🗞️ In the News

The U.S. stock market finished sharply higher Friday, sparked by Federal Reserve Chair Jerome Powell's strongest signal yet that interest rate cuts are coming. "The time has come for cuts," Powell said at the Jackson Hole Economic Symposium, increasingly confident that inflation will return to the central bank's 2% target.

More than half of Fortune 500 companies see artificial intelligence as a potential risk to their business, according to a new survey of corporate filings, a striking jump from just 9 per cent in 2022. By contrast, only 33 of the 108 that specifically discussed generative AI saw it as an opportunity.

Almost $90bn poured into US money market funds in the first half of August as investors look to lock in attractive yields that could outlast an expected interest rate cut by the Federal Reserve next month. Money market funds, pulled in net inflows of $88.2bn between August 1 and August 15 — the highest figures for the first half of a month since November last year.

The dollar hit its lowest level since the start of the year yesterday as investors braced for the Federal Reserve to start lowering interest rates and the August sell-off that spooked markets faded.

China Says ‘Please Stop Buying Our Bonds’. While stock and housing markets languish in China, one asset stands out—Chinese government bonds. Yields on 10-year government bonds fell to about 2.18% from about 2.6% a year earlier. In most countries— especially those experiencing a slowdown like China—that would be welcome. Yet the authorities have gone to extraordinary lengths to try to stem the rally in bonds they issue. The official explanation is that banks could end up with huge losses if the rally takes a sharp turn, citing Silicon Valley Bank as an example.

The U.S. added 818,000 fewer jobs in 2023 and early 2024 than previously reported, officials said, a sign of significant labor market cooling. The updated Labor Department numbers are the latest sign of vulnerability in the job market, which until recently had appeared rock solid despite months of high interest rates.

Western investors have piled back into gold as they position for US interest rate cuts this year, helping to drive prices to record highs. Prices reached $2,531 a troy ounce in trading on Tuesday, taking the precious metal’s gains for the year to more than a fifth, boosted by purchases by institutional investors and bullish hedge fund bets.

This year the number of trips abroad is expected to overtake levels reached in 2019. Spending by travellers, too, is projected to exceed what was shelled out in 2019, according to the World Travel and Tourism Council.

📚Educational Insights

About seven years ago, Intel had the chance to buy a stake in OpenAI, then a fledgling non-profit research organization working in a little-known field called generative artificial intelligence, four people with direct knowledge of those discussions told Reuters.

Over several months in 2017 and 2018, executives at the two companies discussed various options, including Intel buying a 15% stake for $1 billion in cash. They also discussed Intel taking an additional 15% stake in OpenAI if it made hardware for the startup at cost price. OpenAI was interested in an investment from Intel because it would have reduced their reliance on Nvidia's chips and allowed the startup to build its own infrastructure.

In a cruel twist of fate, Intel — long one of the world’s most important companies — now has a market cap about the same as OpenAI’s (both around $80bn) . Because of worse-than-expected results lately, Intel is laying off 15,000 employees and stopping work on all kinds of “non-essential” projects.

So why didn’t they do the deal? Intel ultimately decided against a deal, partly because then-CEO Bob Swan did not think generative AI models would make it to market in the near future and thus repay the chipmaker's investment. Short-term financial orientation vs long-term engineering-based vision.

Having a successful outcome in financial markets is not about maximizing every cent you can make, it’s about maximizing the time you can stick with a strategy that will work well enough to get you where you want to go.

MEMOS FROM HOWARD MARKS: Mr. Market Miscalculates

In the real world, things fluctuate between ‘pretty good’ and ‘not so hot,’ but in investing, perception often swings from ‘flawless’ to ‘hopeless.’

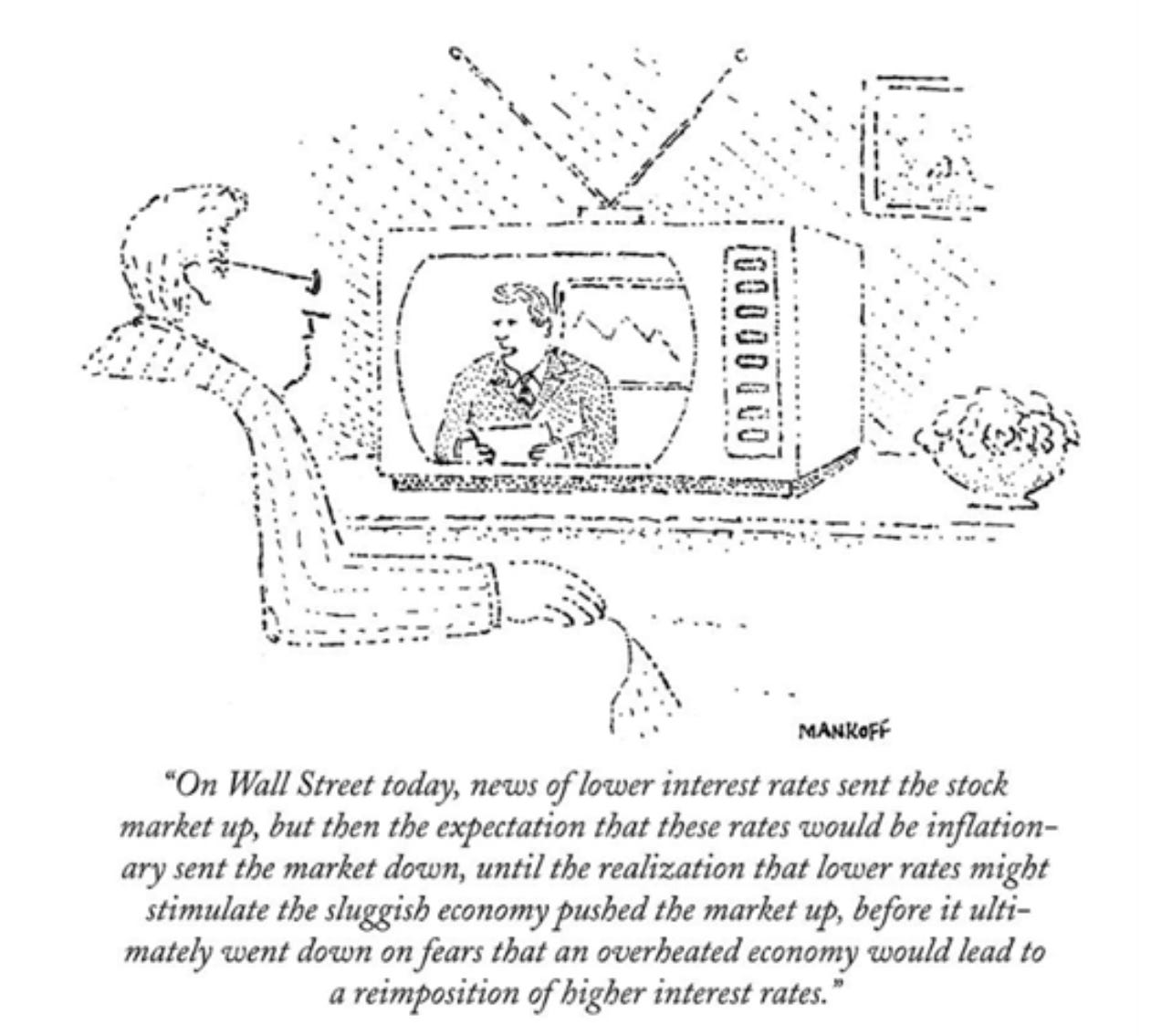

During big market moves, no one performs rational analysis or makes distinctions. They just throw out the baby with the bathwater, primarily because of psychological swings. As the old saying goes, “in times of crisis, all correlations go to 1.”

Further complicating things in terms of rational analysis is the fact that most developments in the investment world can be interpreted both positively and negatively, depending on the prevailing mood.

The day-to-day market isn’t a fundamental analyst; it’s a barometer of investor sentiment. You just can’t take it too seriously.

Source: https://www.oaktreecapital.com/insights/memo/mr-market-miscalculates