Apple has poached dozens of staff from Google in recent years to expand its global AI and Machine Learning team. The iPhone maker has attracted at least 36 specialists from its rival since 2018. Apple has also created a secretive European laboratory in Zurich.

Microsoft has agreed to back an estimated $10bn in renewable electricity projects to be developed by Brookfield Asset Management, in a deal that underscores the race to meet clean energy commitments while satisfying the voracious energy demand of cloud computing and artificial intelligence.

Embraer is exploring options for a new passenger aircraft to rival Airbus and Boeing, people familiar with the situation said. The Brazilian aerospace and defence group is studying plans for a narrow-body aircraft or a long-range business jet, with a business case ready for the company’s board by the end of next year.

The Federal Reserve acknowledged a recent setback in its inflation fight but said it was more likely to keep interest rates at their current level for longer than to raise them again. Officials held their benchmark federal-funds rate steady Wednesday at a range between 5.25% and 5.5%, the highest in two decades and a level it reached last July, following a run of economic data that revealed simmering price pressures in the economy. Fed Chair Jerome Powell indicated that the bar to cut interest rates had gone up, but that the bar to increase rates was even higher.

High flows of immigration into rich countries were helping to strengthen jobs markets and bolster growth, the OECD said yesterday, as it lifted its outlook for the global economy.

Job growth slowed and unemployment ticked higher last month, marking a break from a string of data showing surprising strength in the labor market. U.S. employers added a seasonally adjusted 175,000 jobs in April, the Labor Department reported on Friday. That was far less than in March, when gains exceeded 300,000. It was also below the 240,000 jobs that economists had expected.

If you’d invested $1,000 in the S& P 500 in early 1965 when Buffett took over at Berkshire, you’d have a bit over $300,000 today. If you’d bought Berkshire instead, you’d have more than $42.5 million. If, on the other hand, Buffett had charged hedge-fund fees, you’d have under $5 million—still far more than the market, but about 90% less than Berkshire’s actual results. Put another way, if Buffett had charged conventional hedge-fund fees, his investors would have earned only about 10% of the wealth they have enjoyed.

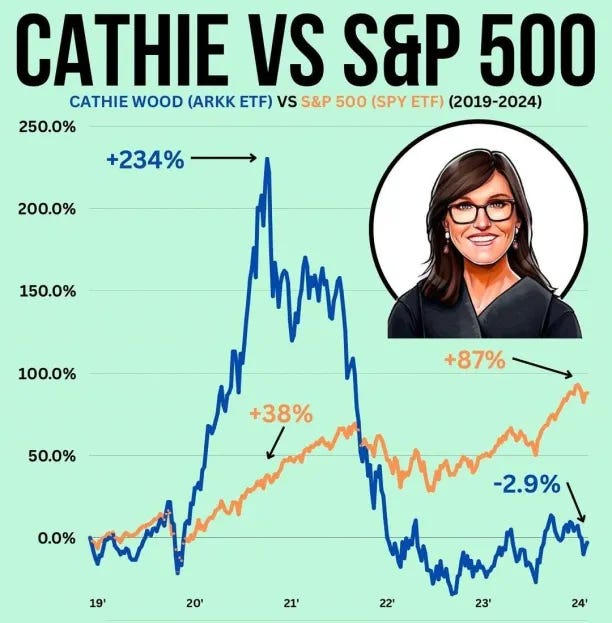

Investors have pulled a net $2.2 billion from the six actively managed exchange-traded funds at her ARK Investment Management this year, a withdrawal that dwarfs the outflows in all of 2023. Total assets in those funds have dropped 30% in less than four months to $11.1 billion—after peaking at $59 billion in early 2021, when ARK was the world’s largest active ETF manager.