OpenAI is reportedly in discussions to raise several billion dollars in a new funding round that would value the company, known for developing ChatGPT, at over $100 billion. This would be the largest infusion of outside capital since Microsoft invested around $10 billion in January 2023. As competition intensifies in Silicon Valley to create the most advanced AI systems, Apple is also in talks to invest in OpenAI, aiming to strengthen its position in the rapidly evolving AI landscape. This potential investment would further cement Apple's ties to a crucial partner in the race to lead the artificial intelligence industry.

Nvidia’s revenue more than doubled in the past quarter as per its earnings report yesterday, however its shares still fell in after-hours trading by as much as 8 per cent as the chipmaker failed to meet Wall Street’s lofty expectations.

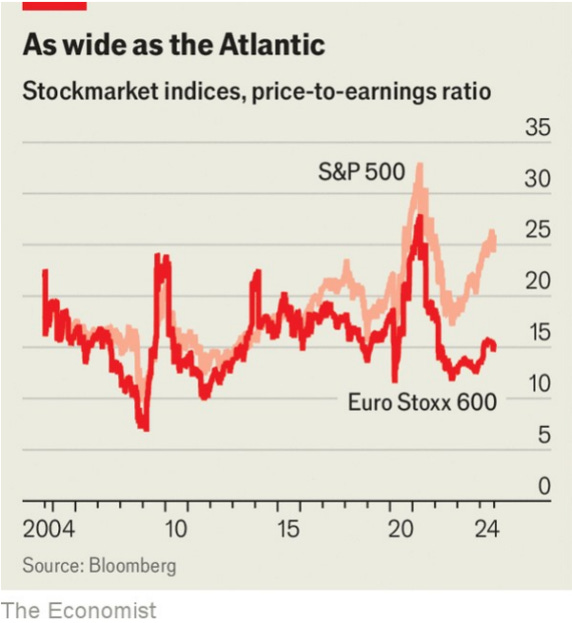

Despite evermore attractive valuations and the better news of recent months, many investors are still not entirely sold on Europe. Asset managers appear to be considering the chance of a slowdown, rather than rushing to gain exposure to an upswing. Even if there are signs of improvement, Europe’s economy has grown by just 4% since before the covid-19 pandemic, compared with 9% in America. And there are continued worries about the weakness of European demand, as well as stagnation in Germany, the continent’s usual economic motor.

The Canadian government decided to slap tariffs of 100% on imports of Chinese-made electric vehicles, and a 25% duty on Chinese steel and aluminium. Following similar steps in America and the European Union, Canada said both industries were unfairly subsidised by the Chinese state. China said the measures would damage trade and co-operation between the two countries.

Shares of Warren Buffett's holding company, Berkshire Hathaway, rose in intraday trading today, pushing its market capitalization above $1 trillion for the first time. Berkshire is just the 8th U.S. company, and 9th in the world, to cross the $1 trillion mark. And it is only the second company outside the technology or consumer discretionary sectors to hit $1 trillion, the first being the Saudi Arabian state-controlled oil company Saudi Aramco. Berkshire and its leader are famous for their slow-and-steady approach to business and investments, and the company's path to the $1 trillion club reflects that. Of all the U.S. companies to reach $1 trillion, Berkshire's path to 13 digits has been the longest.