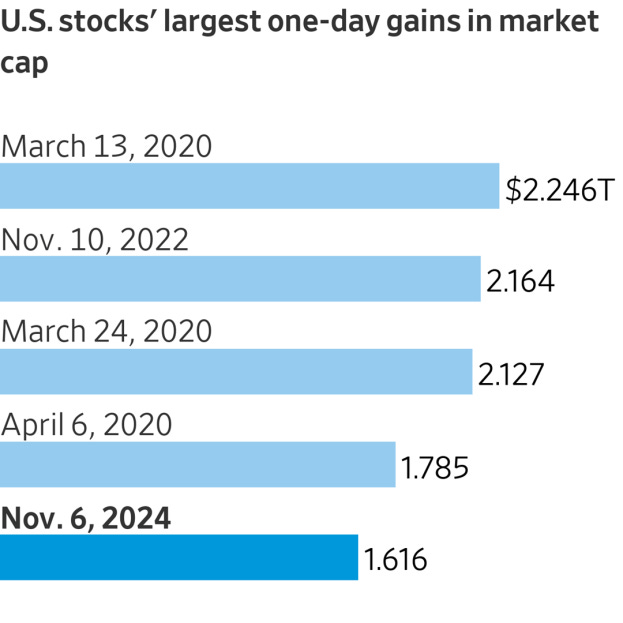

Markets responded positively to Donald Trump’s victory in America’s election. The dollar soared, rising by the most in a day against a basket of currencies for two years. The Mexican peso and the Chinese yuan tumbled amid fears of higher tariffs and more trade protectionism. The “Trump trade” also lifted stock markets. The biggest winners were companies thought to be favored by Mr Trump. Tesla’s stock jumped, as did shares in banks, which will profit from Mr Trump’s promise to overhaul America’s regulatory agencies; he has said he will fire the chairman of the Securities and Exchange Commission. Bitcoin surged to almost $75,000, beating its previous record in March. Mr Trump wants to make America the “crypto capital of the planet”.

Fed Cuts Rates Again, This Time by a Quarter Point. The decision, coming the same week as the election of Donald Trump to a second presidential term, followed an initial cut of a half-point in September and will bring the benchmark federal-funds rate to a range between 4.5% and 4.75%. All 12 Fed voters backed the cut.

Apple’s annual report conceded that its future products may not be as profitable as the iPhone, as it invests billions in artificial intelligence-based services. Meanwhile, speculation mounted that Apple is set to be fined by the European Union’s competition regulator for restrictions at its App Store, which would make it the first tech company to be fined under the EU’s Digital Markets Act.

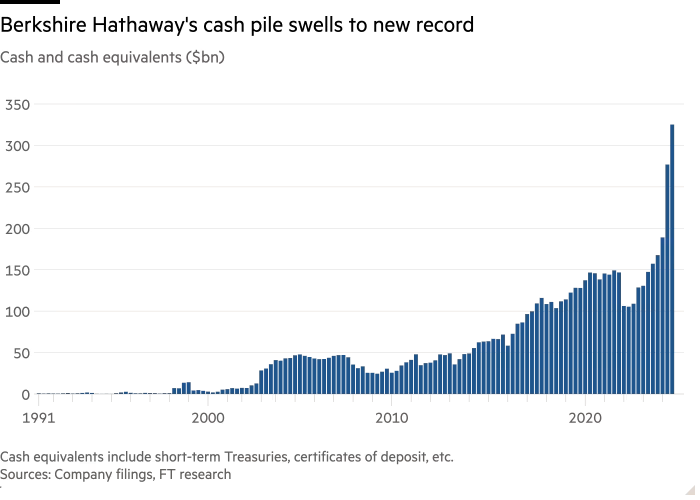

Warren Buffett’s Berkshire Hathaway reduced its stake in Apple further. It now has a $70bn holding in the company, down from $178bn in 2023. After the sale of this and other stock, Berkshire is now sitting on a cash pile of $325bn, its largest ever.

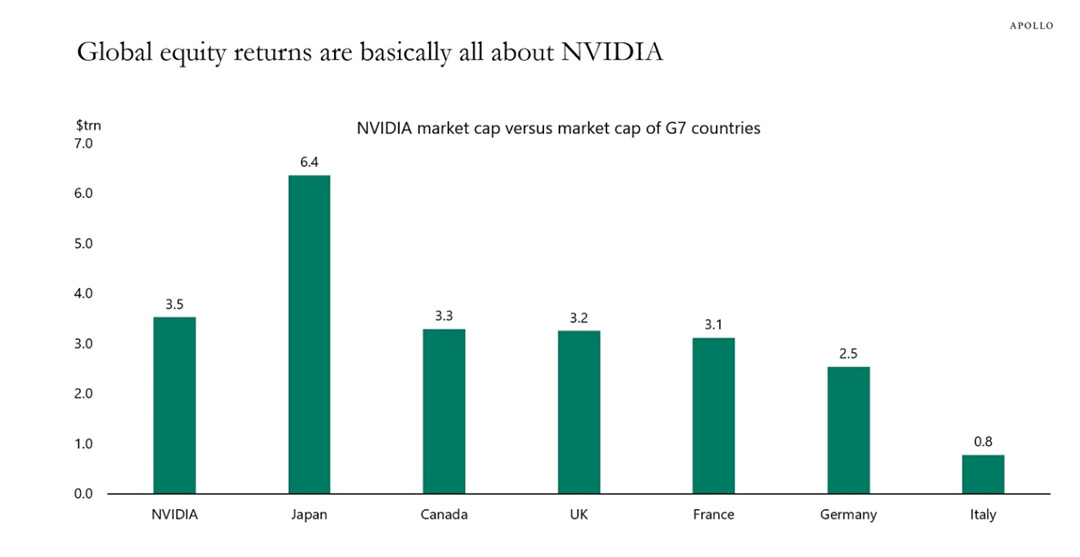

Nvidia replaced Intel on the Dow Jones Industrial Average, a stock market index of 30 blue-chip companies. Intel, which joined the Dow in 1999, has seen its share price fall by 50% this year and it recently reported a $16.6bn quarterly loss. Nvidia’s stock is up by 190% on record revenues and it has surpassed Apple to become the world’s most valuable company. Nvidia's market capitalization is greater than the total value of the entire stock market of five of the G7 nations. Only Japan and the U.S. (not shown) are bigger. In fact, Nvidia is bigger than Germany and Italy combined.

Wall Street’s largest financial institutions have loaned more than $11bn to a niche group of tech companies based on their possession of the world’s hottest commodity: Nvidia’s artificial intelligence chips. Blackstone, Pimco, Carlyle and BlackRock are among those that have created a lucrative new debt market over the past year by lending to so-called neo-cloud companies.

Over the past three years, Europe’s largest economy has slowly but steadily sunk into crisis. Germany has seen no meaningful quarterly real GDP growth since late 2021, and annual GDP is poised to shrink for the second year in a row, with the car, chemicals and engineering sectors all in a slump. What is happening right now is “unprecedented”, one analyst said, and “of a completely different order of magnitude” from previous crises.

In 2023, the unemployment rate for 15-74 years old in the European Union fell to 6.1 per cent of the labor force, the lowest level since 2014, EU statistics agency Eurostat said on November 8. The long-term unemployment rate, as a percentage of the labor force, was 2.1 per cent in 2023, marking a historic low.