U.S. Inflation Eased to 3.4% in April with a key measure of price pressures slowing to its lowest level since spring 2021.

Berkshire Hathaway has quietly built a minority stake in insurer Chubb, one of the world’s biggest insurance companies. The position is worth $6.7bn and highlights Buffett’s continued bets in the finance sector. Stock in Chubb increased by 9 per cent after the announcement.

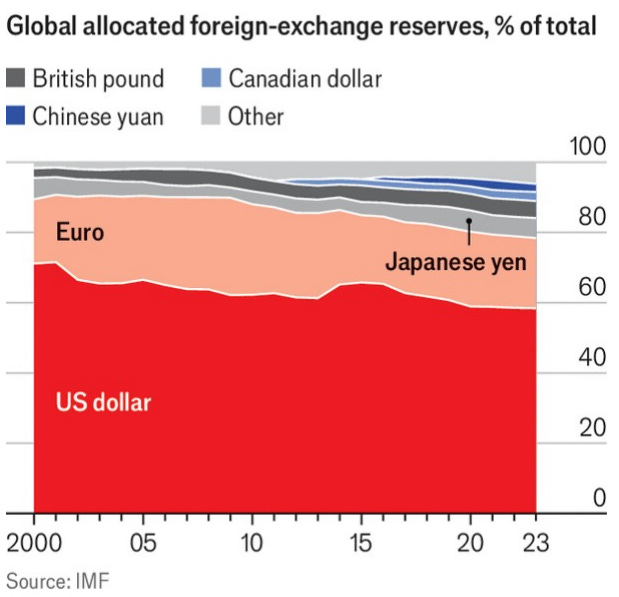

Ray Dalio has warned that rising US government debt could hit Treasury bonds, arguing that investors should move some of their money to foreign markets. The billionaire founder of hedge fund giant Bridgewater Associates raised wide-ranging concerns including the potential for the country to become involved in another international conflict.

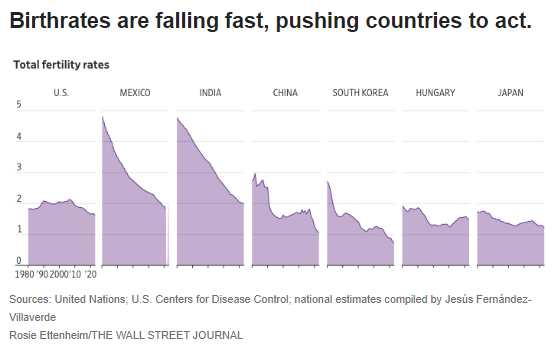

Fertility is falling virtually everywhere for women across all levels of income, education and labor-force participation. Some estimates now put the number of babies each woman has below the global replacement rate of about 2.2.

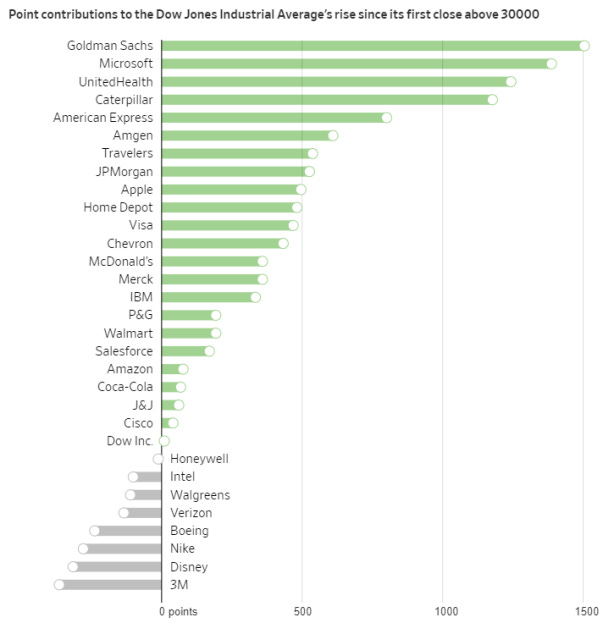

Dow Jones Industrial Average Tops 40000 for the First Time. The recession that so many economists anticipated has remained out of sight, giving investors hope that stocks can keep climbing. As the old saying goes, "Еconomists have successfully predicted nine of the last three recessions".

Investors are winning in almost every market. Almost everything is going up—established Dow stocks, faster-growing tech shares, bitcoin and other cryptocurrencies, and even gold and other precious metals. Risk-averse investors have a bounty of options, too, including certificates of deposit offering yields of about 5%, adding to the glow.

On May 28, the U.S. will move to a new regime where stock trades are settled in just one business day, rather than two. Settlement is the process where shares are delivered to buyers, and cash is delivered to sellers. It’s usually invisible to investors.

US companies have issued €30bn in euro-denominated bonds this year, seeking to take advantage of the continent’s lower borrowing costs. The supply of bonds could reach €85bn, according to Bank of America data. Johnson & Johnson and Booking Holdings are among the companies pursuing multibillion-euro deals.

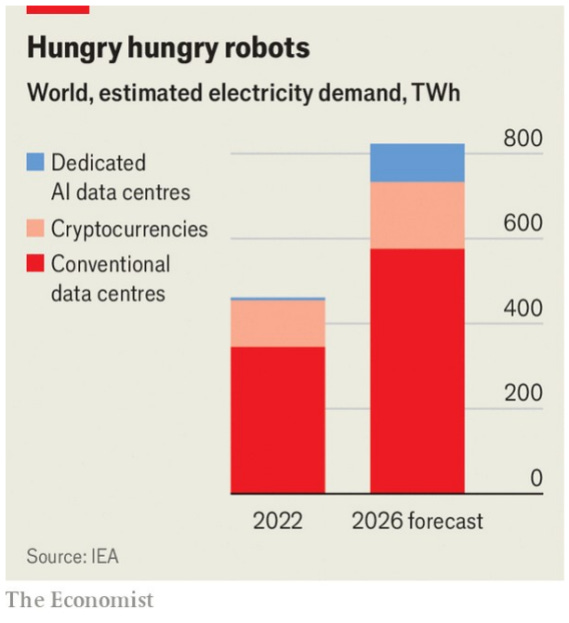

Reddit has struck a deal with OpenAI to use content from the platform for its artificial intelligence chatbot, sending shares in the social media company up as much as 15 per cent in after-hours trading yesterday. The jump would mean a windfall for OpenAI chief Sam Altman, who held close to 10 per cent of Reddit’s stock ahead of its public listing.

UK-based Arup lost $25mn after fraudsters used a digitally cloned version of a senior manager to order financial transfers during a video conference. The Financial Times has confirmed the engineering group, which employs about 18,000 people globally and has annual revenues of more than £2bn, was the target of what Hong Kong police had previously revealed as one of the world’s biggest known deepfake scams.

Higher prices in Japan that are causing consumers to tighten their belts were the main factor behind the economy shrinking by 0.5% in the first three months of the year, quarter on quarter. An earthquake at the start of 2024 also dented output. Britain’s economy pulled out of recession in the first quarter of 2024, growing by 0.6% compared with the last quarter of 2023. That was a faster pace of growth than America’s 0.4% and the euro zone’s 0.3% on the same basis.

The competition accelerated in artificial-intelligence services. OpenAI updated its chatbot model to GPT4o (the “o” stands for omni, or all-encompassing). The latest version is able to interpret voice commands to hold a “conversation”. And Alphabet unveiled Project Astra, an AI assistant that also responds to voice commands.