PepsiCo acknowledged that consumers are pushing back against price rises. The food and beverages giant jacked up the price of its products in 2022 and 2023, but it recorded a decline in the volume of snacks and soft drinks it sold last year. Ramon Laguarta, the chief executive, said that was in part due to pricing. Carrefour, a big supermarket chain in France, has stopped stocking Pepsi’s goods because of its “unacceptable price increases”.

Cost of living concerns are not stopping people from travelling. TUI, Europe’s biggest tour operator, reported a big surge in quarterly revenue, and confirmed it expects sales to rise by 10% this year.

Jeff Bezos, Amazon's founder and executive chairman, recently sold $4 billion worth of stock in the company. He sold the shares for nearly $183 a piece, as the stock had rallied roughly 30% since the October announcement that he planned to offload shares.

Nvidia’s sales more than tripled in its fourth quarter, as the semiconductor maker scrambled to meet the demand for its chips that are powering new artificial-intelligence systems. Chief Executive Jensen Huang described AI as hitting “the tipping point” as chip maker reached $2 trillion valuation.

We hope you’re not investing in the company at these crazy valuations. However, if you decide to do it, you can check out these four entertaining episodes of our favorite podcast, Acquired, and learn more about Nvidia.

Episode 1: https://www.acquired.fm/episodes/nvidia-the-gpu-company-1993-2006 Episode 2: https://www.acquired.fm/episodes/nvidia-the-machine-learning-company-2006-2022

Episode 3: https://www.acquired.fm/episodes/nvidia-the-dawn-of-the-ai-era Interview with Jensen Huang, the CEO: https://www.acquired.fm/episodes/jensen-huangMore Federal Reserve officials signaled concern at their meeting last month with cutting interest rates too soon and allowing price pressures to grow entrenched as opposed to the risks of holding rates too high for too long. At a news conference after last month’s meeting, Fed Chair Jerome Powell volunteered that officials weren’t likely to consider cutting rates at their next meeting, March 19-20. Economic data released over the past three weeks has further underscored why Fed officials were skeptical of investors’ expectations of an imminent and sustained interval of rate cuts.

It took over 34 years, but trading floors across Tokyo today erupted in cheers and applause at the end of the market session. The Nikkei 225 (NKY:IND), Japan's main stock index, closed at a new all-time high above 39,000, following a record run last seen during the country's late-1980s asset bubble. In fact, the Nikkei has been the world's best-performing major index in 2024, surging 17.5% only two months into the year and trouncing the impressive near 5% advance of the S&P 500.

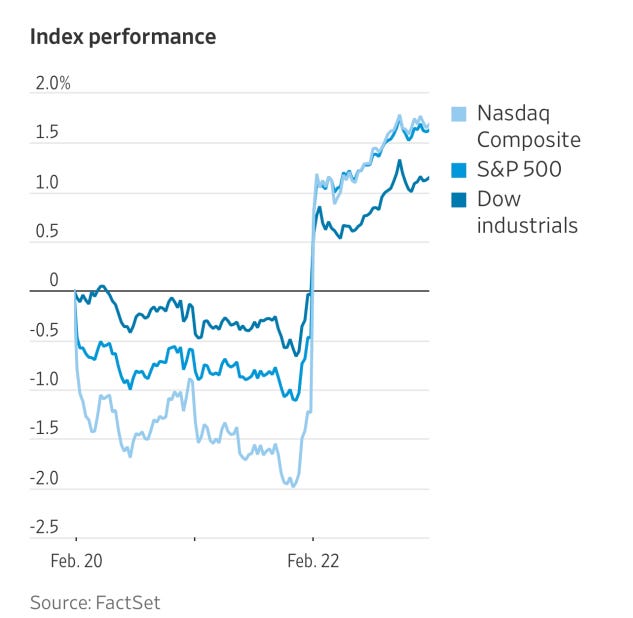

S&P 500 Hits Another Record High. Chip stocks around the globe rally; the Nikkei and Stoxx Europe 600 close at record highs as well.

We believe you'll find this very short book immensely entertaining and useful: