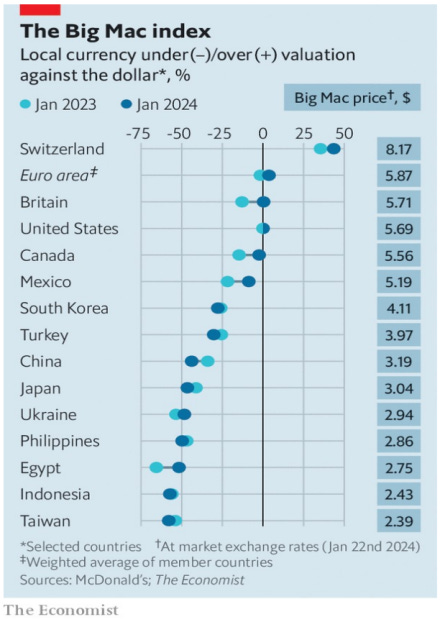

"A Chinese Big Mac cost 23 yuan in December 2023, whereas the

American version came to $5.69. Divide one by the other and the Big

Mac index gives a dollar-to-yuan exchange rate of 4.04. That

compares with a nominal exchange rate of 7.20 yuan per dollar. It

therefore suggests that the yuan is undervalued by 44%. And the

price of a Big Mac in China has fallen since we last updated our index

in June. Deflation has come to the McDonald’s menu as well as the

rest of the economy." (from the Economist)

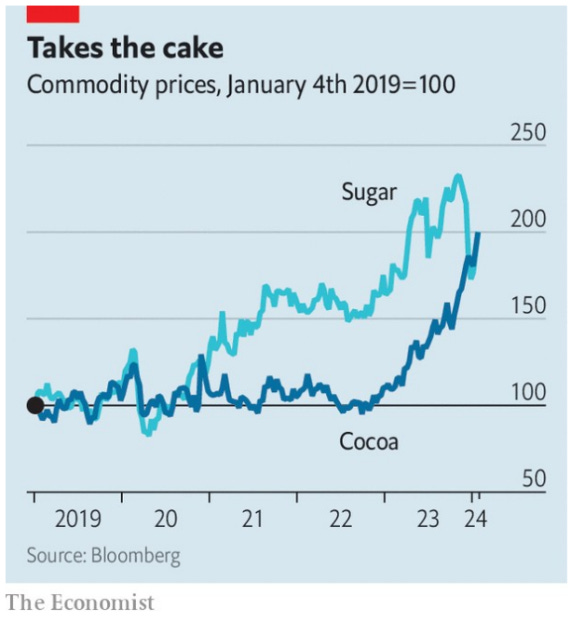

The reason for surging prices is not that consumers have a sudden taste for Coca-Cola and KitKats, but a litany of problems in regions where gourmet commodities are produced. El Niño, a climate pattern, has caused droughts in Australia, India and Thailand, three of the four biggest exporters of sugar. Torrential rain in Brazil, the largest, has complicated shipping.

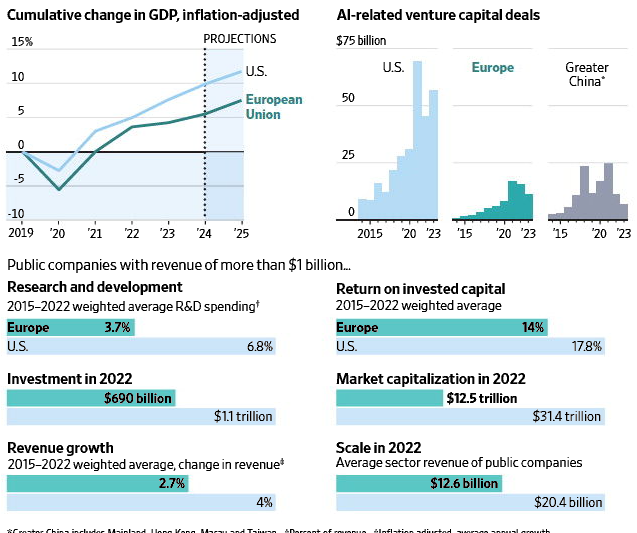

Europe Regulates Its Way to Last Place:

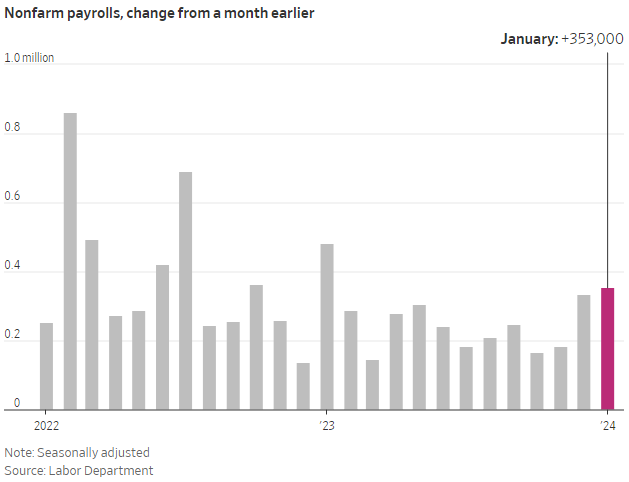

U.S. Hiring Accelerated in January. Employers added 353,000 jobs last month, and the unemployment rate was 3.7%.

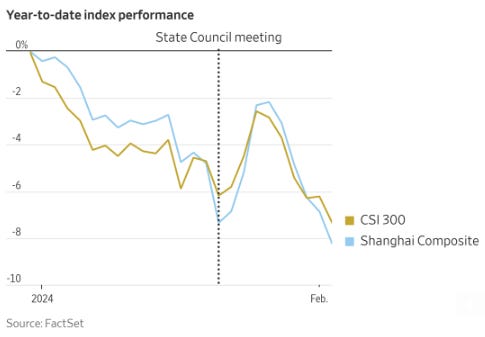

China has pushed a group of state-linked companies to buy exchange-traded funds, part of an effort to boost stock prices. So far, it’s not working. China’s benchmark CSI 300 index has entered its fourth year of declines in a row, and is down 7.3% so far this year. Foreign investors are pulling out of the market. China’s hundreds of millions of individual investors are shifting to safer assets, or betting on stock markets elsewhere.

Stocks extended their record-setting run Friday, with the S&P 500 and Dow Jones average setting fresh record closing highs, as a blockbuster jobs report bolstered the outlook for corporate profits. A rally in tech stocks was sparked by Meta's strong earnings report and announcement of its first-ever quarterly dividend, lifting shares by more than 20%, and Amazon popped 8% after its own earnings topper.

"Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair."

No posts