is now time to address the potential risks. We have already mentioned the most significant one: the labor shortage. However, there are other factors that investors should carefully consider.

There was a lively discussion on ceo.ca in 2019 where critics accused the company of being unable to grow organically. They argued that increasing revenue only through acquisitions doesn’t mean much for share price, it just adds debt or dilutes the share count. Nova Leap Health's reports emphasize their post-acquisition organic growth strategy, which aims to enhance the annual earnings of acquired companies through a variety of approaches. They have implemented operational efficiency measures, resulting in a net income of $380,000 after three consecutive quarters of losses. However, concerns persist about Nova Leap Health's ability or willingness to pursue this organic growth strategy in the future, as they have only opened one new location since the acquisition.

Another significant risk associated with investing in nano-cap stocks is liquidity. The spreads are relatively large, and there are days when trading volumes are very low or nonexistent. If you seek stocks where you can easily enter or exit positions, NLH is not an ideal choice. The share price volatility is pronounced in this case; we have observed it surge by more than 40% in a single day, only to retrace to current levels shortly thereafter. On the other hand, the market significantly discounted the stock to CA$0.125 in May last year following a weak earnings release. We were confident that these setbacks were temporary and that the market's low valuation was absurd. This drop, which lasted for several weeks, allowed us to acquire additional shares at extremely low valuations. Since then, the price has doubled and has remained relatively stable. While these types of stock price movements are not for the faint of heart, they sometimes provide once-in-a-lifetime opportunities.

Another concern for long-term shareholders like us is the possibility of the management taking the company private. They have been actively acquiring shares in the open market and have recently reduced the debt, but these actions have not yet propelled the stock back onto investors' radars. While we acknowledge this as a valid concern, the CEO's statements indicate that they are committed to remaining patient and waiting for the market to recognize the value proposition of NLH. This would allow them to capitalize on the "multiple arbitrage" they have been alluding to.

Our analysis of Nova Leap Health's balance sheet has revealed an unusual item - demand loans. While we don’t consider it as a particular risk, it prompted us to include an educational section in our write-ups, similar to the introduction of the factoring business history in our TFIN analysis:

🧑🏼🏫Educational Section

A demand loan is a rare form of loan that can be called for complete repayment without any prior warning to the borrower. In other words when the lender demands the money, the borrower must pay it. So unlike a regular loan that is paid in installments and has a defined maturity date, demand loans work on the specific demand of the lender.

There is a single analyst covering the stock, with a price target of CA$0.6, which is not significantly different from our assessment of its value at CA$0.7. As mentioned previously, we have owned shares that we began acquiring in the low 0.2s and have substantially augmented our position as the share price declined, reaching approximately 0.13 at one point. There is a prevalent view that resuming acquisitions in 2024 could serve as a catalyst for the share price, and it appears that the company has been actively preparing for this possibility through its recent actions, including reducing debt, enhancing operations, and generating profits.

However, the risks persist, so before making any investment decision, especially in this type of stock, we recommend conducting in-depth research and not relying on others to do your thinking for you. As a good starting point, in addition to the company reports, we recommend the following sources as a valuable initial step: ceo.ca, YouTube interviews and presentations by the CEO, this channel , as well as the official SEDAR fillings by the company.

We hope that you find this article informative and insightful. We welcome any input regarding potential downsides or any aspects we might have overlooked in our analysis of Nova Leap Health. It's important to emphasize that this report should serve just as a starting point for your research and investment decision-making process. We encourage you to delve deeper, seek additional perspectives, and conduct your own thorough due diligence before making any investment decisions. Your financial well-being is of utmost importance, and we wish you success in your investment endeavors.