FINANCIAL STATEMENTS: BASICS AND WHY THEY’RE IMPORTANT FOR INVESTING

Financial statements are the bedrock of financial analysis, serving as the primary means for investors to assess a company's financial health and performance. These statements provide invaluable insights into a company's operations, profitability, and financial stability. They are used by investors, creditors, and other stakeholders to assess the company's financial health and make informed decisions about whether to invest in or lend money to the company. In this article, we will explore what these statements are and why they are crucial for anyone looking to invest wisely.

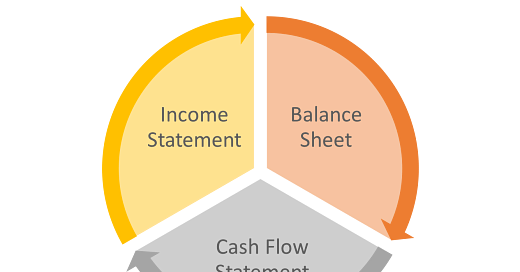

The three main financial statements are:

The balance sheet

The balance sheet shows a company's assets, liabilities, and equity at a specific point in time. Assets are what the company owns, liabilities are what the company owes, and equity is the difference between assets and liabilities.

Assets: Assets are what the company owns. They can be classified into current assets, which are assets that can be converted into cash within one year, and non-current assets, which are assets that cannot be converted into cash within one year.

Liabilities: Liabilities are what the company owes. They can be classified into current liabilities, which are liabilities that must be paid within one year, and non-current liabilities, which are liabilities that do not have to be paid within one year.

Equity: Equity is the difference between assets and liabilities. It represents the ownership interest of the company's shareholders.

Why it's Important for Investing:

Financial Stability: Investors use the balance sheet to assess a company's financial stability. A strong balance sheet with more assets than liabilities indicates a healthy financial position.

Debt Levels: By examining liabilities, investors can gauge the level of debt a company carries, which can affect its financial flexibility and risk profile.

Shareholder Equity: Equity details the value attributable to shareholders. Monitoring changes in equity over time helps investors understand a company's financial health and the potential for future dividends.

The income statement

The income statement shows a company's revenues, expenses, and profits over a period of time, typically one year. Revenues are the money that the company brings in from its sales, expenses are the costs that the company incurs in generating those revenues, and profits are the amount of money that the company is left with after paying its expenses. The income statement is divided into four main sections: revenue, cost of goods sold, operating expenses, and net income.

Revenue: Revenue is the money that the company brings in from its sales.

Cost of goods sold: Cost of goods sold is the cost of the goods that the company sold.

Operating expenses: Operating expenses are the expenses that the company incurs in its day-to-day operations.

Net income: Net income is the company's profit after all expenses have been paid.

Why it's Important for Investing:

Profitability Assessment: The income statement helps investors evaluate a company's profitability. Consistent positive net income suggests a healthy and sustainable business model.

Expense Analysis: Understanding various expense categories allows investors to pinpoint areas where cost management may impact profitability.

Revenue Trends: Tracking revenue trends over time provides insights into a company's growth potential and market competitiveness.

Cash Flow Statement

The cash flow statement shows how much cash the company generated and used during a period of time. It breaks down cash flows into three categories: operating activities, investing activities, and financing activities. Operating activities are the cash flows from the company's day-to-day operations, investing activities are the cash flows from buying and selling assets, and financing activities are the cash flows from raising and repaying debt.

Operating activities: Operating activities are the cash flows from the company's day-to-day operations. They include cash inflows from sales and cash outflows for expenses and other operating costs.

Investing activities: Investing activities are the cash flows from buying and selling assets. They include cash inflows from the sale of assets and cash outflows for the purchase of assets.

Financing activities: Financing activities are the cash flows from raising and repaying debt. They include cash inflows from issuing debt and cash outflows for repaying debt.

Why it's Important for Investing:

Liquidity Assessment: Investors use the cash flow statement to assess a company's liquidity and its ability to meet short-term obligations.

Cash Generation: A positive cash flow from operating activities indicates a company's ability to generate cash organically.

Investment and Financing Decisions: Understanding cash flows from investing and financing activities helps investors evaluate a company's growth prospects and capital structure.

Here are some additional tips for using financial statements when investing:

Read the footnotes to the financial statements. The footnotes provide additional information about the company's financial performance and condition.

Compare the company's financial statements to the financial statements of other companies in the same industry. This can help you to identify trends and make comparisons.

Consider the company's management team. A good management team is essential for a company's success.

Do your own research. Don't rely solely on the information in the financial statements.

Financial statements are public data and every company that is part of the stock exchange is obliged to publish them on its website.

Hopefully, you're beginning to understand the significance of financial statements in making well-informed investment decisions. At PP Investment Education, we're committed to offering you supplementary information, educational materials, and books on this subject. Additionally, we provide insightful case studies showcasing investments made by some of the world's top investors.

However, our commitment doesn't end there. Within our community, you'll have the opportunity to independently analyze and engage in discussions about potential investments alongside fellow community members. We are dedicated to equipping you with the necessary tools to support your journey towards becoming a more proficient and knowledgeable investor.