Wednesday: Trump announced a sweeping new tariff plan, a stark shift in U.S. trade policy. America will impose a 10% tariff on all imports and much higher rates for some nations, Trump said in unveiling a series of moves he declared "Liberation Day" for U.S. trade policy.

Thursday: Stocks Suffer Biggest One-Day Wipeout in Value Since March 2020 U.S. markets slid in their steepest declines since 2020, as investors grappled with the threat that President Trump’s new tariff plan will trigger global retaliation and hurt the economy. Major stock indexes dropped as much as 6%. Stocks lost roughly $3.1 trillion in market value Thursday.

Friday: S&P 500 Closes Down 6% as Tariffs Intensify Stock Rout. The tech-heavy Nasdaq Composite index fell 5.8 percent, pushing it into a bear market and overshadowing some good news about the U.S. labor market. President Trump insisted his policies were working.

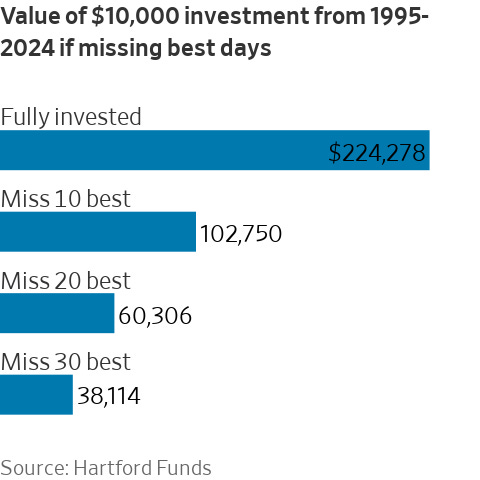

Taking money off the table around critical dates can make long-term results much worse. Hartford Funds calculates that missing just the 10 best days between 1995 and 2024 left an investor in the S&P 500 with less than half as much money. Almost all were during fraught periods.

U.S. tech heavyweights, banks and oil majors extended losses on Friday after Beijing retaliated with additional duties of 34% on U.S. goods, amplifying investor concerns over an escalating global trade war that has stoked fears of a recession.

One of the biggest casualties will be the already slowing US economy. Americans will have to pay more for a variety of imported goods. Together with the damage to business investment, this has increased the risk of a recession, economists say. Markets expect inflation to rise sharply in the short term, making it harder for the Federal Reserve to cut interest rates to boost the economy.

The EU has set itself a four-week window for talks with the US before retaliating further. Europe will also have to prepare for a flood of cheap Chinese imports as badly hit Asian economies try to divert their goods. The UK faces a smaller levy than the bloc, but its manufacturing and agrifood export sectors will be hit at a time when they are already dealing with rising costs.

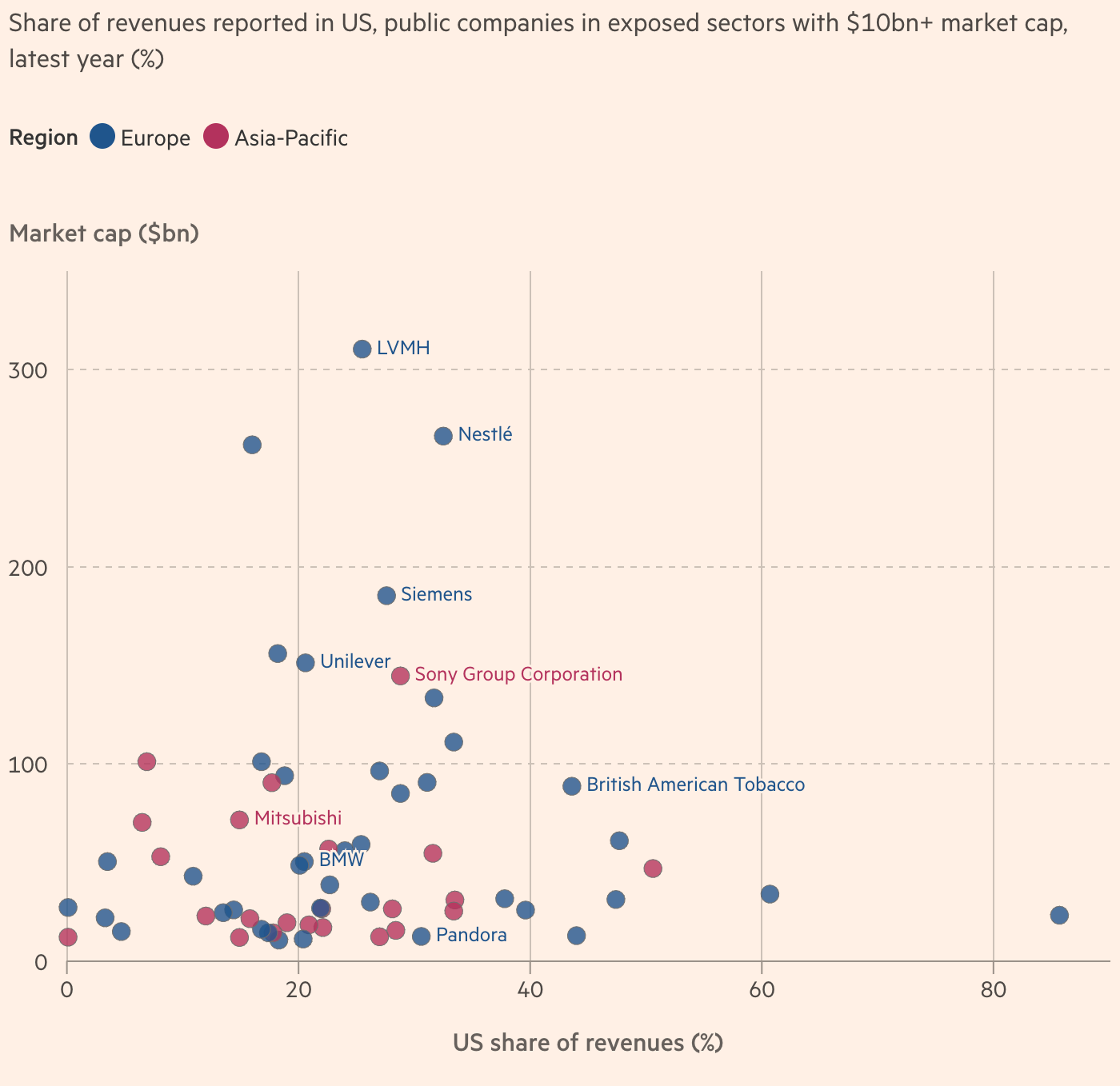

Trump’s latest tariffs will hit almost every industry, with European carmakers such as BMW and Mercedes-Benz and luxury groups including LVMH and Ferragamo among the most exposed.

37%. Proportion of finance executives who cited geopolitical tensions as a top external challenge, compared with 11% a year earlier.

Just 14.2 per cent of equity fund managers outperformed passive strategies over the past decade, according to a recent study by Morningstar. Bank of America estimates that ETFs have saved investors about $250bn in taxes since 1993.

Brazil looks like a winner in the global trade war. Brazilian suppliers of everything from cotton to chicken are banking on higher Chinese demand as Beijing retaliates against Trump’s tariffs with levies on U.S. agricultural producers. At the same time, Brazil is the biggest producer of footwear outside Asia, and its industry trade association hopes the country will be able to send more shoes to the U.S. in place of Chinese products.

An annual survey compiled by Forbes estimated that there are now 3,028 billionaires in the world, up by 247 from last year . America has 902 of them, followed by China and Hong Kong with 516 and India with 205. Germany has 171 and Russia 140. The list’s new arrivals include Arnold Schwarzenegger, Jerry Seinfeld and Bruce Springsteen.