Chinese investment turns to Vietnam and Mexico: China’s companies are increasingly favouring countries such as Vietnam and Mexico as trade tensions rise with the US.

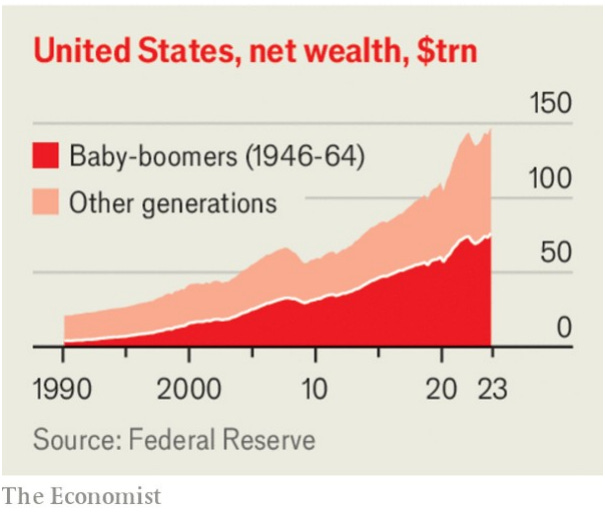

America’s boomers, defined as those born between 1946 and 1964, have a net worth of $76trn, or over $1m per person.

Cheap Chinese high-tech goods have flooded the global economy this year, raising alarms in Washington and Brussels as Western businesses complain about what they see as a new round of unfair competition. China’s industrial sector shows clear signs of overcapacity, especially in industries such as solar panels, automobiles and steel. In some sectors, the situation looks poised to get worse, as China keeps expanding capacity even as domestic demand stays weak.

Nvidia’s market value rose past $3tn to overtake Apple as the world’s second-most valuable company, following a year of incredible growth driven by demand for its artificial intelligence chips. Investors have flocked to Nvidia’s stock as tech groups spend billions of dollars on its chips.

Global investors have pulled a net $40bn from sustainability-focused stock funds, a blow to a much-hyped sector that has attracted trillions of dollars of assets. Research from Barclays shows this is the first year that flows for environmental, social and governance equity funds have trended negative, with redemptions widespread across all main regions.

The European Central Bank lowered interest rates for the first time since 2019, signaling confidence in its effort to bring inflation down. The benchmark deposit rate was lowered to 3.75 percent from 4 percent, the highest in the bank’s 26-year history and where the rate had been set since September. The bank’s move diverged from efforts by the Federal Reserve in the United States, where rates remain high.

America is gaining a new bourse: the Texas Stock Exchange, which announced that it had raised $120m from investors including BlackRock and Citadel Securities. The exchange aims to rival the New York Stock Exchange and Nasdaq, and to host its first listing in 2026.

U.S. job growth burst past expectations last month even as the unemployment rate edged up to 4%, presenting a mixed view of a labor market that has generally been cooling while staying hotter than many anticipated. Employers added 272,000 new jobs in May, the Labor Department reported on Friday, more than in April and well above the 190,000 that economists had expected.

The NYSE on Monday witnessed a technical glitch that triggered trading halts in about a dozen companies, like Class A shares of Berkshire Hathaway, which were displayed as down 99%. The issue appeared to be related to a new software release, but followed another recent glitch that had caused financial websites to halt updates of major indices.