Wall Street’s Magnificent Seven Narrows to Become the Fab Four. Apple shares fell 11% in the first three months of the year, while Tesla dropped almost 30%. Alphabet shares sputtered for much of the period before making a run in the past three weeks and ending up 8%. The other four big tech stocks in the group known as the Magnificent Seven— Nvidia, Meta Platforms, Micro-soft, Amazon.com—continued their runs and outpaced the broader market. Some market strategists have dubbed them the new Fab Four.

OpenAI showcased technology that can recreate a human voice from a 15-second clip, but said it wouldn’t release it publicly until it knows more about potential risks for misuse. The program, Voice Engine, creates an AI-generated version of a person’s voice from a short recording and can use it to read text aloud. Voice Engine also can recreate a person’s voice in foreign languages, even if the original sample is provided in English.

Artificial intelligence (AI) holds immense promise in revolutionizing healthcare, promising better diagnoses, personalized patient support, accelerated drug discovery, and heightened efficiency. Analysts predict that in Europe, deploying AI could save hundreds of thousands of lives each year, while in America, it could shave $200 billion to $360 billion from overall annual medical spending, which currently stands at $4.5 trillion a year (or 17% of GDP).

Banking regulators are scrutinizing whether index-fund giants BlackRock , Vanguard and State Street are sticking to passive roles when it comes to their investments in U.S. banks. The three firms manage more than $23 trillion in total, with much of it in funds that passively mimic indexes such as the S& P 500. BlackRock and Vanguard each hold more than 10% of the shares at many banks, a threshold that normally determines whether an investor is assumed to have a controlling interest in a lender.

Disney saw off an epic proxy challenge from Nelson Peltz at its annual general meeting. Through Trian, his hedge fund, Mr Peltz was seeking two seats on the company’s board to “restore the magic”, claiming that poor management and box-office failures have contributed to the underperformance of Disney’s share price. But Bob Iger, the chief executive, fought an extensive campaign defending his turnaround strategy, which won the support of BlackRock, the Disney family and George Lucas, a film producer. Mr Peltz reportedly received just 31% of the vote for his claim to a seat.

Tesla delivered 386,810 vehicles worldwide in the first quarter of 2024, a decrease of 8.5% year on year and its first quarterly decline on that basis since 2020. Investors, already rattled by slowing growth in the electric-vehicle industry, punished Tesla’s stock. Figures from other carmakers were mixed. Ford and Hyundai reported a big rise in EV sales in America, and General Motors announced a sharp decline.

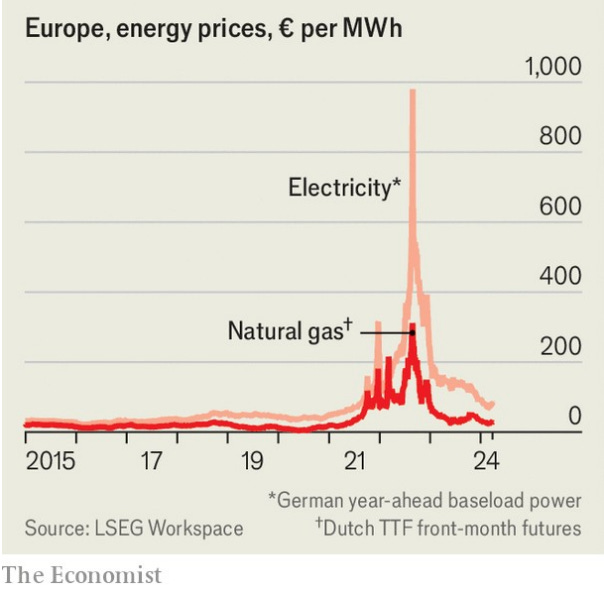

The price of natural gas in Europe fell, after it was reported that gas storage in the EU was around 60% full, a record high for this time of year. That will rise in the coming warmer months as gas supplies are replenished. Two years ago Europe faced soaring gas prices amid Russia’s invasion of Ukraine and low storage levels. The price of TFF, Europe’s benchmark gas contract, now trades around €25 ($27) per megawatt hour compared with €56 a year ago.

EU recently approved €1.2bn in public subsidies for cloud computing by seven countries over several years. As McKinsey Global Institute points out, that comes to about 4% of the annual investment of Amazon Web Services.

U.S. employers added a sea- sonally adjusted 303,000 jobs in March, the Labor Depart- ment reported Friday, signifi- cantly more than the 200,000 economists expected. The un- employment rate slipped to 3.8%, versus February’s 3.9%, in line with expectations. The Dow Jones Industrial Average added 307 points, or 0.8%, while the S&P 500 advanced 1.1% and the Nasdaq Composite gained 1.2%.

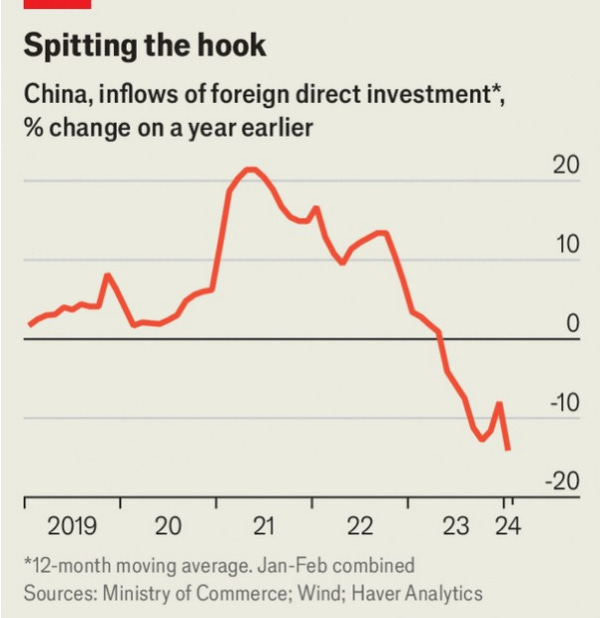

To revive its economic for- tunes, China is flooding the world with cheap goods—a multitrillion-dollar sequel to the China shock that hit global manufacturing more than two decades ago. This time around, the world is fighting back. The U.S. and European Union are threatening to raise trade barriers to Chinese- made electric vehicles and renewable-energy gear. Now, emerging economies including Brazil, India, Mexico and Indonesia are joining the backlash, zeroing in on Chinese imports of steel, ceramics and chemicals that they suspect are being dumped on their domestic markets at knockdown prices.

$570 billion. The amount of cash, short-term and long-term investments that Apple, Amazon, Microsoft and the parent companies of Google and Facebook now collectively sit on—more than double the collective pile of the next five largest nonfinancial companies on the index, according to data from S&P Global Market Intelligence. But putting that capital to work has become more difficult in recent years as regulators have zeroed in on keeping Big Tech from getting bigger.