The U.S. and China have agreed to a 90-day pause to soaring tariffs placed on each other and will each lower reciprocal levies, according to U.S. Treasury Secretary Scott Bessent. Washington has moved to slash tariffs on China to 30% and Beijing’s duties on U.S. imports are being cut to 10%, the countries announced following high-stakes trade talks over the weekend.

U.S. stocks rallied, with the Nasdaq Composite climbing 4.3% and entering a new bull market by closing more than 20% above its April low. The Dow industrials jumped above where they closed on April 2, before Trump’s “Liberation Day” tariffs sent markets into a tailspin. The blue-chip index ended the day more than 1,100 points higher.

U.S. Inflation Stable Ahead of Expected Jump From Tariffs. Economists and policymakers are bracing for inflation to re-accelerate as companies adapt to President Trump’s trade war.

The S&P 500 gained 0.7% Tuesday, closing in positive territory for the year for the first time since February. The Nasdaq Composite rose 1.6%, extending Monday's rally on the heels of the U.S.-China tariff thaw.

Qatar has agreed to buy up to 210 aircraft from Boeing in what Trump hailed as the largest order of jets in the planemaker’s history. As the US president toured the oil-rich Gulf in pursuit of headline-grabbing investments, the White House said economic deals worth more than $243bn had been agreed with Qatar.

American households in May felt worse about the economy than they did in April, with sweeping tariffs raising the prospect of higher prices. The University of Michigan's preliminary index of consumer sentiment for May was 50.8, down about 3% from a final reading of 52.2 in April. The preliminary number represents the second-lowest level on record.

After overtaking the SPDR S&P 500 ETF Trust (SPY) as the world’s largest ETF earlier this year, the Vanguard S&P 500 ETF (VOO) is leaving its competition in the dust. As of today, VOO has amassed $648 billion in assets under management, giving it a nearly $44 billion edge over SPY, which first lost its crown in February.

U.S. Loses Last Triple-A Credit Rating. Moody’s downgrades the U.S. government, citing large fiscal deficits and rising interest costs. Expanding budget deficits mean U.S. government borrowing will rise at an accelerating rate, pushing interest rates up over the long term, Moody’s said. The firm said Friday that it didn’t believe that any current budget proposals under consideration by lawmakers would do anything significant to reduce the persistent gap between government spending and revenues.

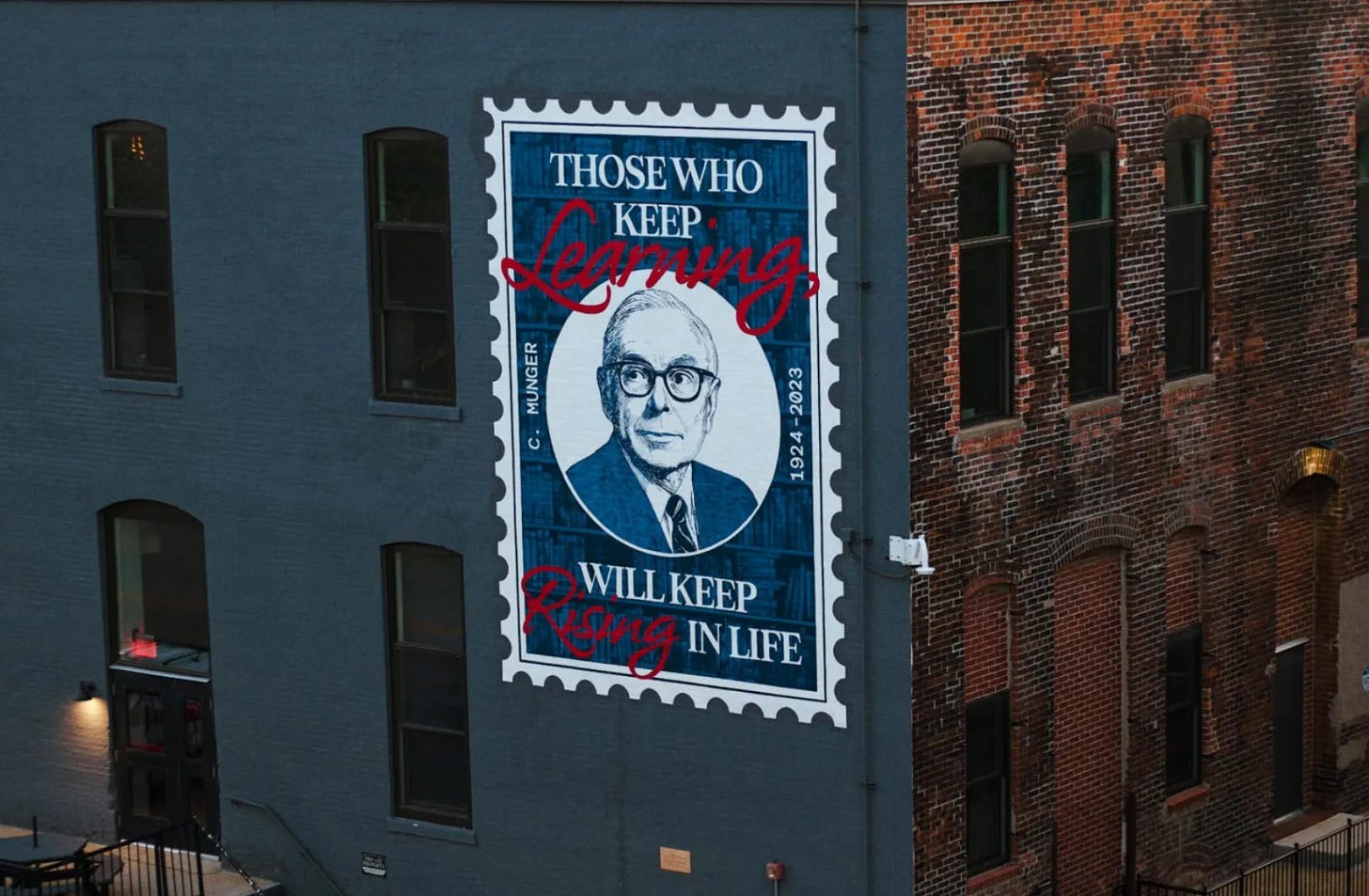

A massive new mural of Charlie Munger now looks out over downtown Omaha. Featuring a timeless Munger-ism — “Those who keep learning will keep rising in life” — its vibrant design nods back to his early involvement with Blue Chip Stamps.