It has been two years since forecasters felt this good about the economic outlook. In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the chances of a recession within the next year to 29% from 39% in the January survey. That was the lowest probability since April 2022, when the chances of a recession were set at 28%. On the other hand, the only function of economic forecasting is to make astrology look respectable.

China said its economy grew a faster-than-expected 5.3% in the first quarter, driven in large part by Beijing’s push to turbocharge manufacturing. But that approach is leading to a lopsided recovery and stoking trade tensions overseas, with Western governments and some big emerging economies crying foul over a growing wave of cheap Chinese imports that they say threaten domestic jobs and industries.

Firm inflation during the first quarter has called into question whether the Federal Reserve will be able to lower interest rates this year without signs of an unexpected economic slowdown, Chair Jerome Powell said Tuesday. His remarks indicated a clear shift in the Fed’s outlook following a third consecutive month of stronger-than-anticipated inflation readings, which derailed hopes that the central bank might be able to deliver pre-emptive rate cuts this summer. The S& P 500 fell slightly after Powell spoke, ending Tuesday’s trading down 0.2%, and investors sold Treasurys, sending up yields. The yield on the 2-year Treasury note briefly hit 5% for the first time since November.

Corporate pension funds are shifting money into bonds. State and local government funds are swapping stocks for alternative investments. $325 billion is the amount that pension funds will unload in stocks this year, Goldman Sachs analysts estimate, up from $191 billion in 2023. Like investors of all kinds, the funds are slowly adapting to a world of yield, where they can get sizable returns on risk-free assets.

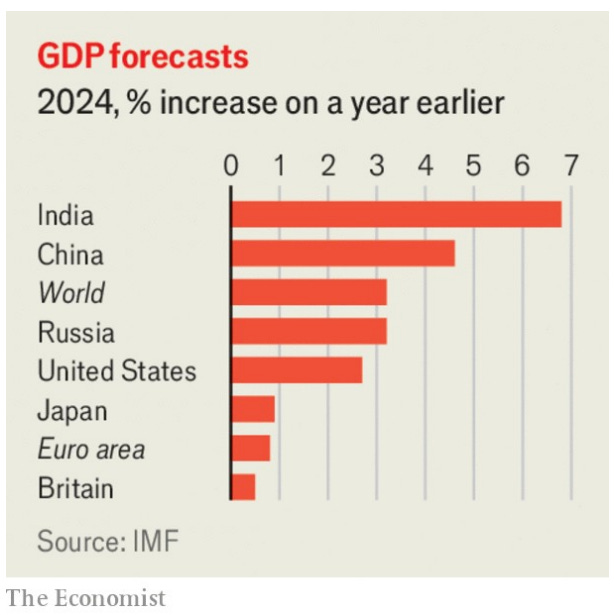

The latest estimates from the IMF suggest that global GDP is on track to grow by 3.2% this year. The fund said the world economy “remains remarkably resilient” and that there would be “less economic scarring” than it had thought from the pandemic. The biggest upgrades to its forecasts for the largest economies it tracks were for America, where the IMF now thinks GDP will expand by 2.7%, and Russia, projected to grow by 3.2%.

Companies are socking away cash at the fastest rate since the pandemic’s onset. Four years ago, companies boosted cash holdings to weather uncertainty stemming from lockdowns. Now, with interest rates hovering at two-decade highs, they are allocating more of their portfolios to high yielding cash accounts and investments, getting a boost from yields that top 5% on money market funds. At Facebook parent Meta Platforms, interest and investment income rose more than threefold in 2023, to $1.6 billion, compared with a year earlier. At Google parent Alphabet, the same figure increased 78% over the same period, to $3.9 billion.

Effective after US market close on April 18, 2024, IBKR will no longer require clients with cash accounts to have cash in the trading currency of the stock they are purchasing in order to place their stock order. Under the new policy, clients can have the necessary amount of cash in any IBKR-supported currency. IBKR will then automatically convert the necessary amount to settle the trade. The automatic currency conversion will be performed at a rate determined by prevailing foreign exchange market rates at the time of execution.