In China the central bank lowered its five-year loan prime rate from 4.2% to 3.95%. The bigger-than-expected cut to the rate is the latest in a number of official attempts to try to revive a moribund housing market. Meanwhile, foreign direct investment to China last year plunged to its lowest level in decades. The foreign capital going into China, came to $33bn in 2023, a big drop from the $180bn recorded in 2022 and the lowest amount since 1993.

IKEA, the furniture retailer, is betting on reviving struggling malls by transforming them into "meeting places" with various attractions beyond just shopping. They believe this will attract more visitors and revitalize the mall format.

Alphabet (GOOG, GOOGL) fell more than 4% on Monday as Google's AI-powered face generator won't return for a couple of weeks. Google paused image generation of people from its Gemini model last week amid criticism over how it handled race, including the AI tool's refusal to depict white people.

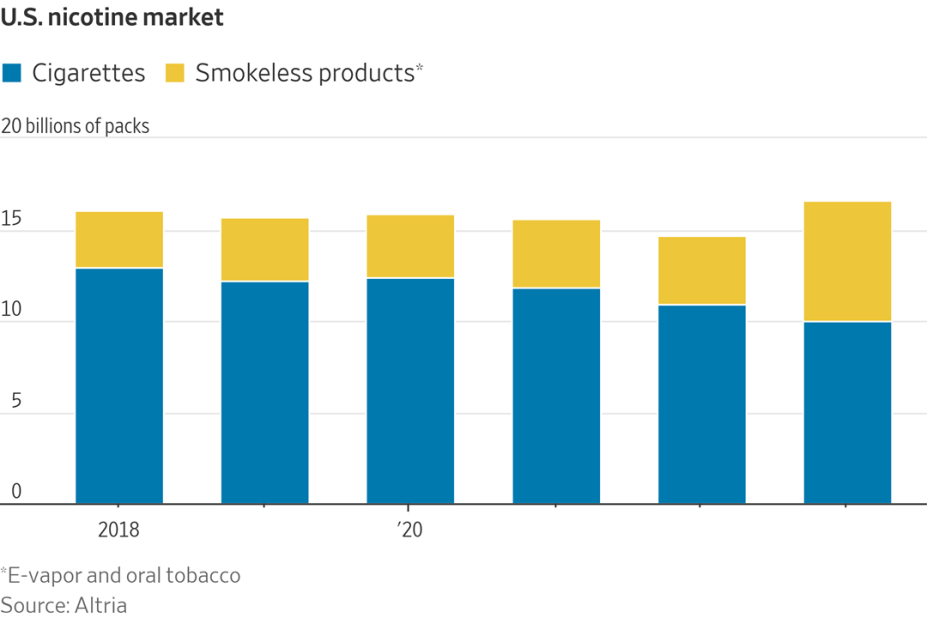

Smokers are switching to smoke-free products such as vapes in higher numbers than expected. If the trend continues, it will only take another three years for cigarettes’ share to slip below 50%

In a surprising move, Apple Inc. has officially terminated its ambitious electric car project, known as Project Titan, after investing billions of dollars over a decade. The decision, disclosed internally by Chief Operating Officer Jeff Williams and Vice President Kevin Lynch on Tuesday, came as a shock to nearly 2,000 project employees.

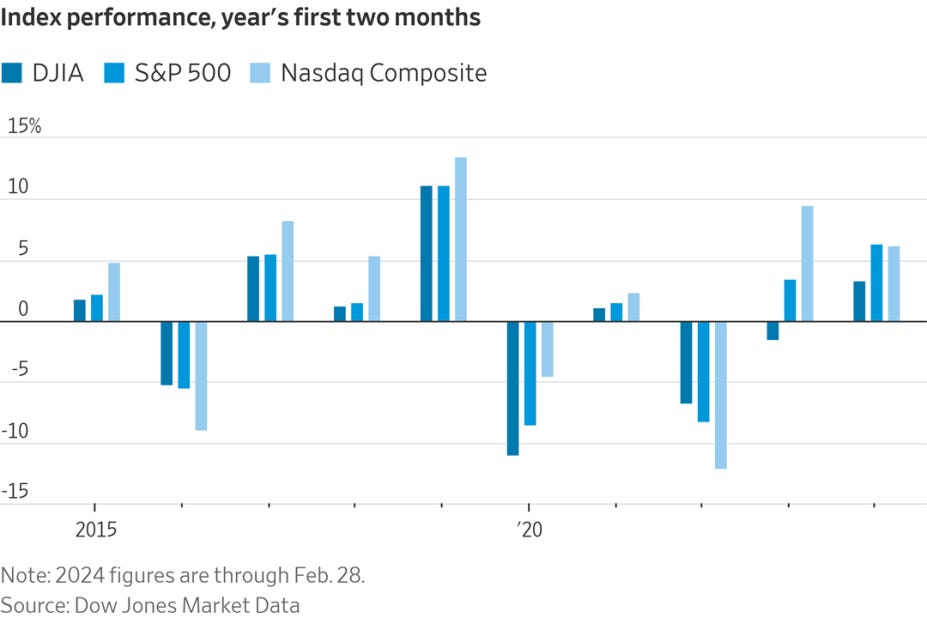

The S&P 500 and Dow industrials are on track to log their best two-month starts to a year since before the pandemic

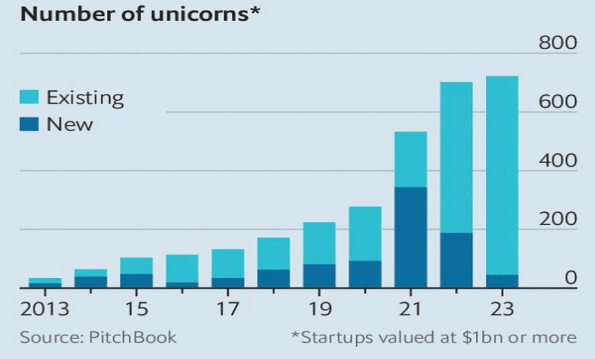

Throughout the 2010s the number of unicorns—private companies with valuations above $1bn—soared in America. Fully 344 of them were minted in 2021. Last year’s figure was 45. The end of the era of cheap money is largely to blame. Now investors are mulling how to sell their stakes in the unicorns of yesteryear.

Berkshire Hathaway, the holding company for Warren Buffett’s investments, reported an annual operating profit of $37.4bn, up by 21% from 2022 and boosted in part by the performance of its insurance business. But the Sage of Omaha warned that there were only a few companies left to invest in that offered the big gains that Berkshire has enjoyed in the past.

Wendy’s, a fast-food chain, denied reports that it would introduce surge pricing for its menu. Surge pricing is used by Uber and other businesses to raise prices when demand increases at any given time. New technology is increasingly allowing many businesses to adjust their prices in real time to changes in demand.

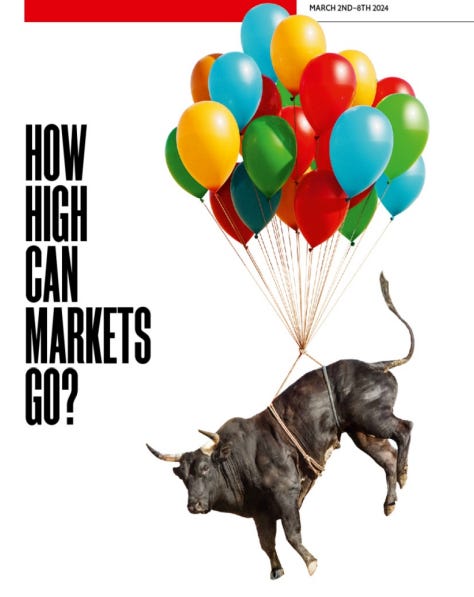

The cover of Тhe Economist this week. American stocks are up by 21% since the end of October; on February 22nd European equities set a new record for the first time in two years. But their golden age is drawing to a close: even AI is unlikely to drive a repeat of the past decade’s performance.

Elon Musk sued OpenAI and its Chief Executive Sam Altman, alleging they broke the artificial-intelligence company’s founding agreement by prioritizing profit over the benefit of humanity.

Jeff Bezos, Nvidia and Microsoft are betting a humanlike robot could be one of the hot new developments in artificial intelligence. They are among a group of investors, including OpenAI, that invested $675 million in an AI robotics company called Figure, the startup said Thursday, valuing it at $2.6 billion.

Some highlights from the latest edition of The Intelligent Investor column by Jason Zweig:

Almost 28% of the S&P 500’s gains so far in 2024 come from the astounding rise of that one company at the forefront of the boom in artificial intelligence. Nvidia’s stock is up 59% in nine weeks—after gaining 239% last year.

In what we might call the Nvidia market moment, it’s easy to feel left behind, which is why it’s vital to put things in perspective. These conditions aren’t unprecedented, stocks aren’t in a bubble, and beating yourself up—or piling on risk to catch up to a racing market—never ends well.

This week, the 10 biggest companies constituted just under one-third of the total market value of the S&P 500. The top three, Microsoft, Apple and Nvidia, account for 17.9% of the total. Nvidia alone is 4.6% of the total value of the index.

In the boom years of the 1950s, the 10 biggest companies, including AT&T, DuPont and General Motors, regularly exceeded 30% of the value of all U.S. stocks. In July 1955, GM alone—up 78% over the previous 12 months—amounted to 6.8% of the value of the entire U.S. stock market

You already have 4.6% of your stock allocation in Nvidia if you own an S&P 500 index fund. But, when it seems everybody but you has made a killing by buying the stock outright, you might feel as if you don’t own it at all.

You can read it in full here