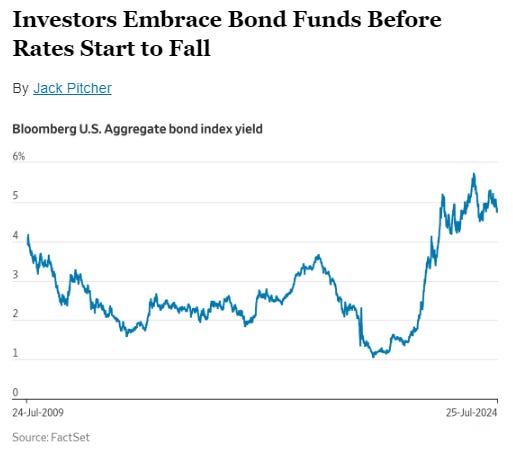

The stock market may be roaring, but 2024 has been Wall Street’s year of the bond fund. Bonds are paying the highest yields in a generation and interest rates are poised to come down. Meanwhile, a record number of retirees are looking to cut risk in their portfolios. That combination has investors pouring money into both indexed and actively managed funds. Wall Street is seeing dollar signs. U.S.-listed fixed-income exchange-traded funds have taken in nearly $150 billion through late July, a record through this point in a year. When looking at mutual funds and ETFs together, taxable bond funds were responsible for nearly 90% of net U.S. fund inflows in the first half, according to Morningstar.

Investors have been rotating out of technology shares and into those parts of the market that have lagged behind. But one such area the consumer-staples sector isn’t benefiting much. While Coca-Cola posted impressive results that demonstrated superior pricing power, others turned in mixed quarterly reports. PepsiCo , by contrast, earlier this month reported a 3% decline in North America beverages volume and only a 1% increase in revenue for the segment, indicating much weaker pricing.

"The borrowing just keeps marching along, reckless and unyielding," said Maya MacGuineas of the Committee for a Responsible Federal Budget, as the U.S. national debt crossed $35T for the first time. Recall that the deficit hit $34T earlier this year and passed $33T just three months before that. The tide of red ink is swelling at a much faster pace than expected amid increased interest costs and mandatory spending on federal programs. The Congressional Budget Office last month even projected that the national debt would rise to a record 122% of GDP in 2034.

Diageo: The maker of Guinness, Smirnoff and Johnnie Walker reported a fall in annual sales and said that the "consumer environment" remained tough this financial year. Shares sank around 8.5% in London.

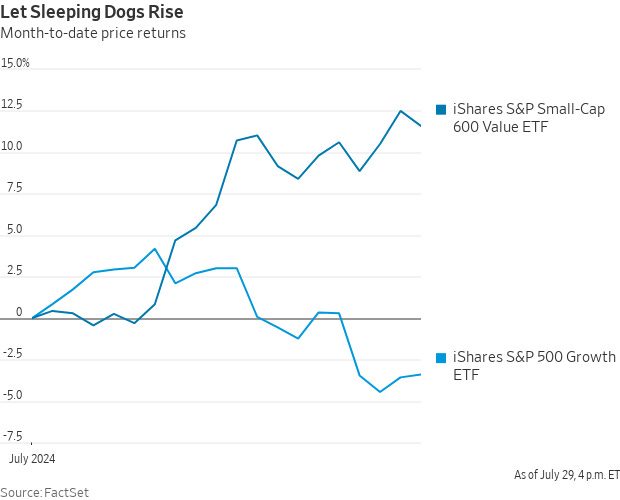

This chart shows how, starting on July 11, when the U.S. inflation rate came in lower than expected, small stocks shot up and big stocks went flying in the opposite direction. They took off, although no one is exactly sure why. Could this be the long-awaited beginning of a durable comeback for cheap "value" stocks and the eclipse of the "Magnificent Seven" tech giants that have dominated the stock market for the better part of a decade? Could it mean that people have begun to care again not only about what they own, but about how much they have to pay for it? Let’s see.

Eurozone growth maintained its pace in the second quarter, shrugging off unexpected contraction in powerhouse member Germany, but fears of a slowdown persist. Sluggish growth adds to the likelihood that policymakers will move to boost the economy in the months ahead. Gross domestic product increased by 0.3% between April and June, the same rate as in the year’s first quarter when the currency union emerged from the stagnation it suffered throughout last year. Most of the 20-member union’s larger economies booked better growth than expected, including France and, with a major 0.8% leap, Spain.

Federal Reserve officials hinted they were moving closer to lowering interest rates when they agreed to hold them steady on Wednesday. “A reduction in the policy rate could be on the table as soon as the next meeting in September,” said Fed Chair Jerome Powell at a news conference after the meeting. “We’re getting closer to the point at which it’ll be appropriate to reduce our policy rate, but we’re not quite at that point.”

Stocks and government bonds rallied on the final trading day of July, capping a topsy-turvy month for global markets with big gains. All three major indexes opened sharply higher, holding on to gains after the Federal Reserve held interest rates steady and Chairman Jerome Powell signaled the central bank is prepared to cut them in September if inflation keeps moving lower. The tech-heavy Nasdaq Composite jumped 2.6%, its best day since February. The S& P 500 added 1.6%. The Dow Jones Industrial Average added 0.2%.

Global stock sell-off hits Asia and Europe. Asian stocks had suffered a bruising day of trading. The broad Topix benchmark, which hit a record high last month, closed down 6 per cent in its biggest one-day fall since 2016. In South Korea the Kospi index fell almost 4 per cent and in Japan the Nikkei 225 index shed 2,216 points in its second-worst point decline ever on Friday.

$58.5 billion - Combined capital spending for Amazon, Google, Microsoft and Meta for the June quarter—up 64% year over year and the biggest jump that group has seen on a combined basis since 2018. Most of it is going toward data centers and Nvidia’s artificial-intelligence systems, which power those facilities.

Warren Buffett’s Berkshire Hathaway sold nearly half of its Apple shares, slashing its mammoth position in the iPhone maker after significant sales earlier in the year, new quarterly filings show.