The "Sell America" trade picked back up on Monday. Stocks fell, with the Dow industrials on pace for their worst April since 1932, and the dollar hit fresh multiyear lows against the euro and other major currencies. Yields on longer-term Treasurys rose and gold surged to a fresh record high. Markets are on edge about President Trump's tariff war as well as his threats to fire Fed chief Jerome Powell.

Japanese investors offloaded more than $20bn in international bonds in the week to April 4, according to preliminary data from Japan’s Ministry of Finance, as Donald Trump’s tariffs shook markets, in a sign of how the Wall Street turbulence cascaded around the world. Japan has the biggest international stockpile of US Treasuries, with $1.1tn across public and private sectors.

Markets surged overnight after Donald Trump said he had “no intention” of firing Jay Powell, pulling back from a historic confrontation with the US Federal Reserve chair. The president reiterated his recent complaints that the Fed needed to cut borrowing costs but added: “I don’t want to talk about that because I have no intention of firing him.” Trump’s sustained criticism of Powell in recent days had rattled global markets and threatened the independence of the Fed, which helps underpin investors’ confidence in the global financial system.

Stocks rallied for a third consecutive day on Thursday, driven by optimism about trade deals and lower interest rates. The Nasdaq Composite rose 2.7%, lifting its weekly gain above 5%, while the S&P 500 officially exited correction territory. Tech shares soared, benefiting from dovish comments from Federal Reserve officials and positive earnings reports.

Huge Swings in Stocks Are the New Normal.The trade war’s swings— both higher and lower—have left many investors on edge. The S& P 500 has gained or lost at least 1% in seven of the past 10 sessions, and April is poised to be the most-volatile calendar month since the Covid crash in 2020, according to Dow Jones Market Data.

The IMF warned that President Trump’s trade war will slow global economic growth, with the U.S., China, and Europe all facing reduced forecasts. Global output is expected to fall to 2.8% this year from 3.3% in 2024, with continued slowing into next year.

The dollar dropped to a three-year low against a basket of currencies amid Mr Trump’s tirade. The price of gold, a haven for investors in times of stress, rose above $3,500 a troy ounce for the first time.

The European Union fined Apple and Meta Platforms hundreds of millions of dollars and ordered the companies to comply with the bloc’s tech rules, a move that risks ratcheting up tensions with the Trump administration as EU officials pursue trade talks.

The race to develop faster charging times for electric-car batteries continued apace when CATL, based in China and the world’s biggest battery producer, announced that its latest product could charge a car in five minutes with a range of 520km (320 miles). BYD, Tesla’s biggest rival in China, recently said it could provide a range of 470km from a five-minute charge.

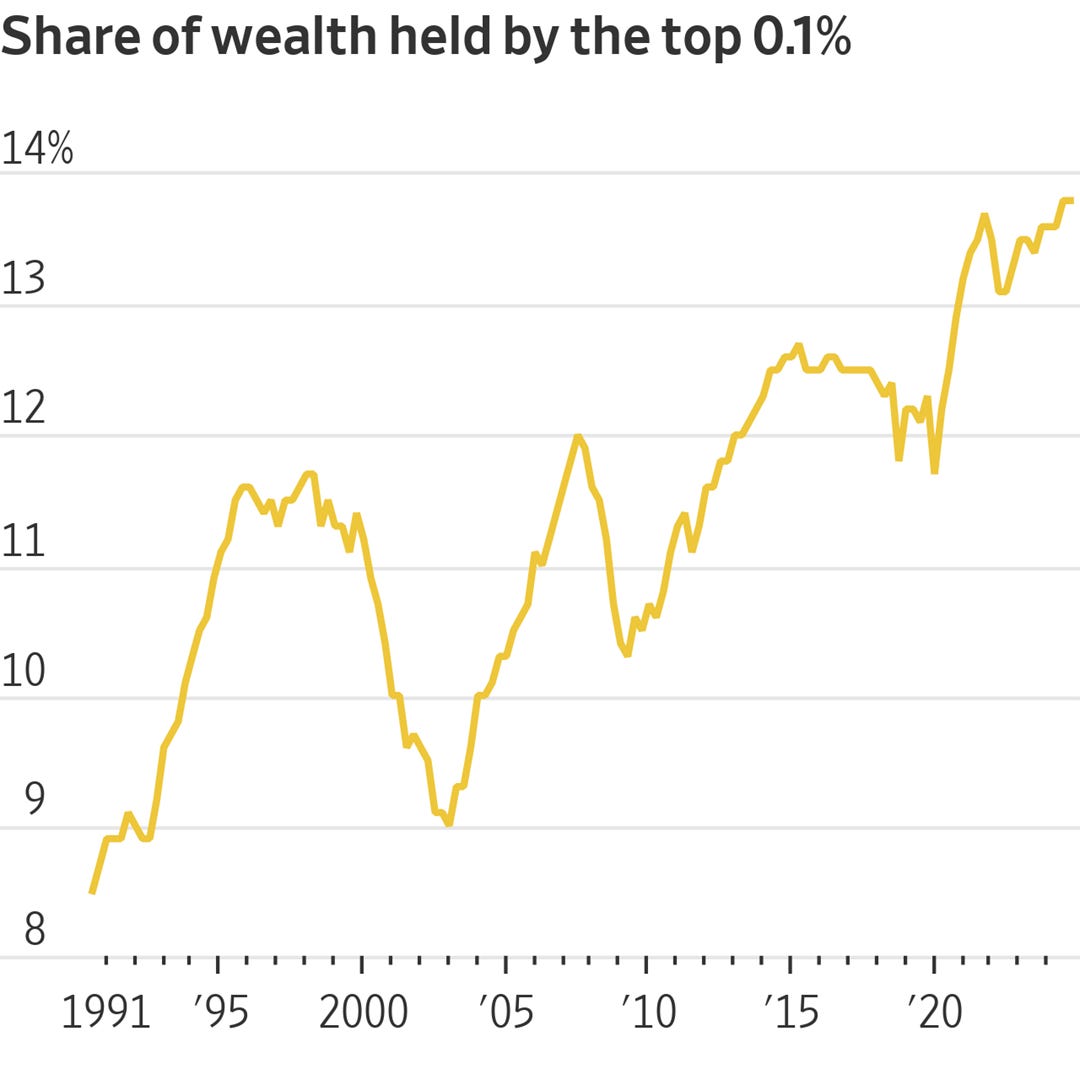

New data suggest $1 trillion of wealth was created for the 19 richest American households alone in 2024. That’s more than the value of Switzerland’s entire economy.

President Trump’s apparent softening on tariffs against China has raised hopes for a detente between the two economies. However, Chinese officials remain resolute, believing Trump will eventually cave if they wait him out. While a tariff reduction would ease tensions, it wouldn’t prevent a rupture or satisfy Beijing, which is calling for a full repeal of tariffs and a return to equality and mutual benefit in negotiations.