The Second Quarter:

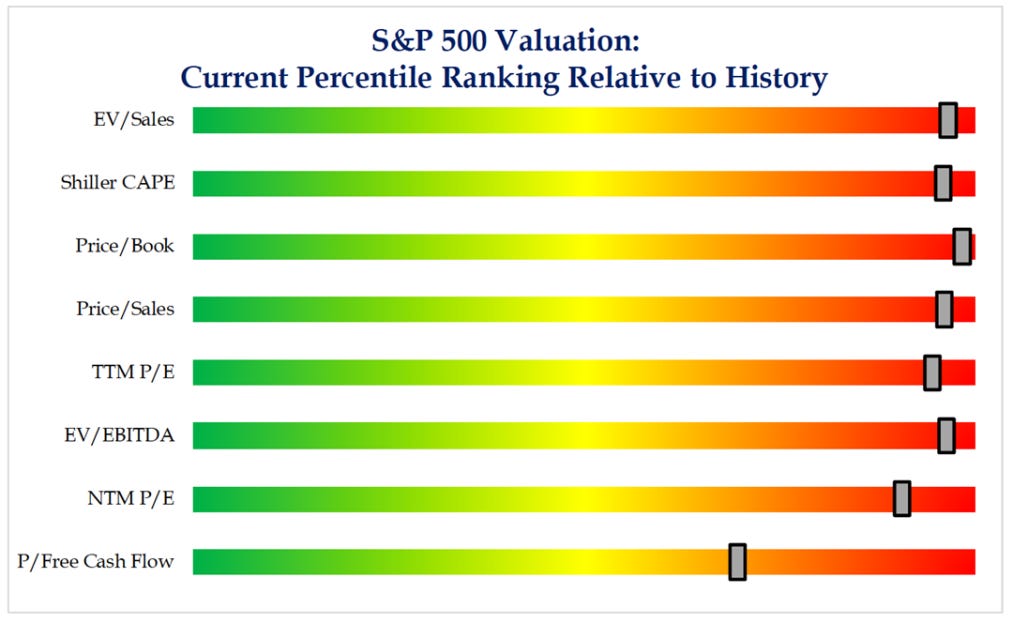

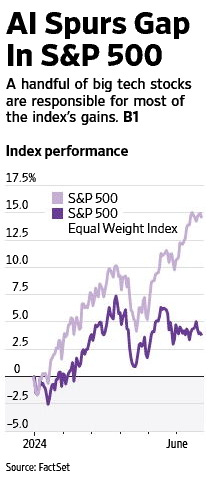

- Beyond artificial intelligence, the S& P 500 has been unloved.

- More S& P 500 sectors are down than up.

- Index volatility has tumbled, but single-stock volatility hasn’t.

- “Higher for longer” rates are now priced in.

- Weaker balance sheets have been punished.

- France has brought political risk back to European markets.

Active funds are struggling. That pokes a hole in one of Wall Street’s most cherished narratives— namely, that it’s worth paying a premium for active management and that stock pickers are sure to do better at some times than at others. The funds’ travails are a reminder of a basic rule: The asset-management industry depends more on marketing than on markets. Despite this purportedly ideal investing environment, stock pickers are doing even worse than usual. In the first half of 2024, according to Morningstar, only 18.2% of actively managed mutual funds and exchange-traded funds that compare themselves to the S& P 500 managed to outperform it.

Amid surging demand for electricity to power AI data centers, the tech industry is moving to secure a steady supply through nuclear power plants. The latest in the spotlight is a reported potential deal between Amazon Web Services and Constellation Energy. Vistra and Public Service Enterprise have also held talks for 'behind-the-meter' deals, where a large customer gets electricity directly from a plant. While the renewed interest in nuclear power bodes well for the industry, the deals could divert existing electricity resources, strain the power grid, and impact targets for reducing emissions.

Rodney Brooks, an MIT robotics pioneer, thinks people are vastly overestimating the promise of generative AI. Brooks says when a human sees an AI system perform a task, they tend to think it can do way more, and thus tend to be overly optimistic.

Former pariahs in emerging markets have been among the world’s best-performing stock markets this year as investors bet reforms in troubled economies such as Argentina and Pakistan will help them leave the worst of their currency woes behind them. Investors say these so-called frontier markets have been attractive because of their cheap valuations.

The investment world has been hoovering up mathematicians to devise new trading strategies for years. But now, the industry is leaning on political scientists for guidance. On the surface, it is not hard to see why given the flurry of elections and conflicts taking place around the world. Increasingly, many senior executives believe the world is going through not just a temporary bout of political volatility but a structural shift that will have a long-term impact on how the industry works.

The euro zone’s annual inflation rate dipped slightly in June, to 2.5%, though the growth of prices in services was still high at a rate of 4.1%. The European Central Bank is expected to keep interest rates on hold at its next meeting on July 18th, after cutting them a month ago.

Nike’s share price failed to recover from the hammering it took after the sportswear company reported weak quarterly earnings and lowered its sales forecast for the year. The stock lost 20% of its value. Nike has been running behind trendy competitors, such as Hoka and On, in terms of sales growth.

Jobs Data Bolster Case for September Rate Cut. The U.S. added a solid 206,000 jobs last month, the Labor Department reported on Friday, slightly beating expectations and continuing a remarkably strong run. But the unemployment rate ticked up to 4.1%, a sign of slack in a labor market that has already shown some hints of gradually slowing down. There were other indications as well that the job market is continuing to cool. Average hourly earnings were up 3.9% in June from a year earlier, marking their smallest gain since 2021.

Let's be honest, a year ago when we launched PP Investment Education, we were a little stubborn. We believed we could be just as proficient in graphic design as we are in investment advice. Well, let's just say it's a classic mistake for an aspiring investor – venturing into unfamiliar territory that seems deceptively simple. Thankfully, we realized this before it was too late! We partnered with the talented young designer Iskra Jovanoska whose amazing work you can see below. This experience solidified a valuable lesson: sometimes, the most efficient path is to let professionals handle their craft. We hope you do the same when you need help starting your investment journey. We'll be here, ready for your call!