JPMorgan Chase Chief Executive Jamie Dimon warned that U.S. interest rates could soar to 8% or more in coming years, reflecting the risk that record-high deficit spending and geopolitical stress will complicate the fight against inflation. “Huge fiscal spending, the trillions needed each year for the green economy, the remilitarization of the world and the restructuring of global trade— all are inflationary,” Dimon wrote in an annual letter to JP-Morgan Chase shareholders released on Monday.

March Inflation in the US Comes in Hotter Than Expected. Annual inflation ticked higher in March at 3.5% and underlying price pressures remained stubbornly strong, raising further questions about how much the Federal Reserve will be able to cut interest rates this year.

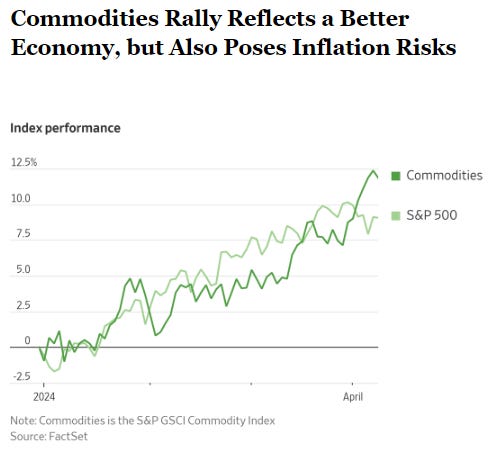

A surge in prices for the raw materials that power manufacturing and transportation shows investors betting on a prolonged expansion—and a potential rebound in inflation.

Google is making more of its own semiconductors, preparing a new chip that can handle everything from YouTube advertising to big data analysis as the company tries to combat rising artificial-intelligence costs. The new chip, called Axion, is a type of chip commonly used in big data centers. It adds to Google’s efforts stretching back more than a decade to develop new computing resources, beginning with specialized chips used for AI work. Google has leaned into that strategy since the late 2022 release of ChatGPT kicked off an arms race that has threatened its dominant position as a gateway to the internet.

The European Central Bank gave the clearest indication yet that it could cut interest rates in June, opening a new phase for financial markets and signaling a possible divergence from the Federal Reserve, whose path to monetary easing is becoming more rocky. The ECB held its key interest rate at a record 4% on Thursday for a fifth straight policy meeting. But ECB President Christine Lagarde signaled growing confidence that cooling inflation in the 20-nation eurozone would enable the central bank to cut rates at its next policy meeting on June 6.

Intel unveiled its Gaudi 3 chip for AI, which it claims is faster and more power-efficient than Nvidia’s H100. It tested the chip on two open-source large language models: Llama, which is run by Meta, and Falcon, a project backed by Abu Dhabi.

Fitch reduced its outlook for China’s sovereign credit-rating from stable to negative, and forecasts that China’s central- and local-government debt will rise to 61.3% of GDP this year. In 2019 it was 38.5% of GDP.