A recent study found that, on average, for every dollar of return they generated from 1995 through 2016, hedge funds harvested 64 cents in management and performance fees. Lately, at some leading hedge funds, expenses have even risen—to as much as 5% to 7% annually.

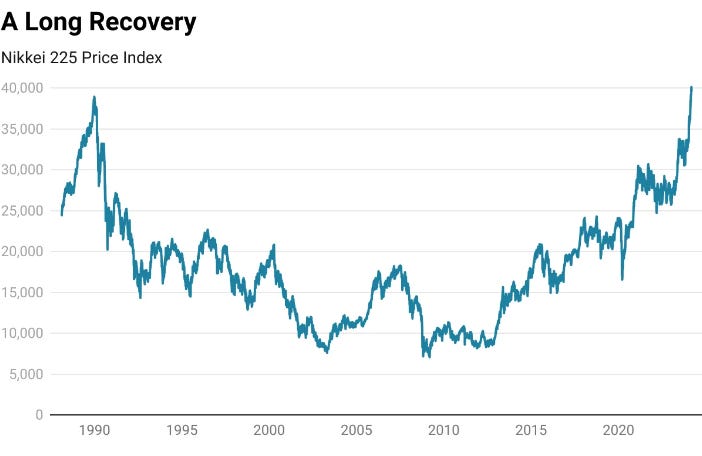

37% of Nikkei constituents trade below book value, compared with ~3% of stocks in the S&P 500. As part of a program to boost the investability, the Tokyo Stock Exchange now requires all companies that trade below book value to lay out a plan to bolster their valuation. The response has been positive: In the past year, dividends and share buybacks have soared, management buyouts are on the rise. So far, engagement in the market has come largely from foreign investors, who account for around 70% of trading. Domestic investors have been slower to return to the market, likely fatigued by how long it has taken to recover (longer even than it took Wall Street to bounce back following its 1929 crash). A government program to incentivise stock ownership could help. In January this year, the government expanded the scope of its tax-free Nippon Individual Savings Account (NISA) scheme. Individuals can now invest up to 18 million Yen ($120,000) over their lifetime without incurring tax on investment income or capital gains.

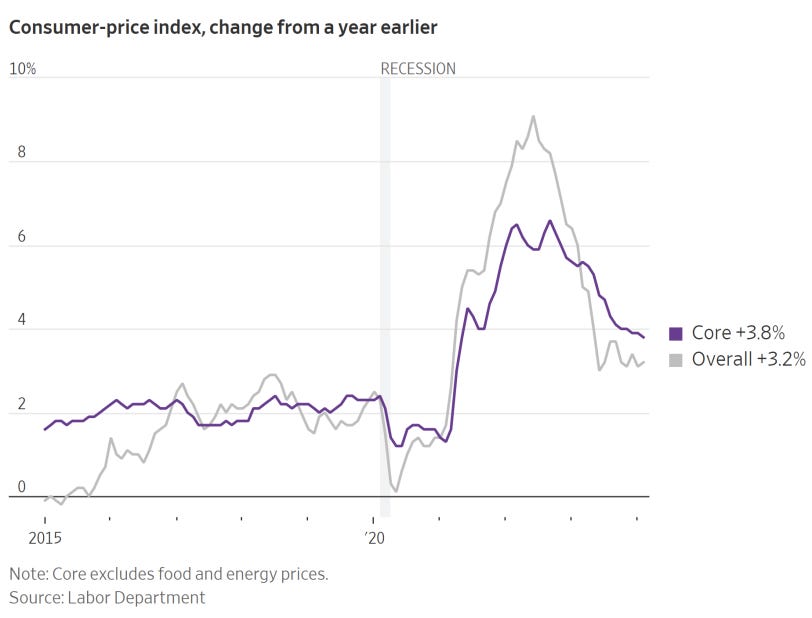

America's Inflation Comes In Slightly Hotter Than Expected. February’s consumer-price index of 3.2% topped the 3.1% economists expected. The data introduces greater uncertainty over whether and when the Federal Reserve will lower interest rates.

Dividend payments to shareholders worldwide reached a record $1.66 trillion last year, up 5.6% year-over-year, according to a new report by asset manager Janus Henderson. Banks took the lead in shareholder payouts as their profits grew amid higher interest rates, although its positive impact was almost entirely offset by cuts in the mining sector. Banking giants, including heavyweights like JPMorgan and Wells Fargo, raised their dividends last year after clearing the Fed's annual stress test.

The House voted 352 to 65 to approve a bill that would ban TikTok from operating in the U.S. or force a sale, with lawmakers largely shrugging off a last-minute lobbying push by the Beijing-owned service and setting the stage for a final showdown in the Senate in the spring.

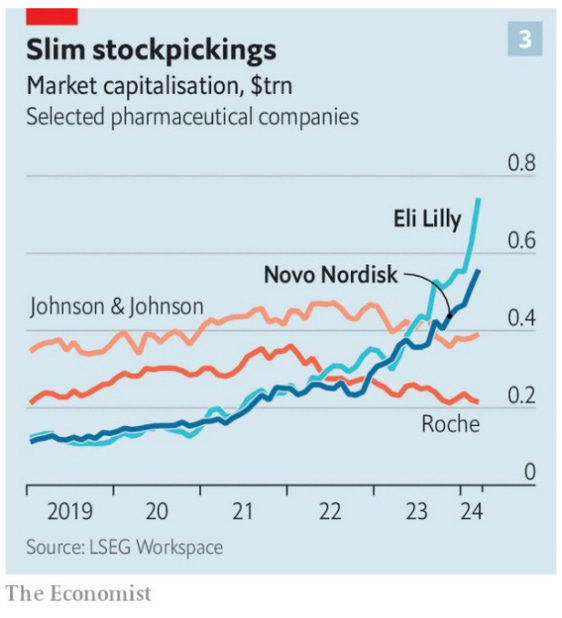

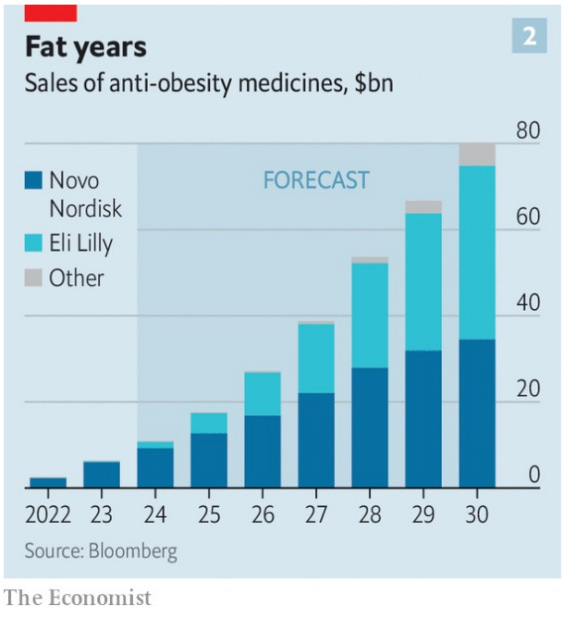

In the past three years Novo Nordisk’s market capitalisation has expanded more than threefold, to $560bn, turning it into Europe’s most valuable company. Eli Lilly is worth $740bn, more than twice what it was at the start of 2023.

Saudi Aramco reported a net profit of $121bn for 2023, more than the combined profits of the West’s five biggest oil companies. Aramco increased its dividend pay-out to $98bn, a big source of income for the Saudi state, and promised even higher payments this year.

The S&P 500 fell Friday and posted its second-straight weekly loss, with tech stocks particularly feeling the heat as inflation concerns linger ahead of next week's Federal Reserve policy meeting. Investor concerns rose after a raft of data showed inflation rising more than economists expected, helping push the benchmark 10-year Treasury yield higher.