Signs that investors in the US bond market are baking in higher inflation would be a “major red flag” that could upend rate-setters’ plans to cut interest rates, a top Federal Reserve official said.

The EU is set to impose minimal fines on Apple and Meta under its Digital Markets Act as Brussels seeks to avoid escalating tensions with US President Donald Trump. Under the DMA, companies can face penalties of up to 10 per cent of their global turnover, but officials said the European Commission was aiming for fines far below that threshold.

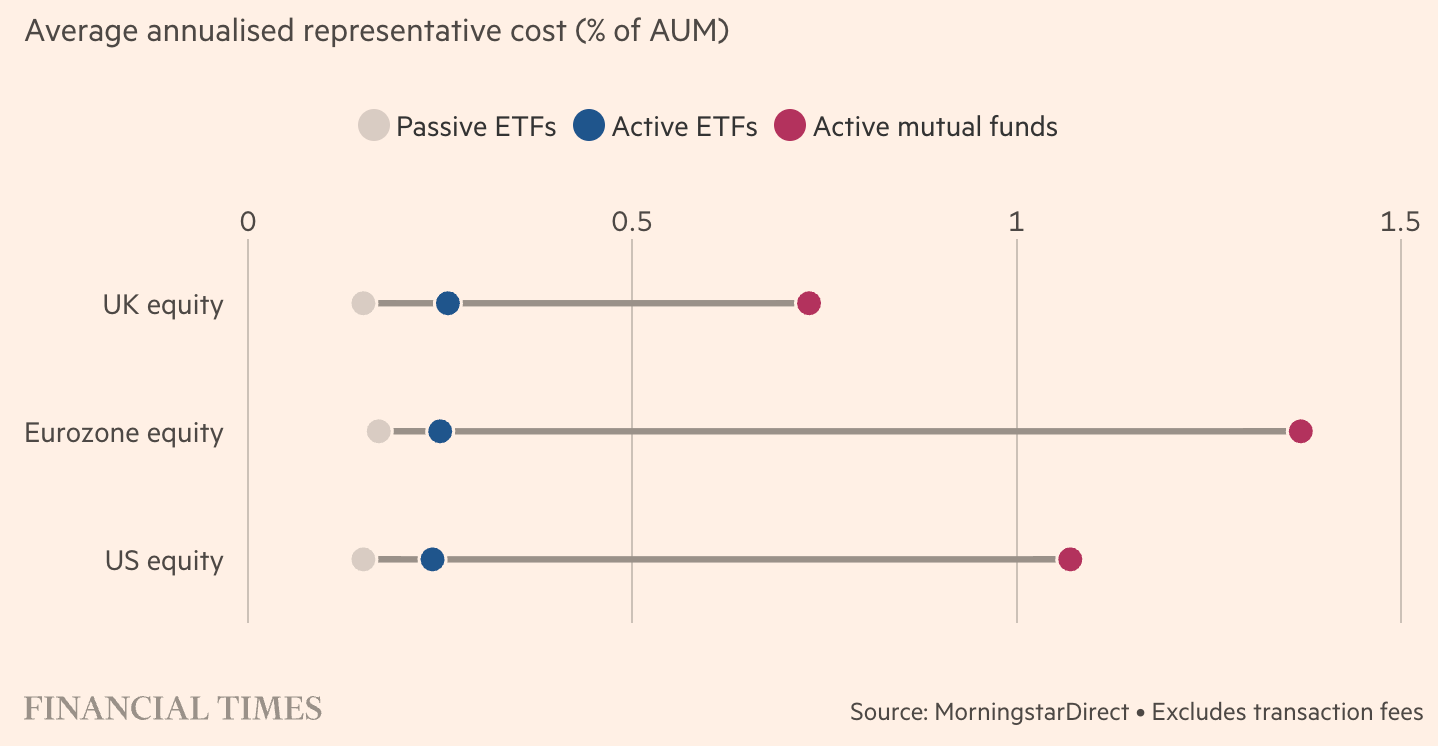

The rise of index tracking, popularized by US-based groups, has challenged the premise of active management, leading to a shift in investor preference towards lower-cost index-tracking products. To compete, British and European asset management groups are embracing active ETFs, which combine active management with the cost-effectiveness and liquidity of ETFs. Active ETFs, which aim to outperform indices at lower costs, are gaining traction in Europe, driven by the convenience and transparency of ETFs combined with active management. While the US market is more developed, asset managers are eyeing Europe as the next frontier, particularly for bond-focused active ETFs.

President Trump’s plan to impose a 25 percent tariff on cars and parts has sent a shudder through the global auto industry. Markets in Asia, Europe and the U.S. wobbled Thursday as many automakers’ share prices fell. Trump has threatened to target the E.U. and Canada if they band together to retaliate.

SAP overtook Novo Nordisk to become Europe’s most-valuable company by stockmarket capitalisation. Based in Germany, SAP, a provider of business software, has benefited from hype surrounding artificial intelligence. Novo Nordisk, by contrast, has seen its share price fall by half since June as the hype around its bestselling weight-loss drugs, Ozempic and Wegovy, recedes.