The Federal Reserve left its benchmark interest rate on hold at a range of between 5.25% and 5.5%. Markets were more interested in the latest moves along its path for rate reductions. The Fed now thinks it will cut just once this year, possibly as late as December, a big change from March, when it predicted three cuts. On June 6th the European Central Bank cut interest rates for the first time in five years, shaving a quarter of a percentage point off the deposit facility, to 3.75%.

America’s labor market confounded expectations again, adding 272,000 jobs in May, far above analysts’ forecasts and the second biggest monthly addition of employees to the payrolls this year. The annual inflation rate fell to 3.3%.

Hedge funds have amassed their biggest bets against Eurozone government bonds in more than two years, hitting $413bn last week, in expectation that the European Central Bank will have limited room to cut interest rates further this year.

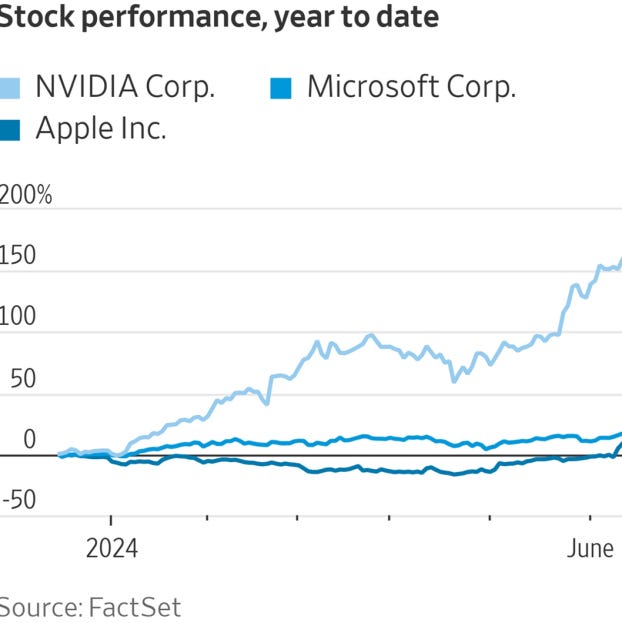

Apple has partnered with OpenAI to integrate ChatGPT into its devices, the iPhone maker said Monday as it outlined upgrades to its software ecosystem. The changes aim to leverage artificial intelligence to provide a smarter Siri voice assistant and more personalized features to enhance productivity. Apple's shares have been on a tear this week, powered by optimism about its new AI offerings. The iPhone maker is closing in on Microsoft as the most-valuable U.S. company, briefly overtaking its rival during Wednesday's trading session.

About $17.5 trillion is sitting in commercial banks and the average savings account earns 0.45% in interest a year.

In a big win for Elon Musk, Tesla's shareholders look set to approve his disputed $56B CEO pay package as well as the electric vehicle maker's reincorporation to Texas from Delaware. The massive 2018 compensation plan had been an overhang on Tesla's shares for months after it was voided by a Delaware judge in January, who called it "an unfathomable sum."

Companies' use of their own stock to pay for mergers and acquisitions has reached its highest level in five years, with M&A buyers taking advantage of the recent market rally. During the first five months of the year, all-stock deals accounted for 27% of the global value of strategic M&A, up from 11% the same period a year earlier and reaching the highest level since 2019.