Pandemic-era winners have collectively shed over a third of their market value the since the end of 2020. Fifty corporate winners from the coronavirus pandemic have lost roughly $1.5tn in market value since the end of 2020, as investors turn their backs on many of the stocks that rocketed during early lockdowns. According to data from S&P Global, technology groups dominate the list of the 50 companies with a market value of more than $10bn that made the biggest percentage gains in 2020.

Deutsche Bank’s asset manager DWS inflated the amount of money it won from clients by billions of euros through an accounting approach that it failed to disclose for years, and which fed into executive bonus calculations.

Investors have been building up bets against the pound as conviction grows that the Bank of England will start cutting interest rates by the summer, ahead of its US counterpart. Currency speculators’ wagers on a fall in sterling have reached a 16-month high, while asset managers have turned the most bearish on the UK currency since March last year.

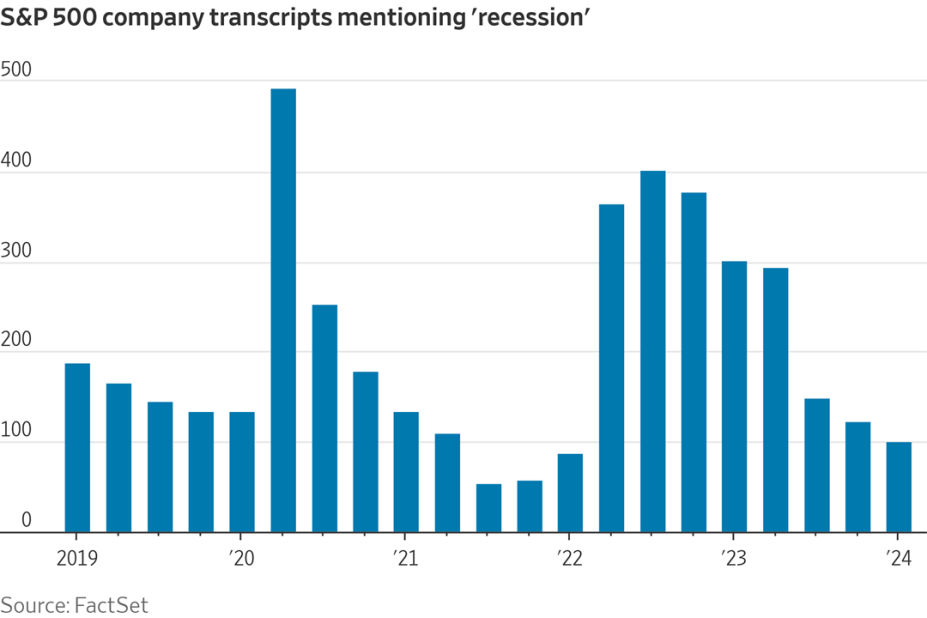

The bulk of U.S. companies have now reported first-quarter results, and they show profit growth is picking up. Earnings per share for companies in the S&P 500 now look to be up 5.2% from a year earlier, according to FactSet, better than the 3.4% analysts expected at the end of March, and marking the strongest growth in nearly two years.

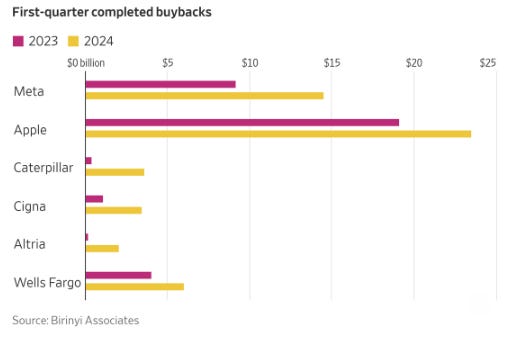

The first-quarter earnings season is turning out better than many Wall Street forecasters had expected. At the same time, companies are stepping up repurchases of their own shares, which is giving a resurgent stock market an extra boost. S&P 500 companies that have reported first-quarter results as of Monday have disclosed buying back $181.2 billion of their shares during the period.

Sweden’s central bank cut its main interest rate by a quarter of a percentage point, to 3.75%, the first reduction in eight years. Central banks in the Czech Republic, Hungary and Switzerland have also been lowering rates and the European Central Bank is expected to follow suit on June 6th, as Europe’s monetary policy diverges from America’s.

A leading venture-capital investor in Silicon Valley said that half of Google’s white-collar employees do no “real work”. David Ulevitch reckons that many could “probably be let go tomorrow” and the company wouldn’t notice. He also bemoaned the “growing professional managerial class” in America as a “weakness, not a strength”. Mr Ulevitch thinks the problem of “fake work” is widespread, and believes his comments were “one of the least controversial things I’ve ever said”.

The benchmark S&P 500 on Friday notched a third straight week of gains, and the index has now erased nearly all of its April losses. The S&P (SP500) is also now just ~0.6% shy of its record closing high. This week's advance was driven by an uptick in Federal Reserve interest rate cut expectations, primarily on the back of further evidence that the highly resilient U.S. labor market was cooling down and some dovish actions from European central banks.

“There are old investors, and there are bold investors, but there aren’t many old bold investors.”