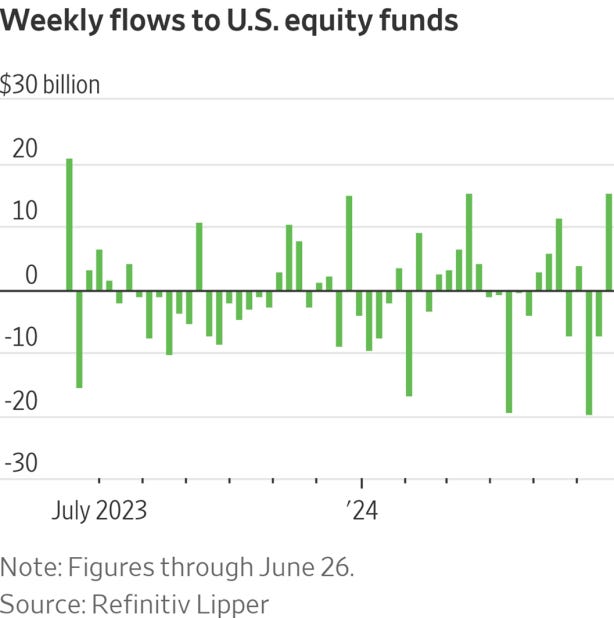

Investors are racing to get a piece of the stock market's big gains. They poured more than $15 billion into funds tracking U.S. equities at the end of June, the biggest haul in a year.

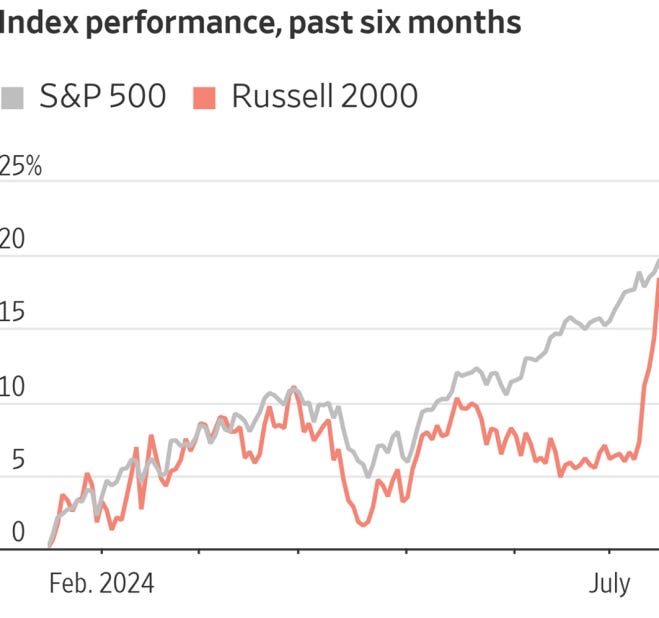

Investors are extending their rotation from shares of mega-cap tech companies to small-cap stocks. The Russell 2000 has beaten the S&P 500 by the widest five-day margin on record, based on data going back to 1986.

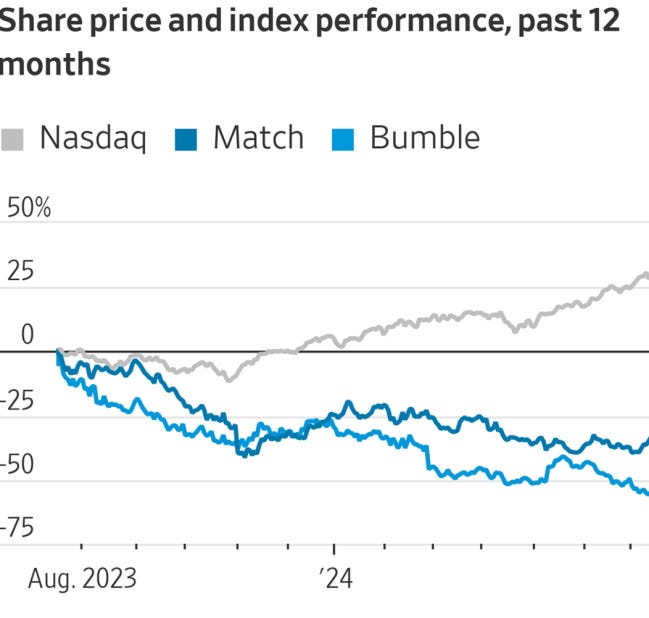

Shareholder activists are hot for online dating apps. Actual users? Not so much. Tinder—Match’s most popular service—has seen payers fall every quarter since late 2022. And payers to the Bumble app grew just a small amount in the first quarter.

Shares of Nvidia, Meta Platforms and other highflying technology shares plunged Wednesday, sending the Nasdaq Composite to its worst day in more than a year. A drop in Magnificent Seven shares helped push the tech-heavy gauge down 2.8%, its biggest one-day decline since December 2022. The S& P 500 fell 1.4%. The Dow Jones Industrial Average, meanwhile, added 0.6%, clinching a fresh high.

OpenAI unveiled the GPT-4o mini, its latest small AI model. This new product is being touted as cheaper and faster than OpenAI’s current AI models. GPT-4o mini will replace GPT-3.5 Turbo as the smallest model OpenAI offers.

A massive global technology outage on Friday took down airlines, medical services, banks and scores of other business and services around the world, a stunning example of the fragile dependence the global economy has on certain software and the cascading effect it can have when things go wrong. The outage was attributed to CrowdStrike, a cybersecurity firm whose software is used by scores of industries around the world to protect against hackers and outside breaches. The problem appeared to result in crashes of machines running Microsoft Windows operating system.

A broad decline in stocks pushed the Dow Jones Industrial Average down 533.06 points Thursday, snapping a six-session winning streak for the blue-chip index. Investors have been shifting from the megacap tech stocks that dominated the first half of the year into areas of the market that could benefit from potential rate cuts, such as shares of smaller companies and more economically sensitive sectors. But Thursday’s selloff extended beyond tech shares, with all but one of the S& P 500’s 11 sectors closing lower. Only three of the Dow industrials’ 30 stocks finished higher. Even the small-cap Russell 2000 index, which earlier this week reached a multiyear high, fell 1.8%

Facebook parent Meta Platforms is in talks to acquire a stake of about 5% in EssilorLuxottica , the eyewear company it partners with to make its Ray-Ban smart glasses. Based on EssilorLuxottica’s recent market value, a roughly 5% stake could be valued at around €4.5 billion, or just under $5 billion. The investment would be relatively small for Meta, given its market value of around $1.2 trillion. Sales of the companies’ latest Ray-Ban smart glasses, called Ray-Ban Meta, have exceeded expectations.

China’s GDP grew by 4.7% in the second quarter, year on year, down from 5.3% in the first quarter. It was the slowest pace of expansion since the start of 2023, underlining weak domestic demand caused by the slumping property market and job insecurity. The sluggish economy has affected many industries, not least luxury-goods companies, which are slashing prices to tempt Chinese shoppers.

Why is it that stock prices rise and fall so much more than the economies and companies that underlie them? And why is it that market behavior is so hard to predict and often seems unconnected to economic events and company fundamentals? The financial “sciences” – economics and finance – assume that each market participant is a homo economicus: someone who makes rational decisions designed to maximize their financial self-interest. But the crucial role played by psychology and emotion often causes this assumption to be mistaken. Investor sentiment swings a great deal, swamping the short-run influence of fundamentals. It’s for this reason that relatively few market forecasts prove correct, and fewer still are “right for the right reason.”

https://www.oaktreecapital.com/insights/memo/the-folly-of-certainty