he U.K. will be the first G7 country to end coal power generation as its last coal-fired plant officially closes on Monday. The Ratcliffe-on-Soar plant, owned by German energy giant Uniper, has been generating electricity since 1967. The closure will end more than 140 years of coal power in Britain, an important milestone for a country that was the first to open a public coal-fired power station in 1882.

Chinese stock markets snapped out of their funk and rallied in response to the government’s recent stimulus package, chalking up their biggest daily gains since 2008. The benchmark CSI 300 rose by 25% over five days, its most ever by that measure. The Shanghai Composite was up by 21% over five days, its largest gain since 1996. Hong Kong’s Hang Seng Index also surged; it has risen by 30% since the start of 2024.

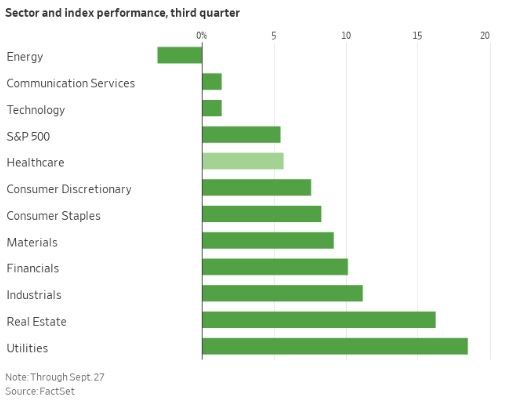

AI fever has loosened its grip on the stock market. Gone is the first half of 2024, when investors’ passion for artificial intelligence drove the market skyward even as stubbornly high inflation dashed hopes that the Federal Reserve would begin cutting interest rates. The third quarter brought a new order to markets. Investors began to look askance at big tech companies’ heavy spending on AI. They took heart in a series of tamer inflation readings that led the Fed to finally lower rates.

OpenAI - Investors are valuing the startup behind ChatGPT at $157 billion. The company was last valued at $86 billion early this year, when employees sold existing shares.

Fourth-quarter trading started with the S&P 500 up more than 20 per cent this year. The benchmark index closed the third quarter at 5,762.48, a gain of more than 5.5 per cent since the end of June.

Investors are turning to complex derivatives trades as they seek to profit from an uncertain US presidential race, which remains extremely close with fewer than 30 trading days to go. Instead of predicting who will win, a growing number of investors are betting on volatility rising sharply in the coming weeks.

U.S. Added 254,000 Jobs in September, Blowing Past Expectations. The pace of hiring picked up strongly in September and the unemployment rate ticked down to 4.1%, signs the economy had continued momentum in a month the Federal Reserve delivered its first interest-rate cut in four years.

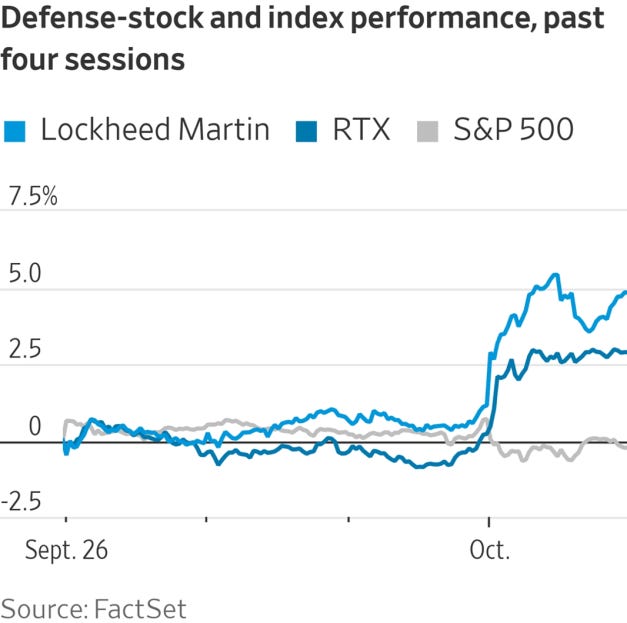

A rise in oil prices intensified Thursday after President Biden suggested that U.S. officials are considering whether to support an Israeli strike on Iranian oil facilities, a move that could push gasoline prices higher just weeks before the presidential election.

Tesla reported its first quarterly rise in deliveries this year. The carmaker delivered almost 463,000 vehicles from June to September, an increase of 6.4%, year on year.

Pink Floyd reportedly sold the rights to its catalogue of recorded songs to Sony for $400m. The deal brings an end to years of squabbling about rights among the band members. The decades-long feud between David Gilmour and Roger Waters is as legendary as Pink Floyd’s music.