Apple and Google have both lost appeals against the EU that could result in billions of dollars in payments. The EU’s top court, the European Court of Justice, ruled that the iPhone maker must pay €13bn in back taxes to Ireland, overturning an earlier decision in Apple’s favour. Google’s case relates to recommendations it gave on its internet shopping service. The European Commission fined the search engine group €2.4bn in 2017 for using its own price comparison shopping service to gain an unfair advantage over smaller European rivals. The ECJ today upheld a lower court’s decision, rejecting Google’s appeal.

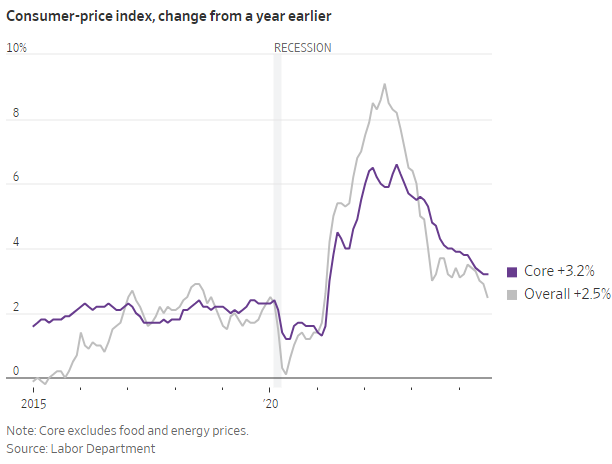

The European Central Bank reduced interest rates by another quarter of a percentage point, taking its main deposit rate to 3.5%. Inflationary pressures have eased in the euro zone, but the ECB expects the headline annual inflation rate to rise again by the end of this year, then decline towards its 2% medium-term target over the second half of next year.

One of the hottest sectors in the hedge fund industry has suffered outflows for the first time in seven years, a sign that investors may finally be losing interest in so-called multi-manager funds. Pioneered by the likes of Ken Griffin’s Citadel and Izzy Englander’s Millennium, the funds have recorded consistent returns — even in bear markets like 2022. But over the past 12 months they have seen net client withdrawals.

The E.U., facing a shrinking share of the global economy, needs to increase its spending by nearly $900 billion a year in sectors like technology and defense to remain competitive against the U.S. and China. That assessment comes from a long-awaited report from Mario Draghi, a former president of the European Central Bank, who yesterday called the challenge for the E.U. “existential.”

US Inflation Extends Cooling Streak to Hit 2.5% in August. Inflation eased to new three-year lows, teeing up the Fed to begin gradually reducing rates this week.

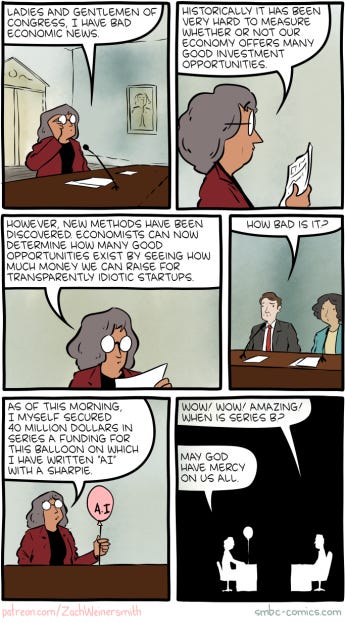

OpenAI is aiming to raise at least $5bn from investors including Apple, Nvidia, Microsoft and Thrive Capital. The San Francisco-based group is seeking more investment to fund its ambitious plans to develop AI models capable of outperforming human intelligence, in a deal that could nearly double the start-up’s valuation to $150bn.

Oil prices are likely to keep falling, the head of the International Energy Agency has said, as producers continue to pump volumes that exceed global demand. The comments follow weeks of falling oil prices. Brent crude, the international benchmark, fell below $70 a barrel this week for the first time in nearly three years.

The U.S. federal government spent $380B more than it earned in August, according to the Treasury Department. It also spent more than $1T on interest payments so far this fiscal year - for the first time ever - as the government's fiscal YTD budget deficit swelled to $1.9T, up 24% from the same period a year ago.

📚

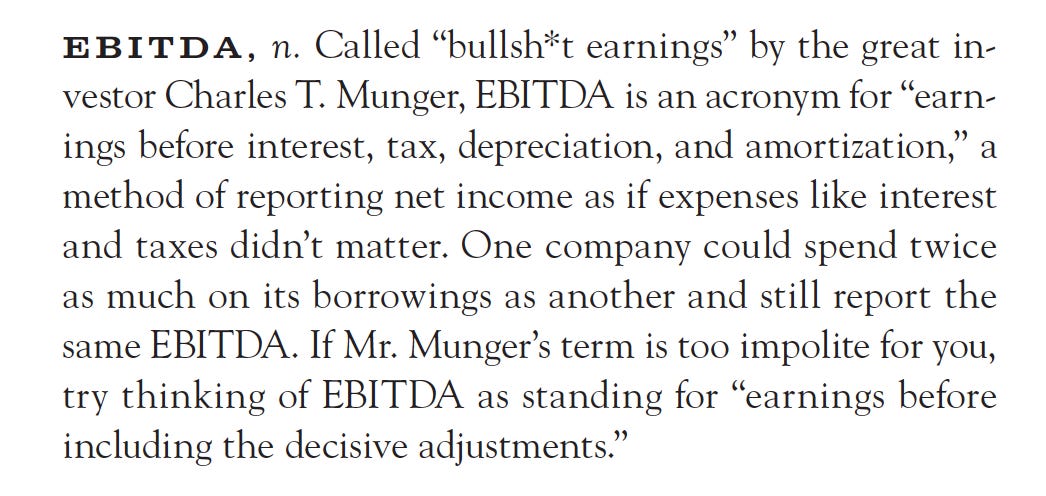

In the earnings release, Adam Aron, AMC's CEO, made one of the strangest statements I've ever seen from a corporate executive: "Indeed, in June of 2024, AMC achieved our highest-ever June Adjusted EBITDA in our company’s entire 104-year history.” And adjusted EBITDA, of course, is even farther from actual earnings; a company can exclude the most basic expenses until it comes up with whatever number it feels like. (In 2018, WeWork was widely mocked for its "community-adjusted EBITDA," a rough indication of what WeWork might have earned if it had virtually no expenses at all.)