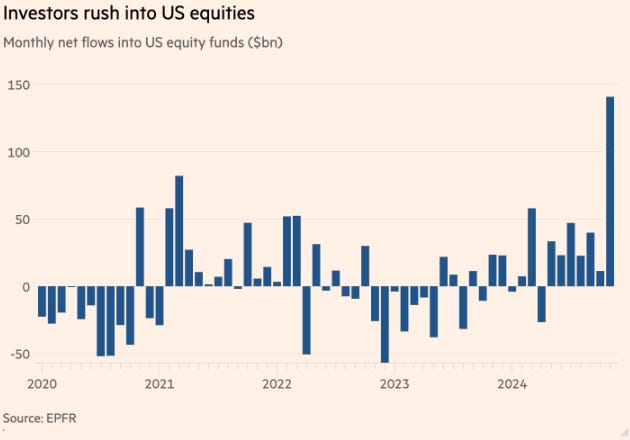

Investors have pumped nearly $140bn into funds made up of US stocks. The rush of buying made November the busiest month for inflows on records stretching back to 2000. Driving the buying spree are traders betting Donald Trump’s administration will unleash sweeping tax cuts and reforms in a boon to corporate America.

Investors have gone too far in their bets on the near-term potential of artificial intelligence, Vanguard has warned. Despite optimism that AI would prove as revolutionary as the adoption of the personal computer in the 1980s, the $10tn asset manager says there is risk of a “correction” in stock prices.

After shooting past $90,000 following Donald Trump’s successful presidential election in early November bitcoin, the world’s biggest cryptocurrency, has exceeded $100,000 for the first time. On Wednesday the president-elect nominated crypto advocate Paul Atkins to run the Securities and Exchange Commission, the main market regulator, raising hopes for a more favorable regulatory climate for the industry. The cryptocurrency’s rise past $100,000 marks a dramatic change in fortune for the sector from two years ago, when the collapse of FTX in late 2022 spurred a crisis in the market and sent the price of bitcoin plummeting to $16,000.

U.S. Job Growth Rebounds. The labor market added 227,000 jobs, a big rebound from October, when storms in the Southeast and a major strike disrupted work. The unemployment rate ticked up slightly to 4.2 percent.

51%. The share of U.S. workers surveyed in November who said they were watching for or actively seeking a new job—the largest proportion since 2015. Job satisfaction has fallen to its lowest level in recent years as employees feel more stuck—and frustrated—where they are, according to Gallup, whose quarterly surveys are widely viewed as a bellwether of workplace sentiment.

67%. The share of business executives who expect the U.S. economy to improve over the next 12 months, up from 24% a year earlier, according to a survey released by the Association of International Certified Professional Accountants.

The UK’s top financial watchdog has opened the door to China’s fast-fashion group Shein joining the London Stock Exchange, saying its decisions on whether companies can list in the UK are based only on their disclosures.

Owners of a new iPad might be surprised to learn that BYD, known globally as Tesla’s most formidable EV competitor, has a second business manufacturing electronics, and it has grown to assemble more than 30% of Apple’s tablets, according to industry executives and analysts. The Chinese company said it has more than 10,000 engineers and around 100,000 employees dedicated to the “fruit chain,” the local term for Apple’s supply chain.

BlackRock undertook another big acquisition, agreeing to buy HPS Investment Partners in a transaction worth about $12bn. HPS has $148bn in assets under management and is one of the big Wall Street players dealing in private credit, which has boomed as companies tap markets for loans from firms that are not banks.