Stocks Fall Sharply After Fed Interest-Rate Decision. The Dow Jones Industrial Average fell more than 1,100 points after the Federal Reserve signaled it might keep interest rates higher than investors expected in 2025. The Federal Reserve cut interest rates by a quarter point and published a forecast suggesting there may only be two rate cuts next year.

The dollar jumped to its highest level in two years against a basket of six currencies, while US stocks and government bond prices fell. The S&P 500 index closed down nearly 3 per cent and the tech-heavy Nasdaq Composite dropped 3.6 per cent. Shares in smaller publicly listed companies, considered particularly sensitive to fluctuations in the US economy, were badly hit, knocking the Russell 2000 down 4.4 per cent.

Economists are warning that China’s export growth could weaken or even contract next year as a result of Trump’s tariffs as the incoming US administration threatens to hamstring a crucial source of expansion for Beijing. Goldman Sachs expects Chinese exports to decline 0.9 per cent in dollar terms next year.

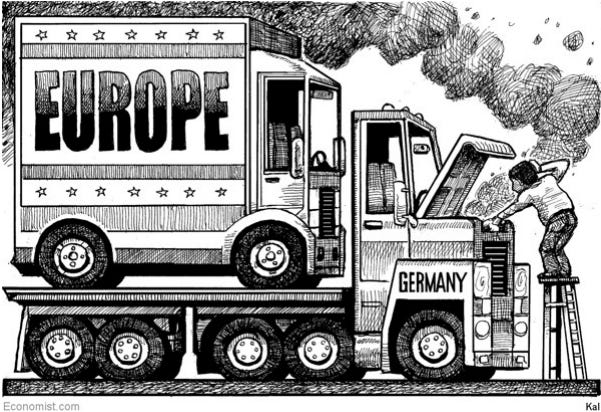

German Government Collapses at a Perilous Time for Europe. Chancellor Olaf Scholz lost a confidence vote, deepening the political turbulence in one of the continent’s most powerful economies.

Big Tech’s spending frenzy on artificial intelligence will continue until the end of the decade, according to the head of Broadcom, which has soared to a valuation of more than $1tn on growing investor excitement about its AI chips business. Hock Tan told the Financial Times his clients in Silicon Valley were drawing up AI infrastructure investment plans spanning “three to five years in a very big hurry”.

A big divergence is going on in the markets, where value stocks are taking a back seat to growth. While it's been pronounced for much of the year, things really kicked off in the aftermath of the U.S. presidential election. Fresh highs keep being notched by the Nasdaq, which recently crossed the 20,000 milestone and inked its 38th record close of the year, compared to the Dow Jones Industrial Average, which just posted its longest losing streak since 2018. To clarify, the blue-chip Dow is still up 17% in 2024, which is an impressive return on a historical basis. All indications suggest that U.S. stocks are still the place to be for investors in 2025, as political and economic trouble hits many Western nations, from France and Germany to South Korea and Canada. Many are also betting on the policies of the incoming Trump administration, whose stance on deregulation, tax cuts, efficiency, and tariff-driven investment could point to a resilient economy.

"As the old joke goes, accountants are interviewing with a CEO to get the job of auditing the company's books. The CEO asks only one question: "What's 2+2?" He dismisses everyone who answers 4. Finally one says, "What do you want it to be?" The CEO hires him on the spot."