The EU is emptying its gas storage facilities at the fastest pace since the energy crisis three years ago as colder weather and a decline in seaborne imports raise demand. The volume of gas in the bloc’s storage sites has dropped 19 per cent from the end of September, when the refilling season ends in gas markets, to mid-December, according to an industry body.

The United States rang in the new year with a lot of red ink as the national debt surpassed $34T for the first time. The debt has since passed the $36T mark and shows no sign of stopping.

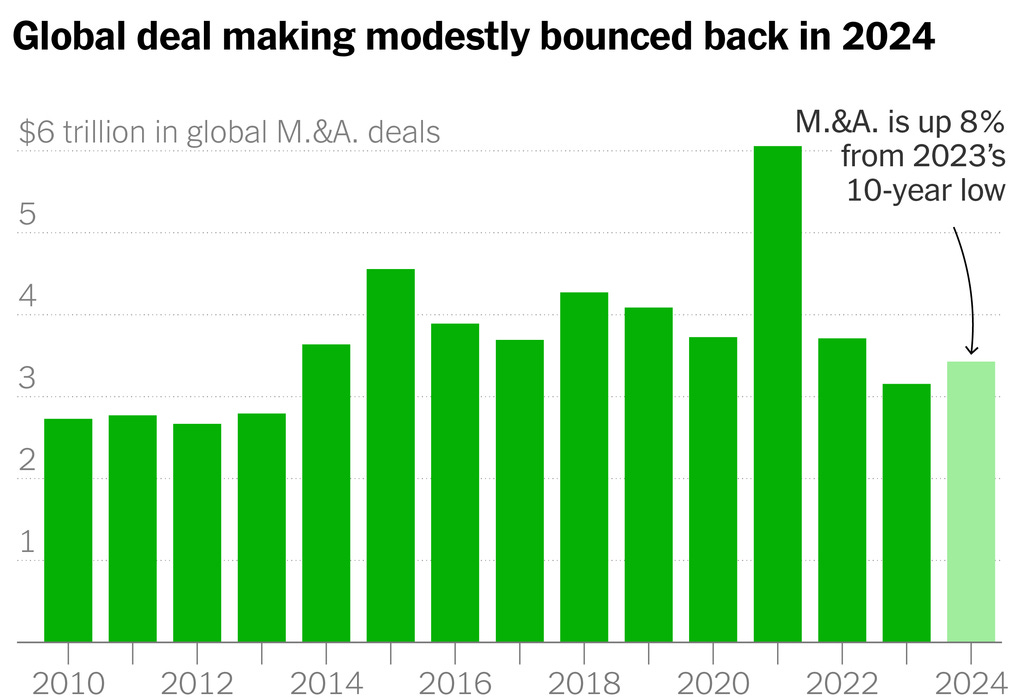

2024 was all about the private credit market, which consists of private loans made by funds to privately owned companies. Fueling the surge were big banks pulling back on the riskier areas of lending due to increased regulation, and higher capital and liquidity rules. The emerging asset class has grown from around $250B in 2010 to about $2T today, and is set to expand by double-digit percentages in the coming years.

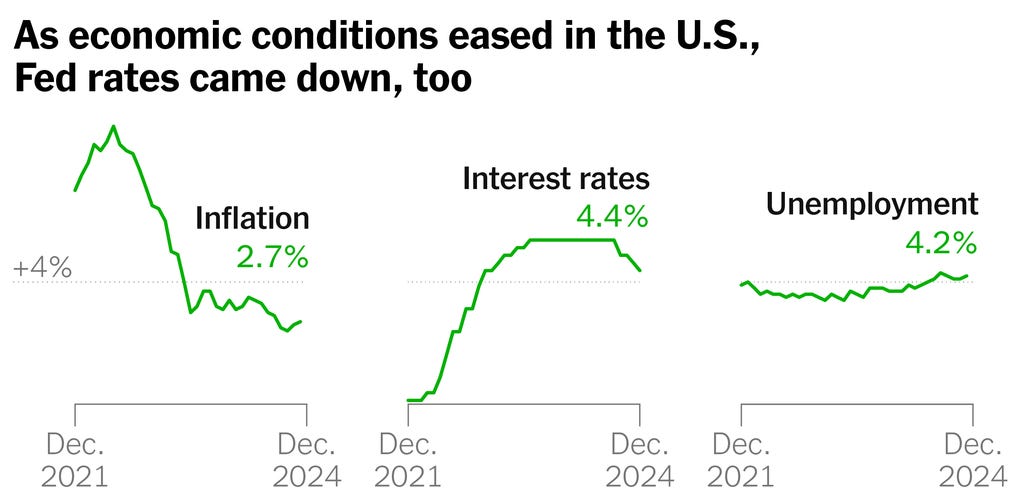

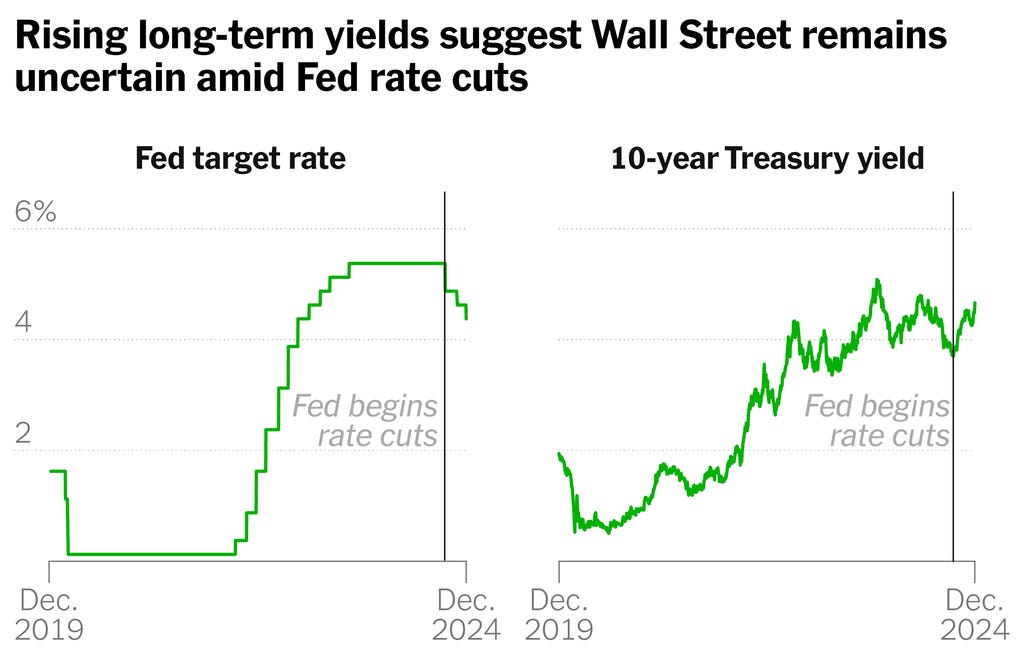

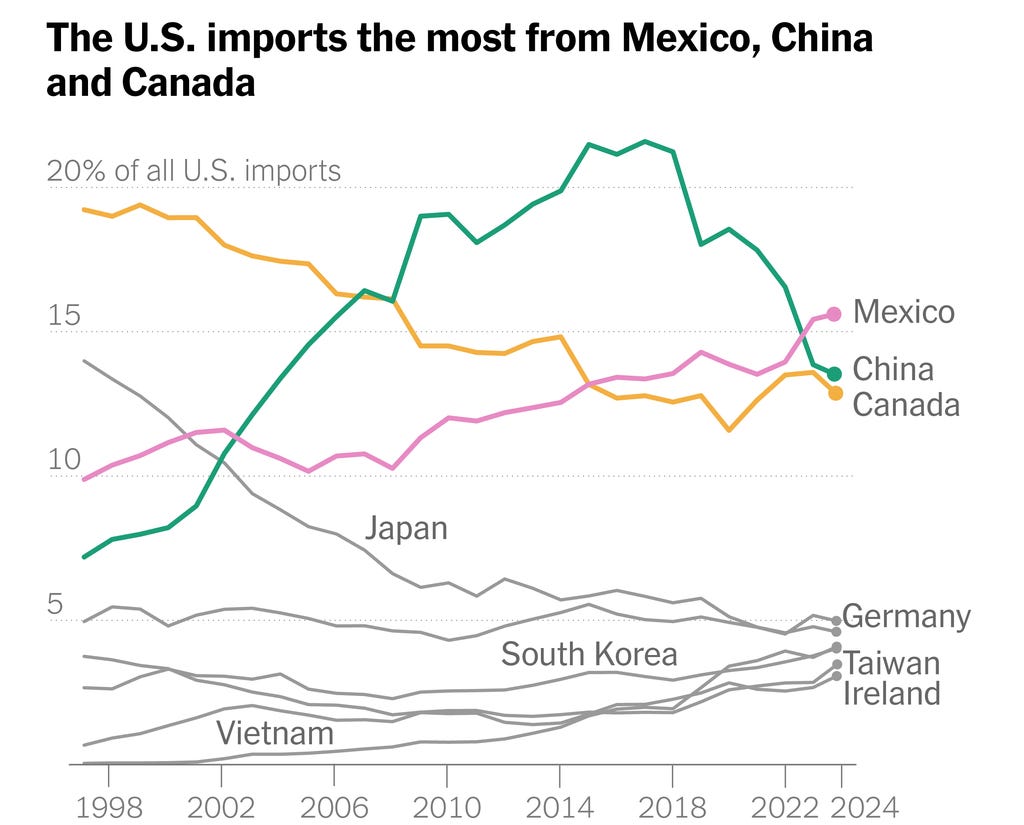

Federal Reserve Chair Jerome Powell is navigating a delicate balance between maintaining apolitical analysis and addressing potential inflationary pressures from President-elect Donald Trump’s proposed policies. While Powell emphasizes the Fed’s independence from political speculation, recent economic projections hint at a more cautious approach, potentially influenced by concerns about Trump’s potential trade and immigration policies. Economists suggest that the Fed’s response to policy changes will depend on the underlying economic conditions and the potential impact on inflation and employment.

U.S. stocks fell on Friday, with the Dow Jones Industrial Average dropping 0.8% and the S&P 500 losing 1.1%. The decline was driven by a fall in shares of large tech companies, particularly the “Magnificent Seven,” and smaller companies sensitive to interest rates and economic health. Despite the daily dip, major indexes are closing in on strong annual gains, with the Dow up 14%, the S&P 500 up 25%, and the Nasdaq up 31% for the year.

In 2025, a record number of Americans will reach age 65, creating significant demand for financial services. This “peak 65” period will likely boost annuity sales and potentially shift retirement assets away from banks towards insurers and alternative asset managers. However, this demographic shift also raises concerns about repayment risk for lenders as retirees increasingly rely on debt, particularly credit card debt.

The Federal Reserve’s interest rate hikes have had a more significant impact on Europe than the U.S., as evidenced by the struggling Stoxx Europe 600 index. While the ECB and BOE have followed the Fed’s lead, investors anticipate rate cuts in 2025 to stimulate Europe’s slower growth. However, absent a U.S. recession, Europe is unlikely to switch to full-on monetary stimulus.