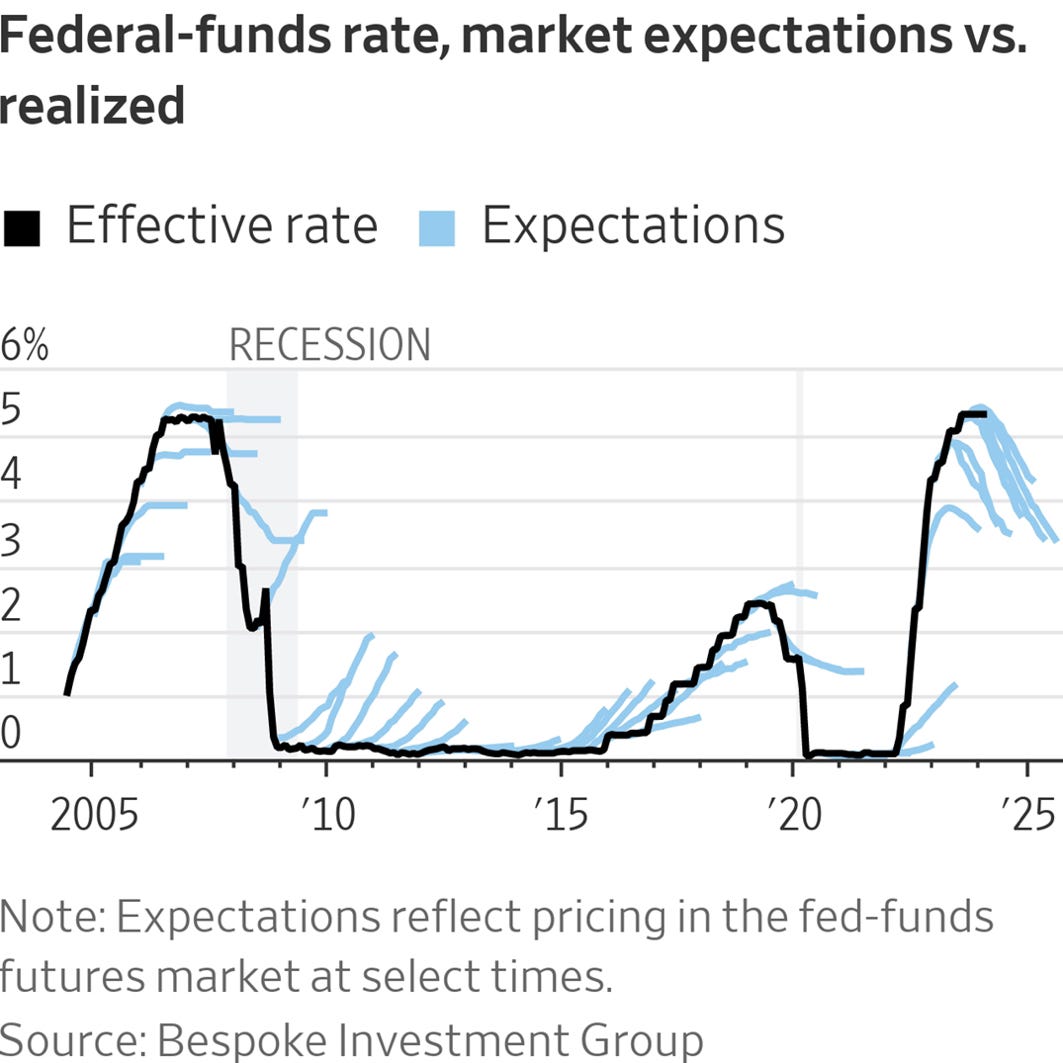

Federal Reserve Chair Jerome Powell said the central bank has shifted its focus toward deciding when to begin cutting interest rates, but that solid economic growth means officials didn’t have to rush that decision. Given recent economic strength, “we feel like we can approach the question of when to begin to reduce interest rates carefully,”

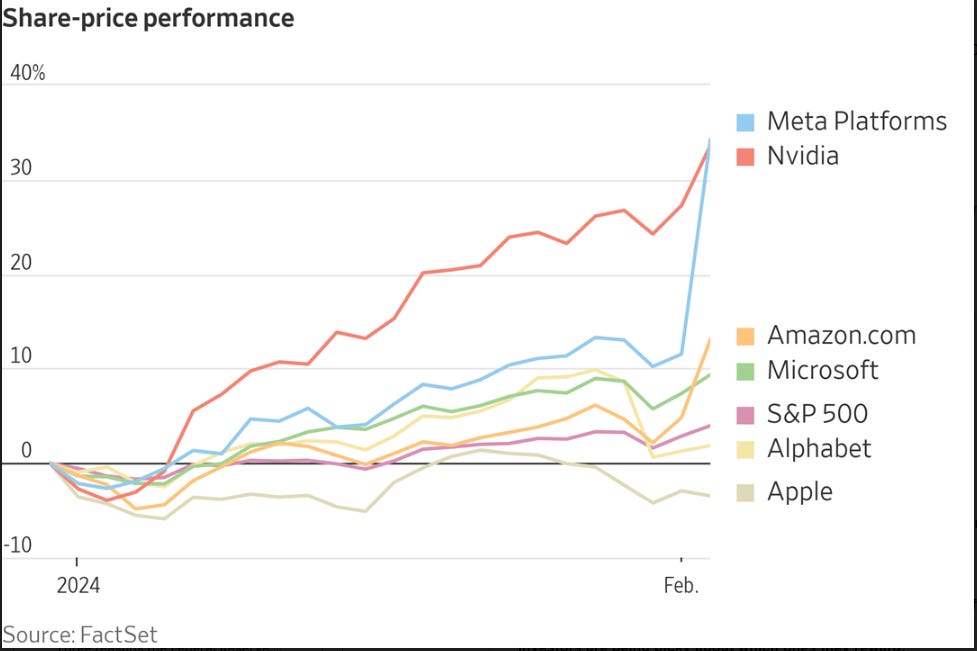

Big Tech Stocks Find Little Room for Error After Monster Run. Investors have a simple request for tech titans this earnings season: nothing less than perfection.

Although it is a laggard in EVs, Toyota retained its crown as the world’s biggest seller of vehicles in total, notching up 11.2m in sales last year. Volkswagen parked in the number-two spot again, selling 9.2m.

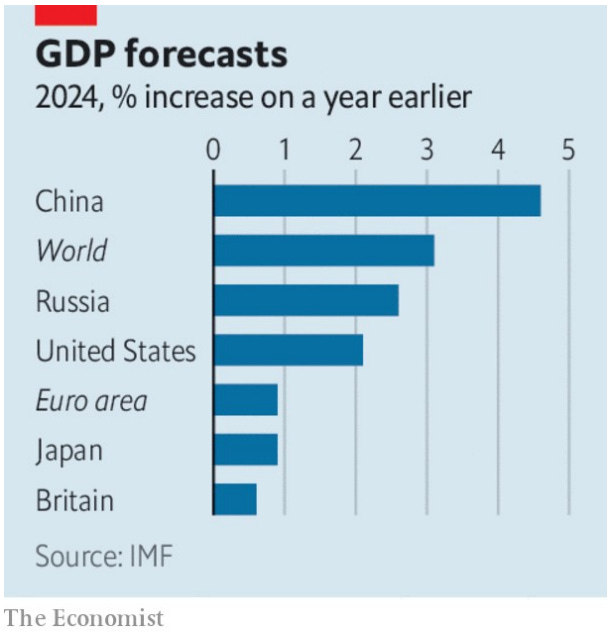

The IMF said it now expects the world economy to grow by 3.1% this year, up from the 2.9% it forecast last October. This is in part because of “greater-than-expected resilience” in the American economy, which expanded at an annual rate of 3.3% in the last three months of 2023. But the fund’s biggest upward revision was to Russian GDP, which it now thinks will grow by 2.6%. Despite sanctions by the West, Russia has been able to sell its oil elsewhere.

AI Pivot Leads Tech To Dump More Jobs DocuSign said it would cut about 6% of its workforce, or 400 jobs, as the e-signature company looks to bring costs down and spur its struggling stock price. That came a day after Snapchat parent Snap said it was cutting 10% of its staff to ensure it can invest in growth. Last week, identification- software company Okta said it is laying off 400 employees, or about 7% of its workforce. Zoom, Google, Amazon. com and others across tech have also moved recently to cut jobs.

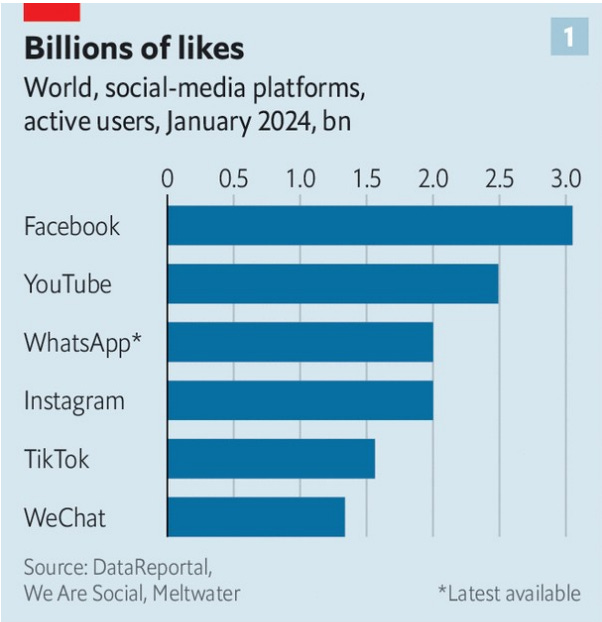

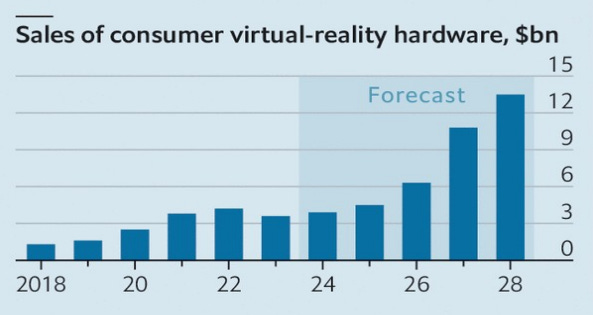

Tim Cook, Apple’s boss, has described trying the Vision Pro as an “aha moment”. “You only have a few of those in your lifetime,” he added. Aha or not, the Vision Pro is part of a trend. In September techies got excited about a new pair of smart glasses made by Meta, Facebook’s parent company, and Ray-Ban, an eyewear brand. In January the r1, a voice controlled gizmo half the size of a smartphone, enthralled attendees at the Consumer Electronics Show in Las Vegas. Its maker, a startup called Rabbit, has sold nearly 100,000. Some 540m “wearables” worth $68bn were shipped last year, according to IDC.

No company has been more central to China’s property crisis, which kicked off in mid-2021 than Evergrande. In a landmark ruling, the court ordered the liquidation of the firm, which is the world’s most indebted property developer, with over $300bn in liabilities. As Tommy Wu of Commerzbank, a German lender, has written, a full liquidation of Evergrande’s Chinese assets would probably send a shockwave through the Chinese economy. Property developers have sold properties to ordinary Chinese folk that they have not yet provided.

Amid diversification efforts and growing trade tensions, Mexico overtook China to be the top source of goods imported by the U.S. in 2023 for the first time in more than two decades.

Investors Are Almost Always Wrong About the Fed. Investors are more convinced than ever that interest rates are coming down later this year. Their record on these things, however, isn’t great.

OpenAI CEO Sam Altman is reportedly in talks with investors to raise as much as $5-$7 Trillion (you read that right) for a major project that would boost the world's chip-making capacity and its ability to power artificial intelligence.

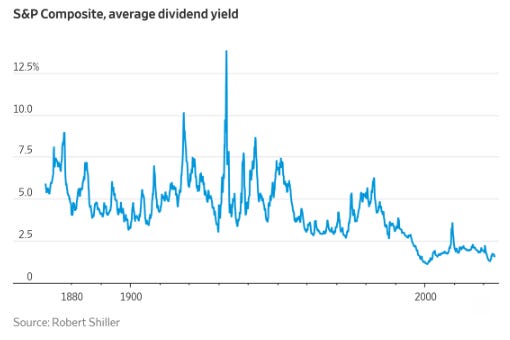

Can Dividend Investing Rise From the Dead? The oldest and simplest stock-picking strategy—dividend investing—lies almost forgotten. U.S. equities with dividend yields above 5% have returned roughly 450% since the end of 2008, below the 640% gain of the wider S&P Composite 1500. No-dividend stocks have returned almost 1,200%.

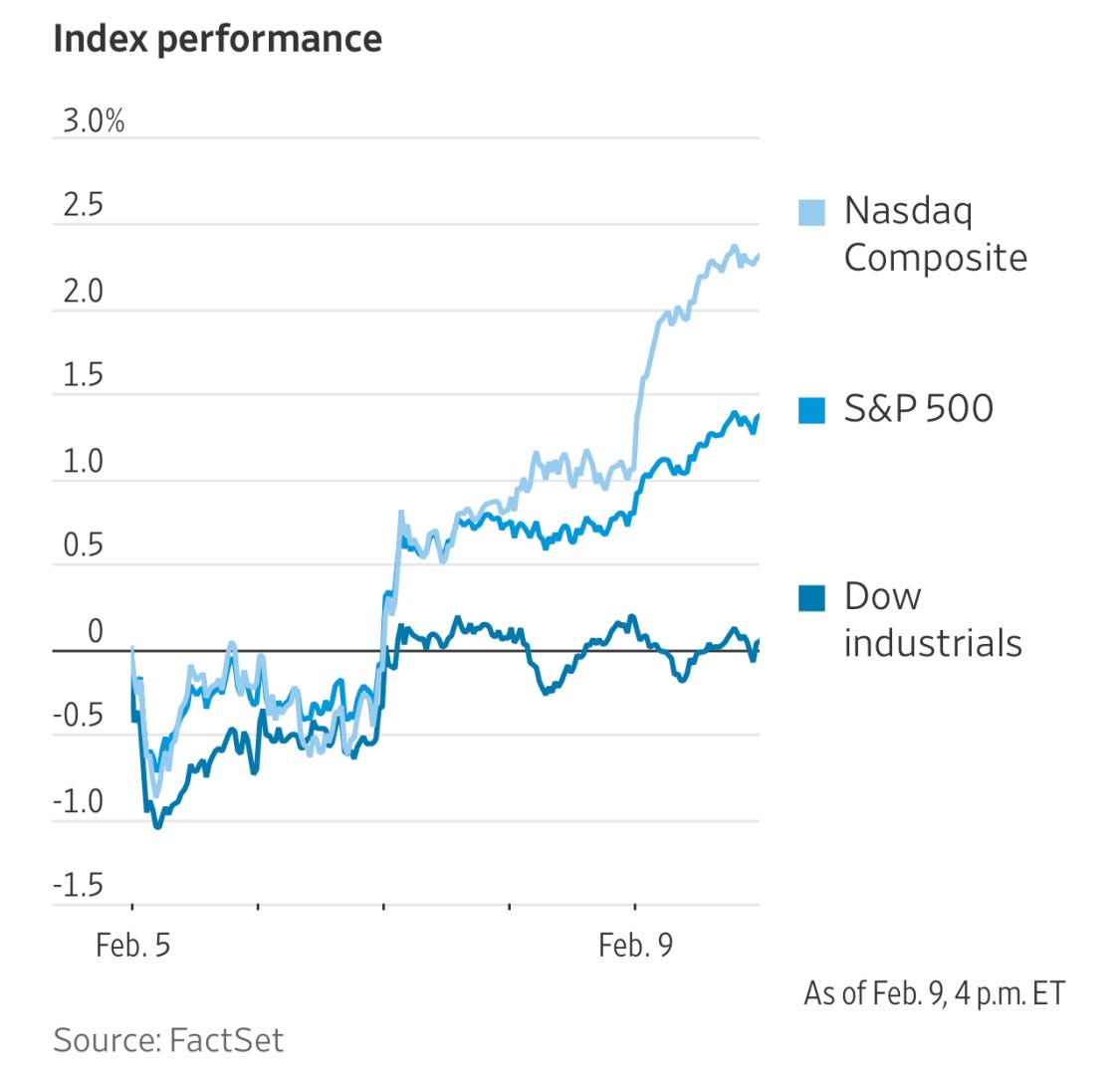

S&P 500: The benchmark index closed above 5000 for the first time and notched its 10th record close of the year. So far this year, it’s up 5.4%.

No posts