The cyclically adjusted price-earnings ratio, popularised by Robert Shiller of Yale University, is at nearly 36. It has been higher only before the crashes of the early 2000s and 2022— and even then, not by much. That a correction will arrive at some point seems a racing certainty, but in the meantime there is a still more worrying prospect. As far as it has come, the rally may yet have further to go.

Baby boomers who aren’t ready to walk away from the stock market are flocking to a hot new class of funds that seeks to ease the pain of its swings. Even as signs of cooling inflation have powered major indexes to records, investors have poured billions of dollars into exchange-traded funds that use derivatives to produce extra dividend income or protect against losses. Such funds, which were almost nonexistent four years ago, give retirees and other investors the chance to chase stock returns while also protecting against a potential market slide. The funds have taken in at least $31 billion of new investor money over the past 12 months, according to FactSet, bringing their total assets to almost $120 billion. They generate higher dividend income than is typical in a stock fund but they also cap investor gains and carry chunky fees. “We like to call this kind of stuff ‘boomer candy,’ ” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence.

In its hustle to catch up on AI, Apple has been talking with a longtime rival, Meta. Facebook’s parent has held discussions with Apple about integrating Meta Platforms’ generative AI model into Apple Intelligence, the recently announced AI system for iPhones and other devices, according to people familiar with the matter. Meta and other companies developing generative AI are hoping to take advantage of Apple’s massive distribution through its iPhones—similar to what Apple offers with its App Store on the iPhone. A latecomer to generative AI, Apple has developed its own smaller artificial-intelligence models but has said it will turn to partners for more complex or specific tasks.

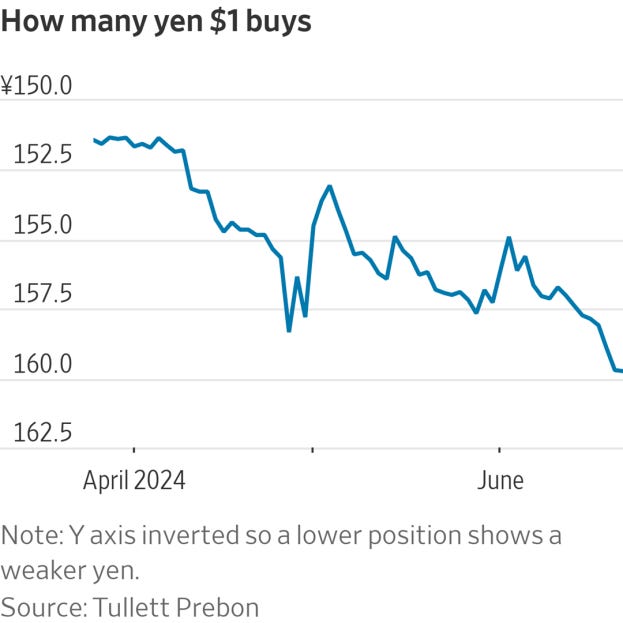

The yen is again approaching a three-decade low against the dollar Monday, drawing a verbal warning by a Tokyo currency official, who said the sharp weakening of the yen could hurt the economy.

As demand for weight loss drugs continues to surge, Novo Nordisk will invest $4.1B to build a second fill-and-finish facility in North Carolina. The development comes as Novo, which makes popular weight loss drugs Ozempic and Wegovy, and rival Eli Lilly, which markets Zepbound, are experiencing supply constraints due to high demand for the treatments (Wegovy also just got the green light in China).

Nvidia has shed more than $500bn in market value since briefly becoming the world’s most valuable company last week. Its shares fell almost 7 per cent Monday, wiping roughly $550bn from Thursday’s peak and taking its market value to $2.91tn, lower than Microsoft and Apple. Nvidia’s share gains alone this year had been responsible for roughly a third of the S&P 500’s increase in 2024 but yesterday’s falls prompted concerns about a broader market sell-off.

Investors poured an unprecedented amount of money into venture-capital funds about three years ago at the peak of the venture market’s recent boom. Those funds haven’t aged well so far. Funds that began investing in 2021, known in the venture industry as the 2021 vintage, are underperforming and threaten to become a long-term drag on the overall performance of the venture asset class. The median net investment rate of return for 2021-vintage venture funds was 2.1%.

US companies have been able to reprice almost $400bn of debt at lower interest rates this year due to booming investor appetite for junk loans. According to strategists at Goldman Sachs, even before the Federal Reserve cuts interest rates from a 23-year high, a number of borrowers in the US leveraged loan market have benefited from the equivalent of two quarter-point Fed cuts.

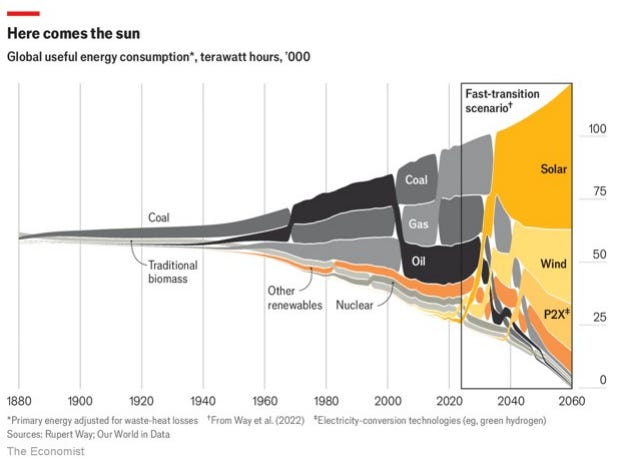

According to the International Solar Energy Society, solar power is on track to generate more electricity than all the world’s nuclear power plants in 2026, than its wind turbines in 2027, than its dams in 2028, its gasfired power plants in 2030 and its coal-fired ones in 2032. In an IEA scenario which provides net-zero carbon-dioxide emissions by the middle of the century, solar energy becomes humankind’s largest source of primary energy—not just electricity—by the 2040s

HOW CAN you tell it is time to get out of the market? In 1929 Joseph Kennedy, an American businessman and politician, supposedly realised the party was over upon hearing a shoeshine boy dispensing stock tips. In 2000 the exit doors beckoned after 17 “dotcom” firms paid millions of dollars each for brief advertising slots during the Super Bowl, an American-football extravaganza. And so to a sell signal fit for 2024: Keith Gill is back on social media. Mr Gill was an architect of the meme-stock frenzy of 2021, exhorting retail traders to buy shares in GameStop, a struggling chain of videogame shops. After a three-year absence he is posting once again, now apparently in possession of a stake in the firm worth a few hundred million dollars. GameStop’s share price has resumed a gutchurning roller-coaster ride and is up by more than 40% since Mr Gill’s return; the ailing company has made use of the excitement to issue some $3bn-worth of new shares. If you are looking for signs of speculative excess in markets, this is Exhibit A.