Investors are piling back into bonds as recession overtakes inflation as markets’ main fear, and fixed income proves its worth as a hedge against the recent stock market turmoil.

Rising wages in Germany are raising questions about September’s expected Eurozone interest rate cuts. Negotiated wages in the Eurozone’s largest economy are expected to shoot up by 5.6 per cent in 2024, based on deals agreed between January and June, the fastest pay increase since 2000.

Starbucks has appointed current Chipotle Mexican Grill chief Brian Niccol as its next leader, an abrupt management change for the coffee chain as it works to turn around its business and contend with activist investors.

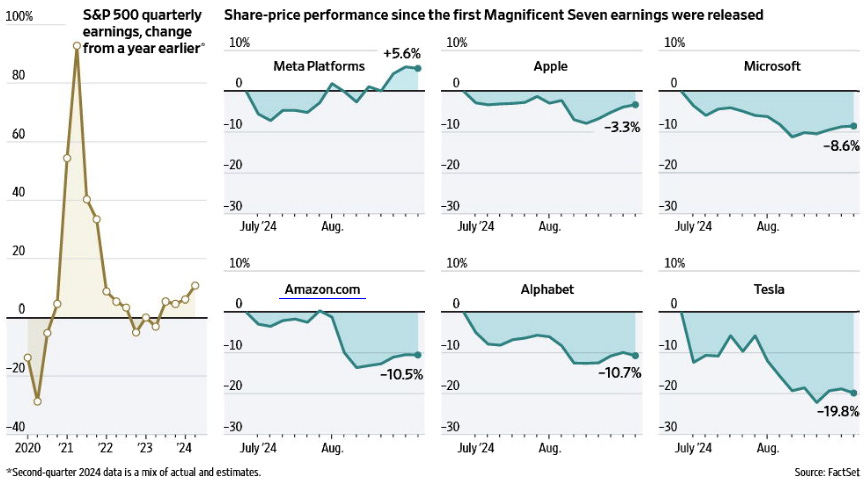

Volatility is back in the stock market after a roughly 18month slumber. Turbulence has mounted since mid-July, culminating last week with the S& P 500 logging both its best and worst days since 2022. Now, for investors both big and small, the question is: Will it continue? Wall Street is growing more skeptical about the payoffs of artificial intelligence, fueling a potentially massive rotation into other stocks and threatening to derail indexes that have become top-heavy with tech shares. A weakening U.S. labor market has rekindled economic fears. The inflation-fighting Federal Reserve in September is expected to begin interest rate cuts that could reroute the global flow of capital. Although the S& P 500 is down 4.1% from its July peak, the index remains 14% higher than the start of the year.

Inflation Slips to 2.9% in July, Lower Than Expected. U.S. inflation edged lower in July, extending a run of encouraging readings following a rocky stretch at the start of the year. It’s the first time inflation has slipped below 3% since early 2021.

Candy giant Mars has inked a $35.9B deal for snack maker Kellanova including assumed net leverage - in what is set to become one of the biggest M&A headlines of the year. The tie-up will pair the company behind M&M’s, Snickers and Skittles with the producer of Pringles, Cheez-It and Pop-Tarts, meaning the next time you reach for a quick packaged bite, it may ring the register of the same privately held conglomerate.

8.5%. The share of U.S. homes that have an estimated value of $1 million or more, a record high, according to a new analysis by brokerage Redfin for the Journal. That is up from 7.6% a year ago and more than double the 4% recorded before the pandemic. The increase is the result of historically high home prices across the country.

The latest government readout on U.S. retail spending—which includes purchases at restaurants and car dealers—showed the strongest gain since January 2023. Two weeks ago, a rise in unemployment, a sudden drop in the stock market and warnings from some big companies stoked fears the U.S. was sliding into recession. The results on Thursday mollified those concerns—and the stock market is rapidly making back its lost ground. The S& P 500 gained 1.6% on Thursday, led by a 6.6% jump in Walmart’s shares, which closed at an all-time high.

Sales of pure-electric and hybrid vehicles overtook those of conventional cars for the first time in China. According to the China Passenger Car Association, these new-energy vehicles accounted for 51% of total vehicle sales in July, up from 7% just three years ago.

Berkshire Hathaway's holdings of cash and Treasury bills increased from $189bn in the first quarter of the year to $277bn at the end of June. Mr Buffett’s reputation has taken on an almost spiritual element: he is known as the “Oracle of Omaha” for a reason. It is no surprise, then, that some onlookers see the cash accumulation as a dark omen.

Mr Buffett’s extraordinary talent as an investor is not based on a capacity for seeing the future. Indeed, his outperformance is all the more impressive for his lack of supernatural abilities. In research published in 2018, Andrea Frazzini, David Kabiller and Lasse Pedersen, all of AQR Capital Management, a quantitative investment firm, found that Mr Buffett’s long-run outperformance can be straightforwardly explained. He has bought high-quality stocks at relatively cheap prices, and applied leverage judiciously.

Just as the explanation for his extraordinary performance is acumen rather than magic, so is the reason for Mr Buffett’s cash build-up. In May Mr Buffett said that his investors should expect him to sell shares and build up reserves for two reasons. One is that he expects taxes on capital gains to rise, and wants to realise his profits before that happens. The other is that he sees few cheap, high-quality companies in which to invest. The stockmarket is expensive across the board.

Mr Buffett has never claimed to posses the foresight his followers attribute to him. Indeed, he once joked that any firm which hires an economist has one employee too many, and says he has never made any investment decision based on an economic prediction.