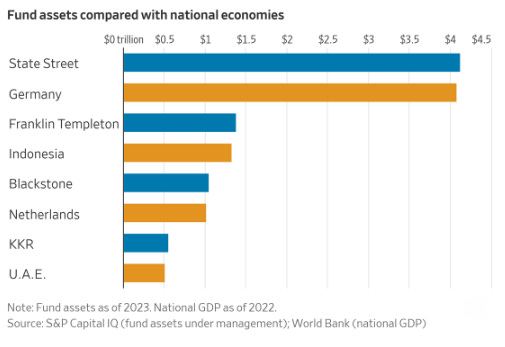

Giant investment companies now control sums rivaling the economies of many large countries. They are pushing into new business areas, blurring the lines that define who does what on Wall Street and nudging once-dominant banks toward the sidelines.

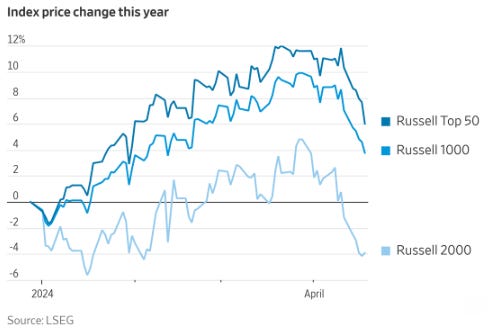

The Russell 2000 index of smaller companies badly lagged the broader stock rally this year, and has fallen more in the April rout than indexes of bigger companies. The main cause is the recent resurgence in interest rates which tends to hit small companies harder.

Traders have built up bets that the Federal Reserve could raise interest rates again, a once-unthinkable prospect that highlights a shift in market expectations after stronger than expected US economic data and hawkish comments from policymakers. Options markets now suggest a roughly one in five chance of a US rate increase within the next 12 months, up sharply from the start of the year, according to analysts. The shift in expectations has hit bond markets, with interest rate-sensitive two-year Treasury yields — which move inversely to prices — reaching a five-month high of 5.01 per cent. Wall Street stocks incurred their longest losing streak in 18 months before jumping Monday.

India is seeking to shore up its access to critical minerals such as lithium, a government official said, as the world’s most populous country rushes to catch up with rivals including China in the race to build next-generation energy supply chains. New Delhi is pushing state-owned mining groups to pursue mineral reserves in South America and Africa.

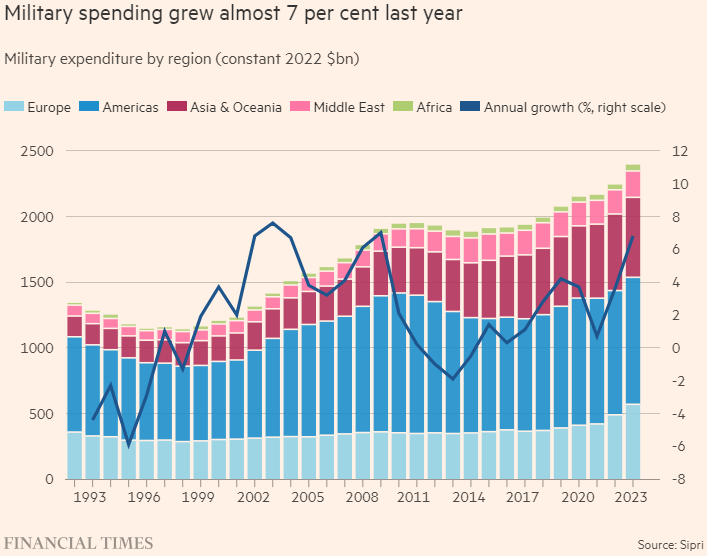

Military spending around the world rose almost 7 per cent to a record $2.4tn last year, the steepest annual increase in 15 years, according to research from the Stockholm International Peace Research Institute, a think-tank.

TikTok ban: US app stores will be banned from carrying TikTok in 270 days unless its Chinese owner sells the video-sharing platform. Read how TikTok Has Changed America over here.

Cyber attackers are experimenting with their latest ransomware on businesses in Africa, Asia and South America before targeting richer countries that have more sophisticated security methods. Hackers have adopted a “strategy” of infiltrating systems in the developing world before moving to higher-value targets such as in North America and Europe, according to a report published today by cyber security group Performanta.

BHP, the world’s biggest mining group with a market capitalization of US$149bn, is seeking to use an all-stock takeover of Anglo American to expand its portfolio of copper mines, according to people familiar with the matter. The approach for the 107-year-old company comes as demand for copper is expected to soar because of a global transition away from fossil fuels.

Europe is less hard-working, less ambitious, more regulated and more risk-averse than the US, according to the boss of Norway’s giant oil fund. The $1.6tn fund’s chief executive told the FT it was “worrisome” that American companies were outpacing their European rivals on innovation and technology, leading to vast outperformance of US shares in the past decade.

“I’m not saying it’s good but in America you have a lot of AI and no regulation, in Europe you have no AI and a lot of regulation. It’s interesting,”

Meta shares fell 16% after the Facebook parent said it would increase its spending levels for the year by as much as $10 billion to support infrastructure investments to support its AI investments. The stock-price decline came despite an increase in sales to $36.5 billion, up 27% from a year prior, a record for the January-to-March period, exceeding analysts’ expectations. The revenue growth was up slightly compared to a quarter prior, when Meta reported annual revenue growth of 25%.

5.96 million. The average daily number of clients’ trades handled by Charles Schwab in the first quarter, the most since the second quarter of 2022 and up 15% from the last quarter of 2023. Trading activity at Morgan Stanley, which owns E*Trade, and Robinhood Markets has also reached highs last seen in 2022. Amateurs flocked to trading platforms during the pandemic but pulled back in 2022 when the market dropped. When stocks climbed to new highs in 2024, many jumped back in—and had fun trading once more.

After posting its worst weekly performance in over a year last Friday, the S&P 500 rebounded this week to score its best performance since October 2023. The rise was primarily driven by a surge in technology stocks and other growth sectors, anchored by favorably received quarterly reports from Tesla , Microsoft, and Alphabet. However, aside from earnings, market participants received a bit of a reality check in the form of economic data on GDP and core PCE that pointed to stalling growth and sticky inflation.