Chinese investors are going all-in on gold. The country’s central bank has lifted its gold reserves to a record, while its consumers load up on gold jewelry—in part because they are nervous about the shaky economy. Stock traders are buying the shares of gold miners and rushing into exchange-traded funds that track the price of the metal.

As exchange-traded funds continue growing in popularity, asset managers are increasingly converting mutual funds to ETFs to adapt to client demands. There have been more than 70 mutual fund-to-ETF conversions in the U.S., and asset managers expect this number to rise further over the next year.

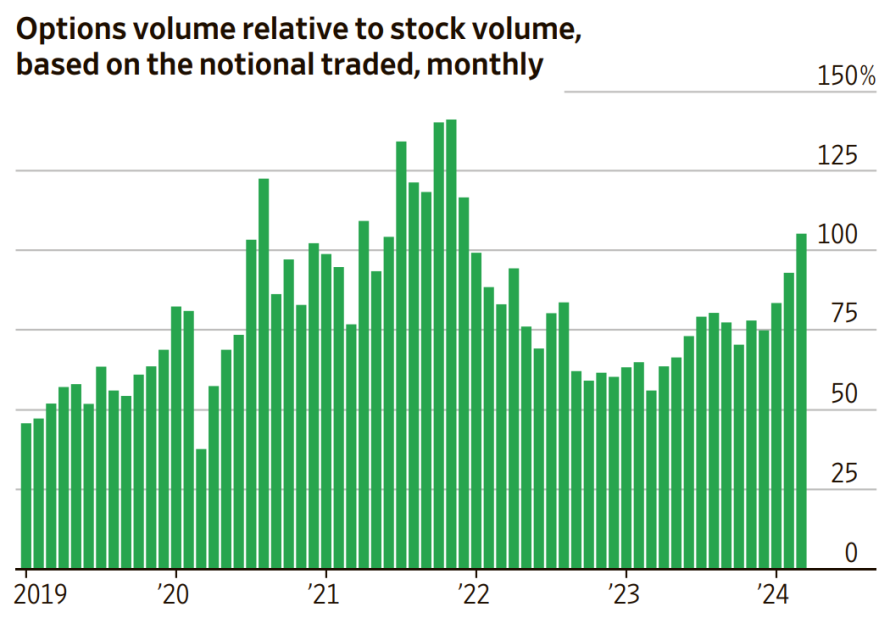

The stock market is calmer than it has been in years. Some worry that a popular strategy is contributing to the tranquility. Measures of market volatility have fallen to levels last seen in 2018, while major stock indexes have climbed to repeated records. The S&P 500 is up 9.4% in 2024 and has set 20 closing records. Investors are seeking protection from potential losses by pouring money into what are known as derivative-income, or sometimes covered call, exchange-traded funds that sell options contracts in a bid to juice income or boost their returns. Options are contracts that allow the holder to buy or sell shares at a predetermined price.

Under pressure from activist investors, Unilever set out a restructuring plan that could see it shed 7,500 jobs, about 6% of its workforce. The consumer-goods conglomerate is also spinning off its ice-cream division, which includes the Magnum and Ben & Jerry’s brands. Ice-cream accounts for 16% of Unilever’s sales, but prospects for the business’s growth are melting.

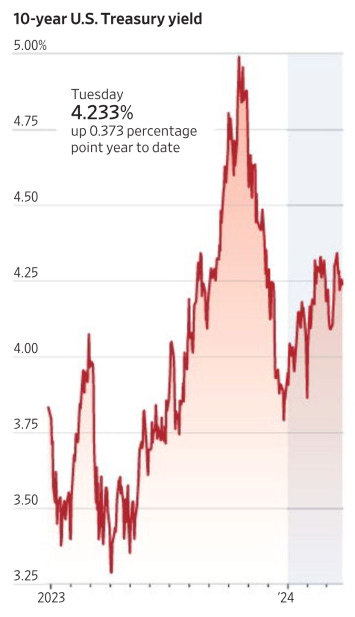

As of Tuesday, the yield on the benchmark 10-year U.S. Treasury note was 4.233%, up from 3.860% at the end of last year. The climb has surprised many on Wall Street, who had expected yields to fall. Right now, the Fed’s short-term rate sits in a range between 5.25% and 5.5%, a 23year high. Coming into 2024, investors expected the Fed to cut that rate six times this year, bringing it down to 3.75%— 4%. Now, traders expect rates to end the year between 4.5% and 4.75%.

Tesla is stepping up promotion of the driver-assistance technology it calls “Full Self-Driving Capability”. An upgrade available for $12,000 up front or $199 a month as a subscription service, includes features that can navigate cars through city streets. Tesla’s stock rose nearly 3% Tuesday.

Amazon.com said it has invested an additional $2.75 billion in the artificial-intelligence startup Anthropic , a major investment from a tech giant looking to compete with Microsoft, Google and others in the AI arms race. Amazon has now invested a total of $4 billion in Anthropic after making a $1.25 billion initial investment in the company in September.

Sam Bankman-Fried, the founder of the FTX cryptocurrency exchange, who was convicted of stealing $8 billion from his customers, was sentenced to 25 years in prison. He was also ordered to forfeit $11.2 billion in assets.

S&P 500 Clinches Best Start To Year Since 2019. Many investors had high hopes going into 2024. The market’s robust first-quarter rally still managed to surprise them. Everything from stocks to bitcoin to gold marched to new records. The S& P 500 gained 10% in the first quarter, its best start to the year since 2019. Any weakness in the stock market hasn’t lasted more than a few sessions, with investors buying the dip and sending the index to 22 all-time closing highs. And it isn’t just a small group of megacap tech stocks participating in the rally. All but one of the 11 sectors of the S& P 500 have risen. The Russell 2000 index of small-cap stocks is up more than 4%. A Russell index of value stocks outperformed its growth counterpart in the past month.