European households are saving at higher rates than during the pre-pandemic era, according to data that highlights a clear divergence from more buoyant US consumers driving the global economic recovery. While Americans are now comfortable to “spend, spend, spend”

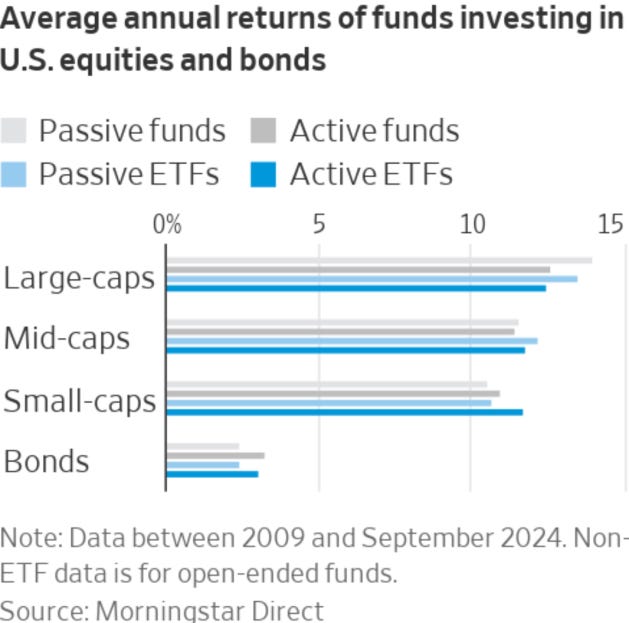

For most investors, exchange-traded funds are synonymous with passive investment. The asset-management industry is trying to change that—and likely not for the better. ETFs are the big market story of the past few years: Over the past decade, assets managed by these vehicles in the U.S. have leapt from roughly $1.5 trillion to more than $10 trillion, according to Wall Street analysts. Active ETFs are the latest attempt to differentiate, and they seem to be taking investors full circle. That is, paying more to get less performance—and ignoring the longstanding wisdom that active managers often struggle to beat the wider market after accounting for fees. The performance record isn’t great.

The U.S. budget deficit topped $1.8 trillion in the latest fiscal year, driven by higher spending on interest and programs for older people, as the government faces a persistent gap between federal outlays and tax collections. Тhe government collected $4.92 trillion in revenue and spent $6.75 trillion, putting the deficit at $1.83 trillion.

Several low-key sectors have been leading the stock market higher in recent weeks. The S& P 500 has advanced 19% this year, driven higher in the first half of 2024 by tech titans and their artificial-intelligence ambitions. Since the start of the third quarter, a less-glitzy group of sectors—including utilities, materials and industrials—has picked up the baton to broaden the market’s rally.

The Justice Department is considering splitting up Google, among other restrictions, to end what it called an unlawful monopoly in search, according to a court filing submitted Tuesday

U.S. inflation is cooling more slowly than expected, new data showed. The consumer-price index rose 2.4% from a year earlier, the Labor Department said, after rising 2.5% in August.

Chinese stock markets fell back to earth with a bang, when a meeting of economic officials produced no additional stimulus on top of the measures that were recently rolled out. The blue-chip CSI 300 and Shanghai Composite fell by roughly 7% in a day, their biggest daily declines since the start of the pandemic.

Germany’s economy is now expected to shrink by 0.2% in 2024, according to the government, which would be the second consecutive year of contraction. It is forecast to grow by 1.1% in 2025.

Samsung Electronics issued a public apology for not meeting expectations on performance and for the sense of crisis gripping the company. The South Korean firm has fallen behind the likes of Micron and SK Hynix in supplying chips for artificial intelligence. Its estimate of profit for the third quarter has come in well below forecasts. “Respected customers, investors, and employees,” Samsung said in an open letter, “these are testing times.”