Oil prices surged and stocks dropped on Friday after Israel attacked Iranian nuclear sites and military leaders, and Tehran retaliated with drone strikes. The S&P 500 dropped 1.1%, the Nasdaq Composite fell 1.3%, and the Dow industrials lost 1.8%. Energy and defense stocks gained, while airline shares fell.

President Trump said the U.S. deal with China was done, subject to final approval from himself and Chinese leader Xi Jinping. Posting on his Truth Social platform, Trump said China would supply critical rare earths and magnets "up front," and Chinese students would be able to attend U.S. colleges and universities. "WE ARE GETTING A TOTAL OF 55% TARIFFS, CHINA IS GETTING 10%," he added.

OpenAI’s annual recurring revenue has nearly doubled to $10 billion, driven by surging demand for ChatGPT. Despite this growth, the company, along with rivals Anthropic and Cursor, remains loss-making. OpenAI, backed by SoftBank and others, aims for profitability in 2029 with projected revenues of $125 billion.

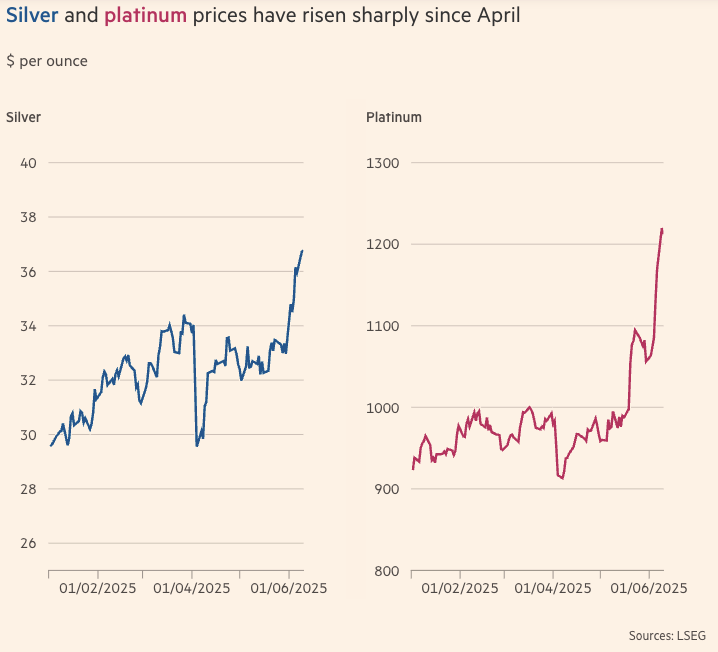

Investors are pouring money into silver and platinum as they seek “gold alternatives” amid growing concerns that the haven is overvalued. Both metals are up more than 10 per cent this month.

Companies are increasingly adopting a “bitcoin treasury strategy,” buying digital assets to boost stock prices. This approach has attracted about 60 companies, including those in software, marketing, and healthcare. While this strategy has driven up share prices, it also exposes companies to the volatility of digital assets, potentially amplifying selloffs and increasing risk.

$14 billion. The amount Meta is in advanced talks to invest in data-labeling startup Scale AI. The deal would be one of the social-media giant’s largest-ever outside investments and show the dramatic steps it is taking to revamp its AI work, which has suffered setbacks including the delayed release of a major new model.

Google's new "AI Overview" and "AI Mode" are transforming search by providing direct answers to queries, leading to a rise in "zero-click searches." This means users get information without visiting external websites, a trend that accelerated in 2025, with 60% of searches now ending on the search engine itself. This shift is problematic for publishers and marketers who are seeing drops in website traffic.