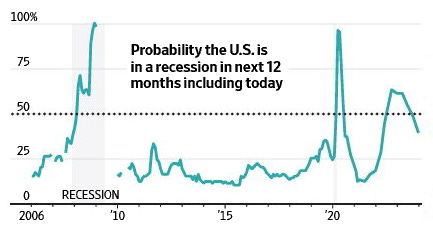

The good news is the probability of a recession is down sharply, according to The Wall Street Journal’s latest survey of economists. The bad news is that, for a lot of people, it is still going to feel like a recession. Business and academic economists surveyed by the Journal lowered the probability of a recession within the next year to 39% from 48% in the October survey.

Though the Federal Reserve stopped raising interest rates last summer, it is quietly tightening monetary policy through another channel: shrinking its $7.7 trillion holdings of bonds and other assets by around $80 billion a month.

Germany, the European powerhouse’s economy, the largest on the Continent and the world’s fourth-biggest, shrank last year, extending a six-year slump that is raising fears of deindustrialization and sapping support for governments across the region. Output in the country likely shrank by 0.3% in the three months through December from the previous quarter, the German federal statistics agency said Monday. Other large eurozone economies likely grew last year, including France, Italy and Spain, according to European Union estimates.

Strong economic growth has ignited the Indian stock market in recent months. Japan’s Nikkei 225 rose for a sixth consecutive day, hitting another multidecade peak.

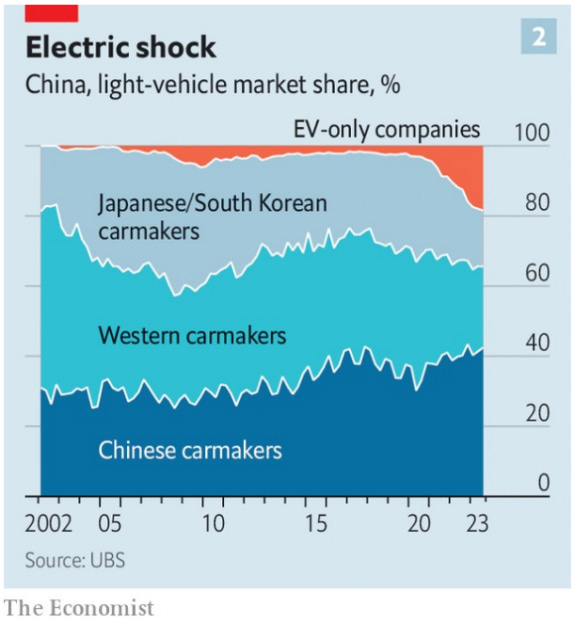

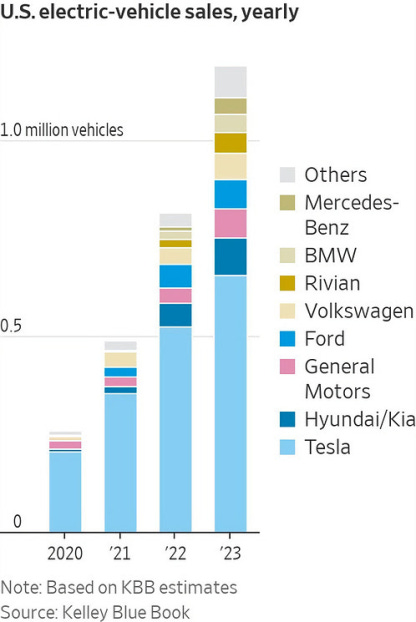

In 2023, Chinese industry groups claim, China overtook Japan to become the world’s biggest exporter of cars, in part because of surging sales of EVs.

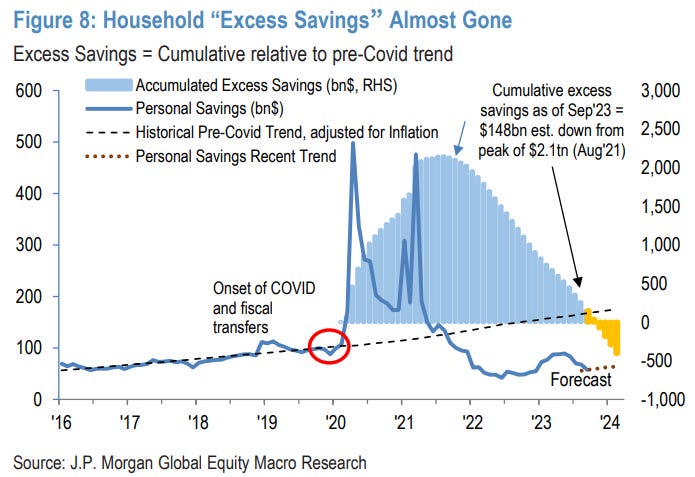

JP Morgan: household excess liquidity to be exhausted by June 2024

A Google AI system outperformed human physicians in diagnosing certain medical conditions. It was also rated more caring by the 20 people who tested it without knowing whether they were texting a human or a machine. The researchers point out that the chatbot hasn’t yet been evaluated for biases or trialled on people with real health problems.

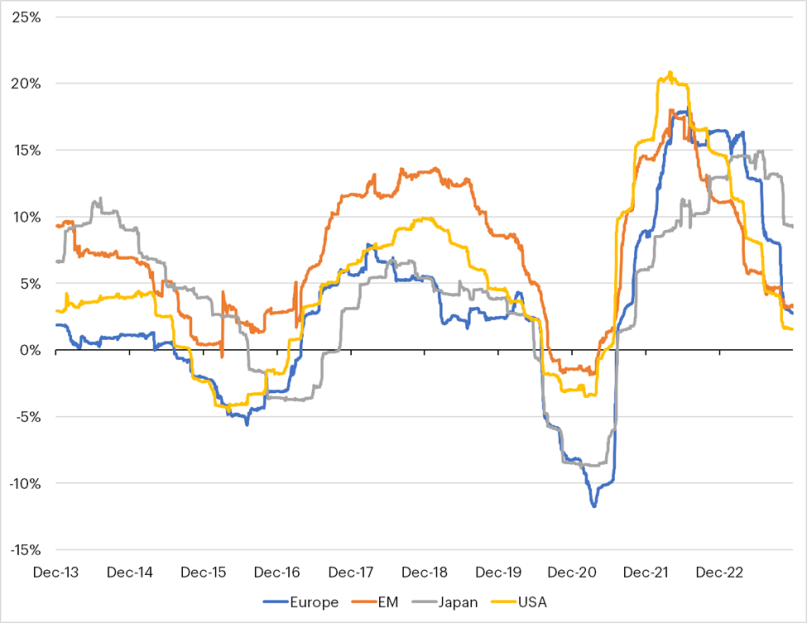

Data shows that the US has won not necessarily by growing fastest every year, but rather by having strong growth throughout the decade, with about 20% lower volatility than Europe or Japan.

Real-Time YoY Revenue Growth by Region:Goldman Sachs reported a 51% surge in fourth-quarter profit, giving the Wall Street giant a boost after eight quarters of declines. Full-year profit at JPMorgan Chase, meanwhile, shot up 32% to a record $50 billion.

China’s growth rate was 5.2% last year, one of the lowest levels in decades, underscoring the heavy toll that a property-sector collapse and weak consumer confidence have taken despite the lifting of all Covid-19 restrictions. Also China ended 2023 with 1.410 billion people, the National Bureau of Statistics said Wednesday, down from 1.412 billion in 2022, when it hit a historic turning point: the first year the population shrank since starvation years in the early 1960s.

Spotify has a plum position in the audio-streaming business. It’s the leading platform, with some 600 million users. Its 30% market share is twice that of its next-largest competitor. Spotify is adding millions of new subscribers a month, and few of its users cancel. Most companies can only dream of that kind of industry dominance. Yet not even the leading audio-streaming company has consistently made money off audio streaming.

Samsung’s newest Galaxy S24, S24+ and S24 Ultra smartphones, announced Wednesday and shipping at the end of this month, are all about artificial-intelligence features that go beyond a voice assistant that can execute basic tasks.

Germany’s new-car market went into a free fall in December, led by a near halving of new electric-vehicle sales, pulling the sale of new EVs in the broader EU down for the first time since early 2020.

Passive funds and ETFs have surpassed actively managed funds for the first time. At the end of December, passive US mutual funds and ETFs held about $13.3tn in assets while active ETFs and mutual funds had just over $13.2tn.

Rising interest rates drew trillions of dollars into money-market funds and other cash-like investments in the past two years, with more than $8.8 trillion parked in money funds and deposits as of the third quarter of 2023. Investors are optimistic that with rates poised to fall, people will redirect that money and fuel markets’ next leg higher.

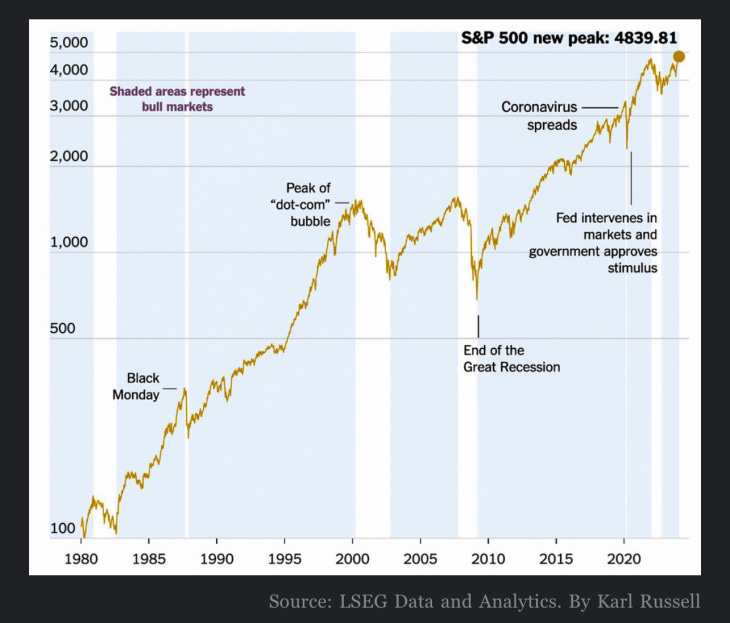

The S&P 500 posted its first record close in more than two years, as tech shares led a rally in stocks.

Have a great week!