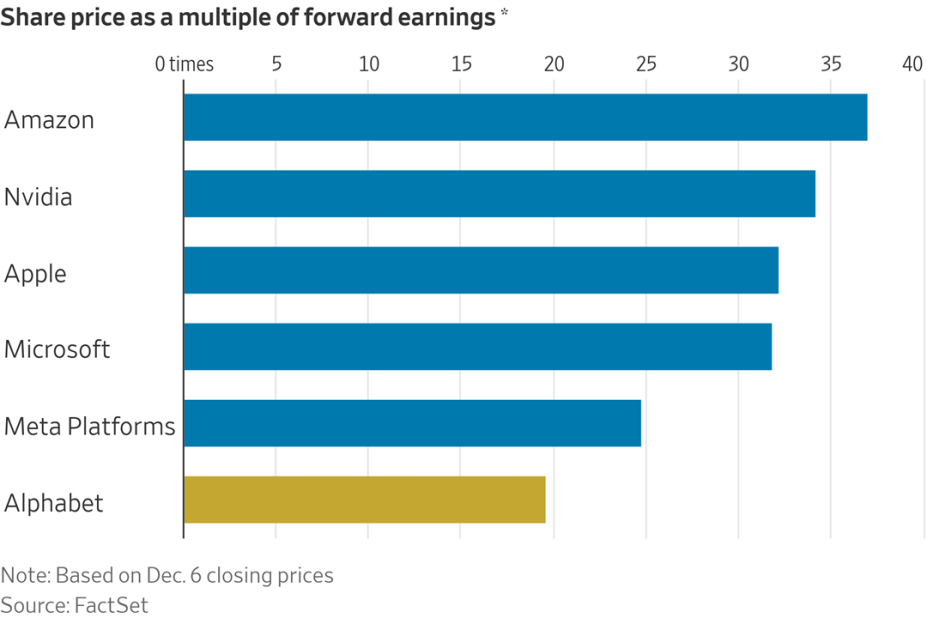

Wall Street banks are betting that the blockbuster rally in US stocks will cool next year as investors turn cautious on the AI boom. Ten major banks expect the S&P 500 to rise roughly 8 per cent by the end of 2025, below the index’s historic average annual returns. Morgan Stanley’s chief investment officer said: “We’re fighting . . . euphoria that has helped people buy stocks versus the realities of next year.”

U.S. Inflation Ticks Up Slightly Ahead of Fed Meeting. Consumer prices rose 2.7 percent in the year through November, a slightly hotter rate than the previous month. The Federal Reserve is considering whether to cut interest rates this week.

The European Central Bank lowered interest rates by a quarter point, aiming to stabilize an economy rocked by debt worries in France and highly exposed to the trade tariffs threatened by President-elect Donald Trump. The ECB reduced its key interest rate to 3% from 3.25%, widening a gap in benchmark borrowing costs with the Federal Reserve.

Investors are bringing out the champagne glasses after the Nasdaq closed above 20,000 points for the first time ever. Helping notch the new heights were the latest CPI numbers, which cemented expectations for another quarter-point rate cut by the Federal Reserve next week. The new milestone brings the return of the tech-concentrated Nasdaq to over 30% YTD and shows the staying power of the index's bull market rally that commenced in May 2023.

Trading volumes in US equities rose 38 per cent in November from the same month in 2023, reaching levels not seen since the meme stock craze of early 2021, according to exchanges operator Cboe Global Markets.

A US court has thrown out rules requiring Nasdaq-listed companies to have boards meet certain racial or gender diversity criteria or explain why they did not. The appeals court’s majority said the Securities and Exchange Commission should not have signed off on the rules.

The global advertising industry will surpass $1tn in revenue for the first time this year. Tech companies are expected to dominate, with Google, Meta, ByteDance, Amazon and Alibaba forecast to earn more than half the total.

Тhe volume of structured finance transactions has hit $380bn this year, the biggest boom since the lead-up to the global financial crisis in 2007. Тhe boom in complex — and often riskier — deals highlights how buoyant markets and persistent US economic strength are allowing bankers to sell more esoteric products to investors keen to lock in high fixed returns. “We have seen standout years with relentless investor appetite and that is what is going on right now,” said Jay Steiner, who leads US asset-backed securities at Deutsche Bank.

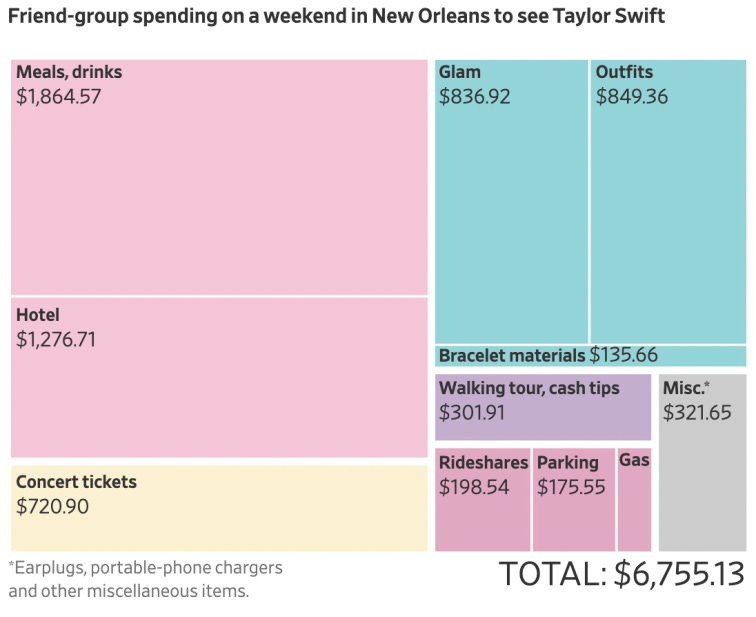

Taylor Swift's Eras Tour, wrapping up after 149 shows, brought in $2 billion from ticket sales alone. A group of Mississippi Swifties shared their trip expenses to New Orleans, offering a glimpse into the global "Taylor Swift economy."

A surging US dollar and a “confluence of bad news” have sparked the biggest sell-off in emerging-market currencies since the early stages of the Federal Reserve’s aggressive rate-raising campaign two years ago. The decline has been broad, with at least 23 currencies tracked by Bloomberg falling against the dollar this quarter.

So-called GLP-1 drugs such as Ozempic and Wegovy have helped transform the waistlines of patients and the top lines of pharmaceutical groups. But beyond their original focus on obesity and diabetes, GLP-1 treatments could also potentially be used for addiction, heart disease and Alzheimer’s. Lower-priced orally administered drugs could help tackle the rising tide of chronic diseases and lower costs for public health systems.