Share buybacks on mainland China’s biggest exchanges have soared to a record high of $33bn so far this year, more than double last year’s total and far surpassing the previous record in 2022. The rush comes amid policymakers’ attempts to revive a flagging stock market.

Weaker businesses are rushing to take advantage of a red-hot credit market, issuing bonds and loans to refinance older debt, strengthen their balance sheets and fund dividend payments to their owners. In September alone, companies borrowed a combined $109.7 billion in junk-rated bonds and loans. That is the third largest monthly total in records going back to 2005. The extra yield that investors demand to hold speculative-grade corporate bonds over U.S. Treasurys fell to 2.85 percentage points last week, just a touch higher than the 14-year lows reached in 2021.

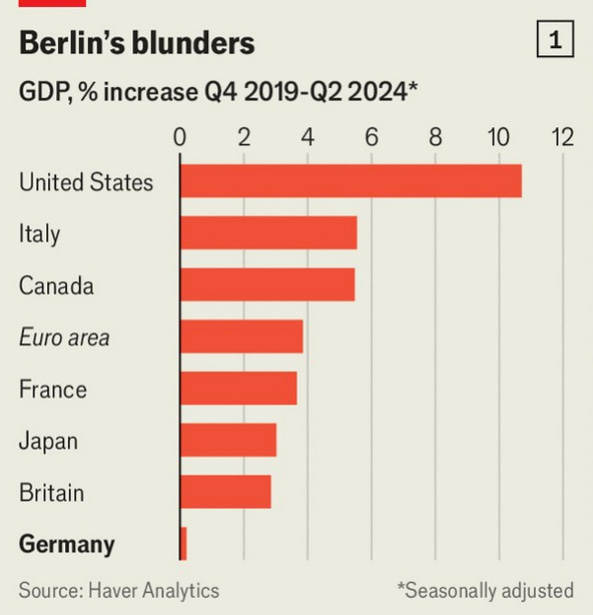

Over the past three decades America has left the rest of the rich world in the dust. In 1990 it accounted for about two-fifths of the GDP of the G7. Today it makes up half. Output per person is now about 30% higher than in western Europe and Canada, and 60% higher than in Japan—gaps that have roughly doubled since 1990. Mississippi may be America’s poorest state, but its residents earn, on average, more than Brits, Canadians or Germans.

Large investment funds run by groups such as Fidelity and T Rowe Price are being forced to offload shares to avoid getting into trouble with US tax authorities. This year’s lopsided stock market rally has pushed them up against strict limits requiring them to maintain diversified portfolios. The stock market rally has driven the S&P 500 and other indices to near-record levels of concentration.

The European economy is set to fall further behind the US’s by the end of the decade, the IMF warned yesterday. The fund estimated Europe’s annual GDP growth rate for the 10 years until 2029 would fall to just 1.45 per cent, while the US’s is estimated at 2.29 per cent for the same period.

The gold price broke a new record this week, hitting nearly $2,750 per troy ounce. Meanwhile, government borrowing costs have been rising sharply on both sides of the Atlantic. Ten-year American Treasury bonds now yield 4.2%, up from 3.6% in mid-September; ten-year British gilts also yield 4.2%. The same period saw a slide in the value of the Japanese yen. One dollar now fetches ¥152, up from ¥140.

The share price of McDonald’s fell sharply after America’s Centres for Disease Control and Prevention traced an outbreak of E. coli to the fast-food chain’s restaurants. The public-health authorities found 49 people who had been infected, in ten different states, one of whom died. All reported having eaten at McDonald’s before becoming sick. The chain has stopped selling “quarter-pounder” burgers, thought to be behind the outbreak, in a fifth of its American outlets.

Nvidia dethroned Apple as the world's most valuable company on Friday, following a record-setting rally in the stock powered by an insatiable demand for its new supercomputing AI chips. Nvidia's stock market value briefly touched $3.53 trillion, while that of Apple was $3.52 trillion.