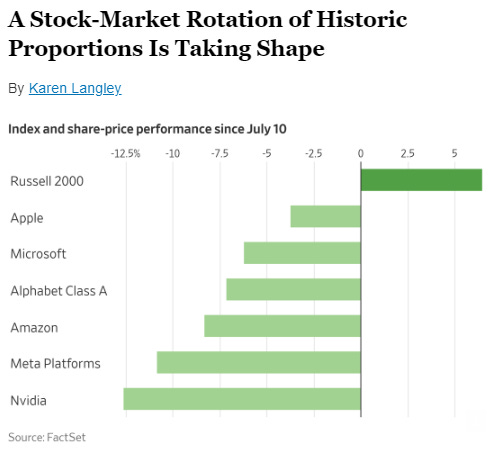

The stock market has suddenly turned upside down. The market’s laggards have sprung to life in recent days, while the seemingly impervious “Magnificent Seven” group of technology stocks has stumbled. Investors are even more focused than usual on corporate earnings as they try to anticipate what comes next. The Russell 2000 index of smaller stocks beat the S& P 500 over the seven days through last Wednesday by the largest margin during a period of that length in data going back to 1986, according to Dow Jones Market Data. The Russell 1000 Value index, meanwhile, notched its biggest lead over its growth-stock counterpart since April 2001, after the dot-com bubble burst.

European airlines can’t outfly the discounting war. Ryanair shares plunged about 17% on Monday after the Dublinbased carrier reported lower-thanexpected earnings for the April-to-June period. It also said that this summer’s airfares would be “materially lower” than last year’s. The prospect of a cutthroat holiday season dragged down the stocks of Ryanair’s budget peers easyJet and Wizz Air and, to a lesser extent, those of British Airways owner IAG , Air France-KLM and Germany’s Lufthansa .

U.S. Economy Keeps Going Strong in Second Quarter. Gross domestic product rose at a 2.8% annual rate in the second quarter, as lower inflation and a strong labor market fueled consumer spending.

A stock-market selloff intensified Wednesday, wiping out hundreds of billions of dollars in value from the Magnificent Seven group of tech giants and pushing the Nasdaq Composite to its first decline of 3% or more in 400 trading days. After a frenzy over artificial intelligence sent stocks to new heights in the first half of the year, investors have suddenly grown more skeptical of its potential payoffs.

The People’s Bank of China said Thursday that it cut a key interest rate and pumped the equivalent of more than $25 billion into China’s banking system. The move caught investors by surprise, as it occurred outside the usual sequence for policy shifts in the PBOC’s complex collection of interest rates and other tools.

OpenAI is launching a test version of its long-awaited search engine, which it says will cite sources of information. The tool, called SearchGPT, will summarize the information found on websites, including news sites, and let users ask follow-up questions, just as they can currently with OpenAI’s popular chatbot, ChatGPT. The sources are linked at the end of each answer in parentheses. Let's see how it does compared to Preplexity.

Alphabet reported revenues of $84.7bn for the three months to June, 14% higher than for the equivalent period in 2023. Advertising revenue rose by 11%, allaying concerns that alternative AI services such as ChatGPT will soon eat into its profits. Nevertheless, its share price still dropped by 5% over the following trading session, as part of a broad sell-off of big tech stocks.

Share prices for sellers of luxury goods also took a tumble on July 24th. Those of LVMH, Prada and Kering (which owns Gucci) all dropped by around 5%. Investors worried about faltering demand from Chinese consumers as the economy continues to cool. Many have been forced to roll out hefty discounts in Chinese stores.

The British pound reached its strongest level since the vote to leave the EU in 2016, as measured against a trade-weighted basket of its peers. Its gains have been fuelled by faster growth than was expected, delayed interest-rate cuts and the perceived stability of Britain’s new Labour government.