US inflation climbed 0.3% in December from the prior month and increased 3.4% from a year earlier, the Labor Department said Thursday.

European governments are selling a mountain of new debt this week, taking advantage of the recent retreat in interest rates. On Monday and Tuesday, eurozone governments sold about €26 billion in bonds.

After decades of trying, consumer electronics companies are rolling out a solar technology that mimics photosynthesis in plants. It lets devices charge indoors and, in some cases, can eliminate batteries entirely.

An excerpt from Howard Marks` latest memo:

“In short, these were easy times, fueled by easy money. Like travelers on the moving walkway, it was easy for businesspeople and investors to think they were doing a great job all on their own. In particular, market participants got a lot of help in this period as they rode the 10-year-plus bull market, the longest in U.S. history. Many disregarded the benefits that ensued from low interest rates. But as one of the oldest investment adages says, we should never confuse brains with a bull market.”

Read the full memo over here.

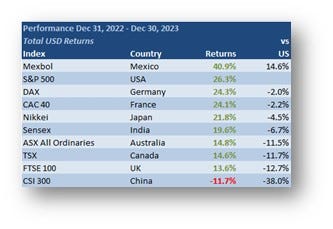

Taking a step back at global markets, but dialling in to the recent 12 months, in terms of major global markets, Mexico outperformed everyone, with the US, Germany, and France all generating similar strong performance. Meanwhile, things weren’t great in China.

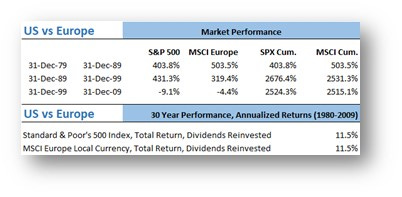

But if we go back to the beginning of the last decade, the US has crushed it. In size.

From the end of 1979 through the end of 2009, the total returns from Europe and the US were almost precisely the same (both of them 26-baggers!), each generating 11.5% total annual returns over 30 years.

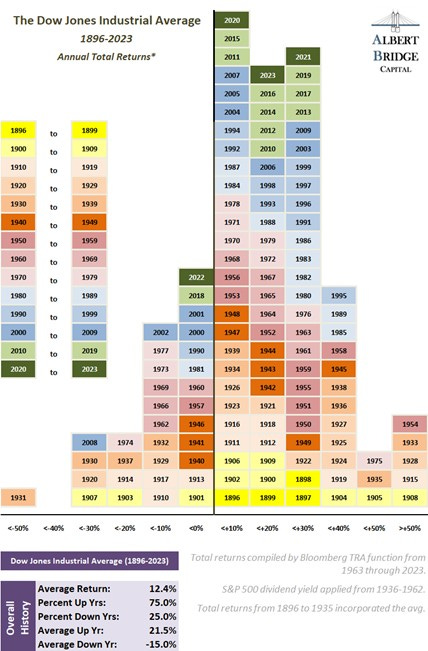

Average annual returns of the Dow Jones Industrial Average:

Have a great week!